Challenge

In emerging markets across Africa, microfinance institutions (MFIs) and other financial service providers (FSPs) play a critical role providing financial services to people who are unable to obtain traditional finance. Despite its important role, this sector in Africa faces enormous challenges. In 2013, our survey of African FSPs revealed governance and risk management as the primary vulnerabilities in the sector. Weak governance and risky behavior also played a role in microfinance crises in Nicaragua, Morocco, Bosnia-Herzegovina, and Pakistan. CFI decided to commit to helping African FSPs focus on governance and risk—and not just individually, but at a sectoral level—to avoid this fate.

Navigating Obstacles

We quickly realized we would be starting nearly from scratch. The handful of existing governance resources on the market at the time comprised generic, one-off trainings or were geared to corporate participants. We knew that this kind of classroom-based, lecture-heavy, training was not an effective strategy for senior board members, whose time was valuable and who were often in positions of authority in other walks of life.

We wanted to create something meaningful and effective, tailor-made for FSPs, and delivered in a manner that would stick with participants so that they could lead their organizations and their industry to grow and prosper.

Approach

In partnership with Mastercard Foundation and FMO Entrepreneurial Development Bank in 2015, CFI launched a unique governance and risk management executive education opportunity for African FSP leaders in the form of the Africa Board Fellowship Program.

The Africa Board Fellowship is an unmatched peer exchange program specifically for CEOs and board members of African FSPs focused on a variety of topics in governance and risk. The six-month program offers in-person, peer-led seminars featuring real life case studies, role plays, interactive animation and networking, together with a virtual platform for structured learning, dialogue and collaboration. During the program, fellows establish individual and institutional goals and work with an advisor on achieving those goals. Fellows continue to have access to a virtual community forum even as alumni. In this way, our program is creating a network of leaders across the continent who can connect with each other about the similar challenges they face.

Phillip Karugaba, Opportunity International Uganda Board Chairman and ABF Fellow“ABF has put together an outstanding program for directors of financial institutions with a focus on microfinance. The practical and real-time topics are presented by world class facilitators using a variety of methods that allow us to live the lessons. The superior ABF technology platform allows fellows to remain in touch and keep up to date on further learning.”

Results

The Africa Board Fellowship is not only changing the way board members and CEOs lead their institutions, but also fortifying African financial services for underserved communities at an industry level. ABF Fellows are more effectively implementing good governance strategies, managing risks, and becoming more client-centric as a result of their experience in the ABF program.

Doubling Down on Good Governance

ABF Fellows are becoming more effective supervisors of their institutions, as evidenced by implementing a robust system of checks, balances and internal controls. These are especially crucial in competitive markets where pressure to grow can lead to relaxed business practices. As Vincent Kaheeru, ECLOF Board Chairman and ABF Fellow explains, “We’ve put a strong emphasis on the quality of lending and invested in training our frontline people in credit appraisal and administration, and in the importance of following policies to the letter.”

Mitigating and Anticipating Risks

ABF Fellows have used the program to hone their ability to manage risk. For example, following a period of political instability in 2016, the board and CEO of Microcred, based in Ivory Coast, took steps to manage and anticipate risks as a result of ABF. To reduce concentration risk, the board embarked on an expansion plan, successfully opening new branches and diversifying its client base. The Board also directed staff to pair experienced branch managers with newer ones to more effectively cope with the strain of higher portfolio at risk. Microcred also established a board-level committee that meets monthly to review and evaluate all areas where the FSP might be at risk.

Embracing Client Centricity

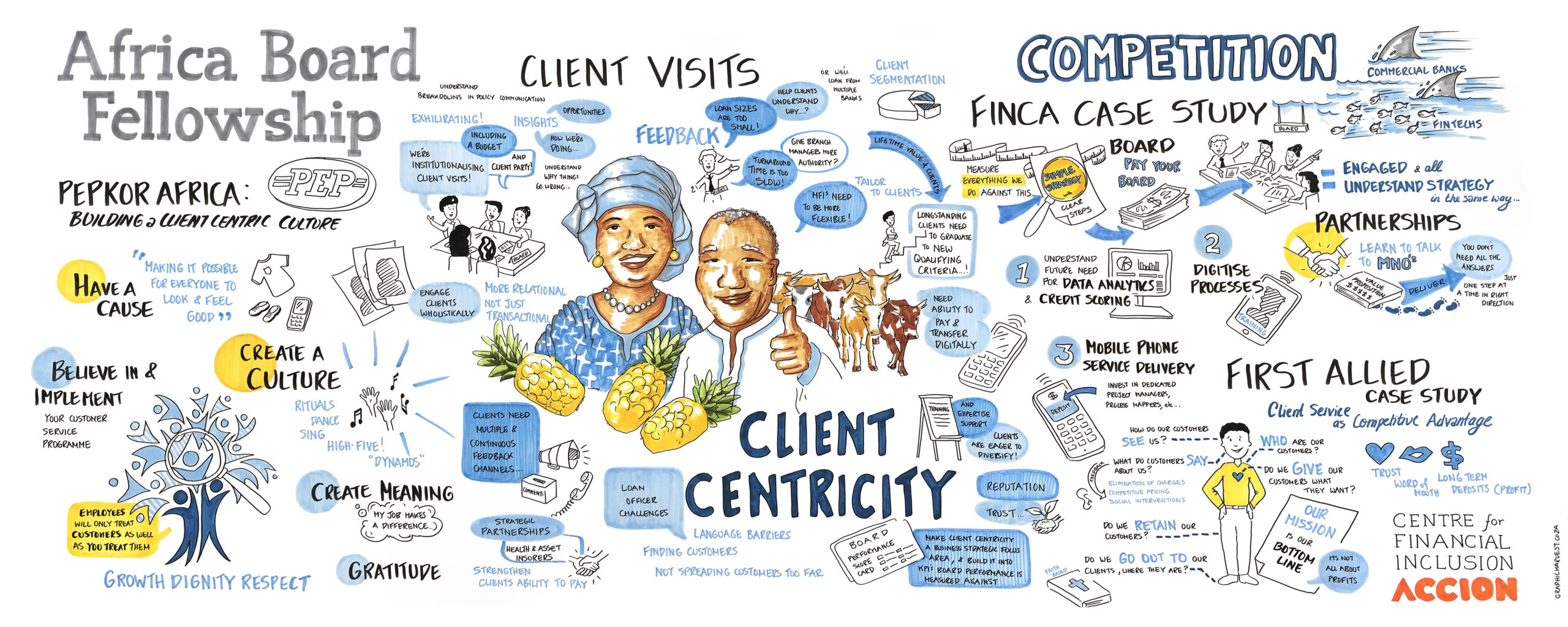

Because boards and management are often far removed from clients, the ABF Program emphasizes client centricity. During the program, ABF fellows conduct client visits to appreciate the triumphs and hardships of entrepreneurship as well as what it’s like to be an FSP client. Client visits make a big difference. We see ABF Fellows not only taking the practice back to their FSPs, but also modifying their products and practices to better serve clients.

ABF At-A-Glance (2015-2018)

190

20

71

7.2m

Vincent Kaheeru, ECLOF Board Chairman and ABF FellowClient visits were an idea we picked from the Africa Board Fellowship. [The Board] had done them occasionally, but we intensified the number of visits and changed the approach to make the visit more effective. When you visit customers, you understand the context of all that is going on. That helped me and my team.

Olive Kabatalya, UGAFODE Board Member and ABF FellowWe are visiting clients to ensure that we are not just reading performance reports, which do not usually include anything to do with meeting the needs of the client.

Andrew Shaw, FMOWe were very impressed with the ABF, and in particular the way that you managed to keep a group of senior people so engaged for 3 days. The tendency with a lot of training or learning events is to have a clear taper and drop-off of interest just after the mid-point, and I didn’t see that happening in Cape Town. I think that this speaks to how you have gotten the tone, the faculty, the curriculum and the material spot-on.