SMEs in agriculture play a critical role in developing the sector by creating employment, facilitating market access for farmers, and providing inputs, credit, and training for smallholder farmers. However, the gap in financing to agricultural SMEs is estimated to be billions of dollars and no single actor can bridge this massive gap alone. To help address this, ten years ago a group of seven impact lenders — Alterfin, Oikocredit, Rabobank’s Rabo Rural Fund, responsAbility Investment AG, Root Capital, Shared Interest Society, and Triodos Investment Management – formed the Council on Smallholder Agricultural Finance (CSAF) with the goal to expand finance to agriculture businesses that operate in developing countries by creating a platform for like-minded lenders to convene on a regular basis to share data, learning, and experiences on agriculture finance.

CSAF aims to improve the livelihood of smallholder farmers and promote environmentally sustainable practices by financing agricultural SMEs.

Today, the CSAF alliance includes 17 lending institution members and affiliates. Since 2013, they have collectively lent over $5.5B to 1,546 enterprises, reaching 6 million farmers across 81 countries. Aiming to improve the livelihoods of smallholder farmers and promote environmentally sustainable practices by financing agricultural SMEs, CSAF members are impact-driven lenders that prioritize social and environmental impact over financial return by investing in higher-risk, high-impact enterprises. As CSAF members’ lending meets only a small share of the overall financing demand of agri-SMEs, CSAF’s role in promoting industry standards and best practices aims to engage a wider set of stakeholders to build a more inclusive and impactful finance market that can help bridge the finance gap for agri-SMEs.

In 2014, CSAF members and affiliates began reporting portfolio and client data. CFI has partnered with CSAF since 2020 to collect and analyze data, in an effort to present insights on the landscape of agricultural SME finance. The results from the annual survey are shared in a published report and data is made publicly available in the CSAF Data Portal.

Of the takeaways from the 2022 State of the Sector report, CFI found the following four to be particularly relevant as we look to the future of agriculture finance. While focusing on overall trends, the insights zoom in on developments in Sub-Saharan Africa.

1. Sub-Saharan Africa represented a growing share of lending, as CSAF annual disbursements to agricultural SMEs reached peak levels in 2021.

Lending to agricultural SMEs in 2021 grew by 35 percent from 2020 – perhaps unsurprising given that CSAF lenders contracted their disbursements in 2020 due to COVID-19 restrictions, marking a growth in disbursements by 18 percent from 2019 pre-pandemic levels. Since 2013 (the year when CSAF members began to report data), annual disbursements have more than doubled, but the increase has not been gradual.

Sub-Saharan Africa saw the greatest increase in disbursements between 2013 and 2021 (+$199M), followed by Central America (+$105M), South America (+$69M), and South & East Asia (+$45M). In 2021, following a five-year trend, Sub-Saharan Africa received the majority of annual disbursements (36 percent), with Cote d’Ivoire accounting for 40 percent of regional disbursements, followed by Kenya, Uganda and Rwanda.

2. Lenders focused on serving existing borrowers and faced challenges finding new investment-ready borrowers.

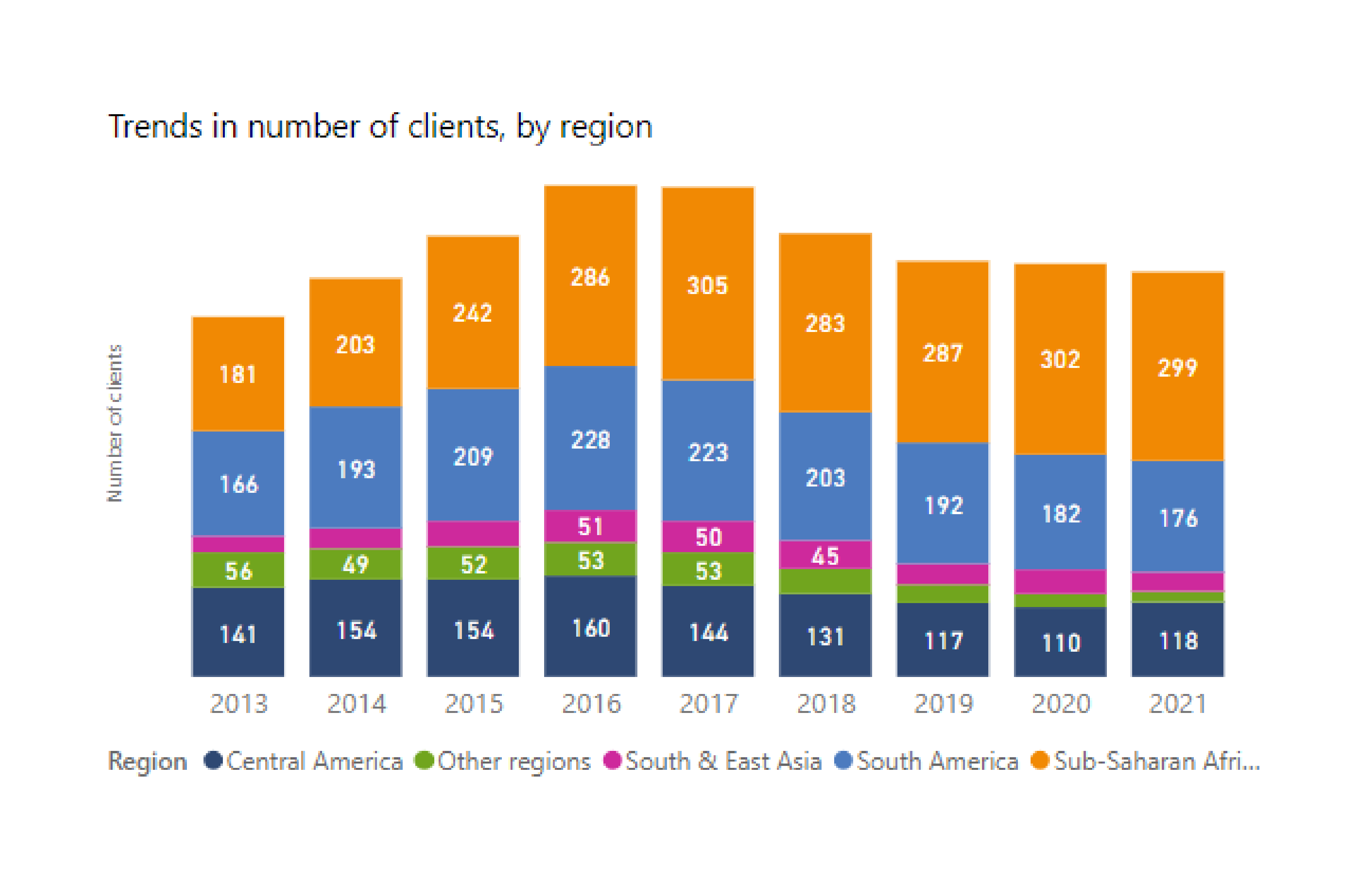

In 2021, the number of total borrowers declined from 654 agricultural SMEs in 2020 to 641 in 2021, marking an increase of only 13 percent from 2013 to 2021. New client origination remained low in past years, indicating that lenders have focused their attention on existing borrowers, which accounted for 90 percent of total borrowers. CSAF members face challenges in serving first-time borrowers, who are often riskier and require smaller, less-profitable loans that do not allow lenders to operate within their risk-return models.

While experiencing a slight decline in 2021 from 2020, Sub-Saharan Africa reported the most borrowers (47 percent of all CSAF member borrowers), spread across 21 countries. In the past 4 years, Sub-Saharan Africa also experienced the highest borrower turnover – with almost the same number of exiting borrowers as entering, but also the highest number of new borrowers.

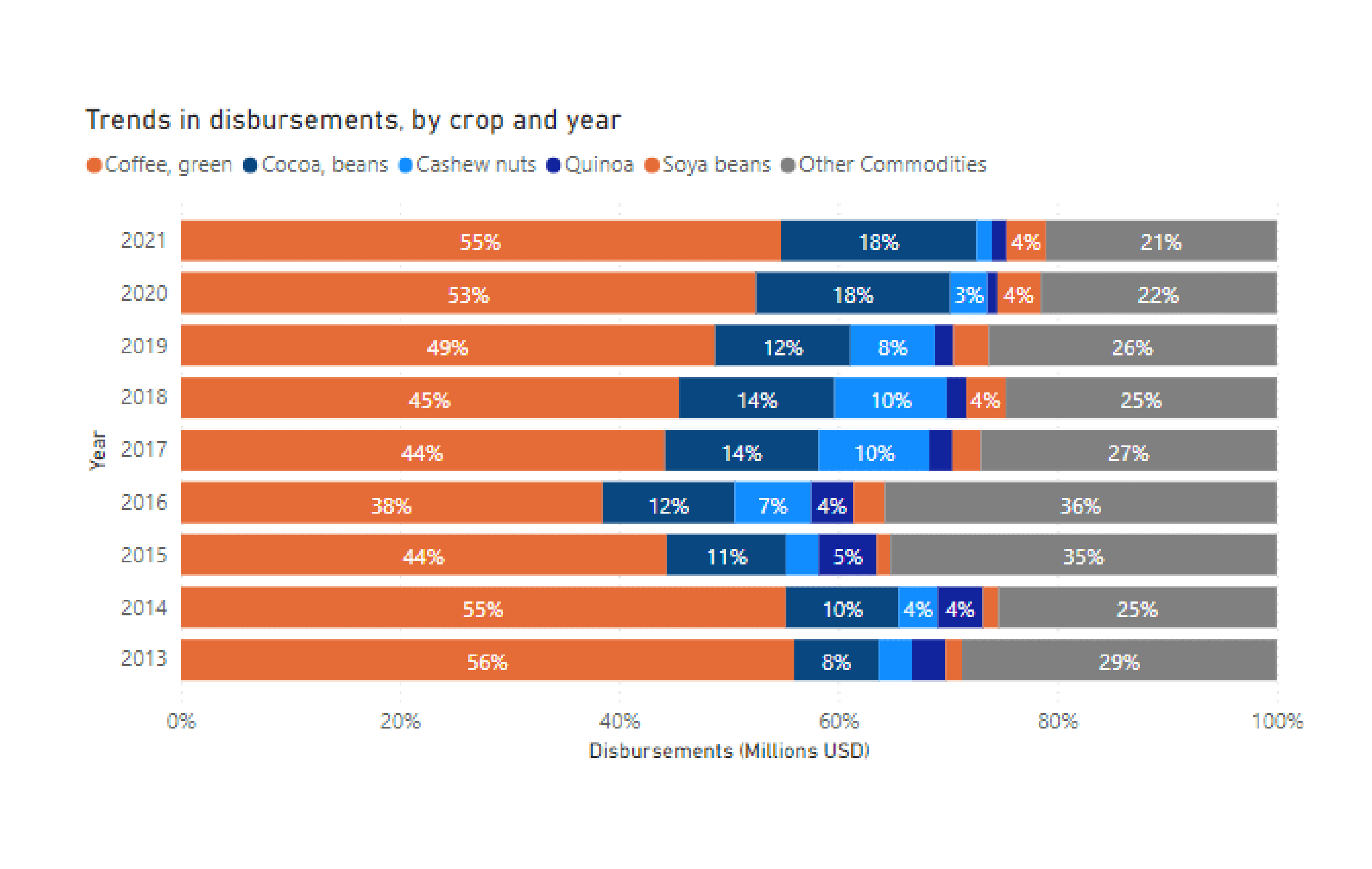

3. Financing to cash-crop value chains (coffee and cocoa) accounted for over 70 percent of disbursements, despite prior attempts to diversify into other crops.

In 2021, CSAF lenders increased coffee disbursements by 40 percent, in response to increased demand for financing associated with rising coffee prices. Since 2013, coffee has been the most financed commodity by CSAF members, with a high concentration in South and Central America. Attempts to diversify away from coffee and cocoa between 2013 and 2017 were met with increased portfolio-at-risk and lenders returned to expanding financing growth in less-risky coffee and cocoa sectors.

Disbursements to cocoa, the second most financed crop, increased by 36 percent in 2021, driven primarily by growth in Cote d’Ivoire and Ghana. Sub-Saharan Africa is the most diverse region in terms of crops financed, as only 62 percent of 2021 regional disbursements went to coffee and cocoa, compared to 83 percent and 94 percent in South America and Central America, respectively. However, there is still concentration in the region; the increase in cocoa disbursements in Cote d’Ivoire accounted for 45 percent of the regional increase and came primarily because of a few borrowers receiving larger loans.

4. Normalized portfolio quality improved as write-offs and restructured loans remained high.

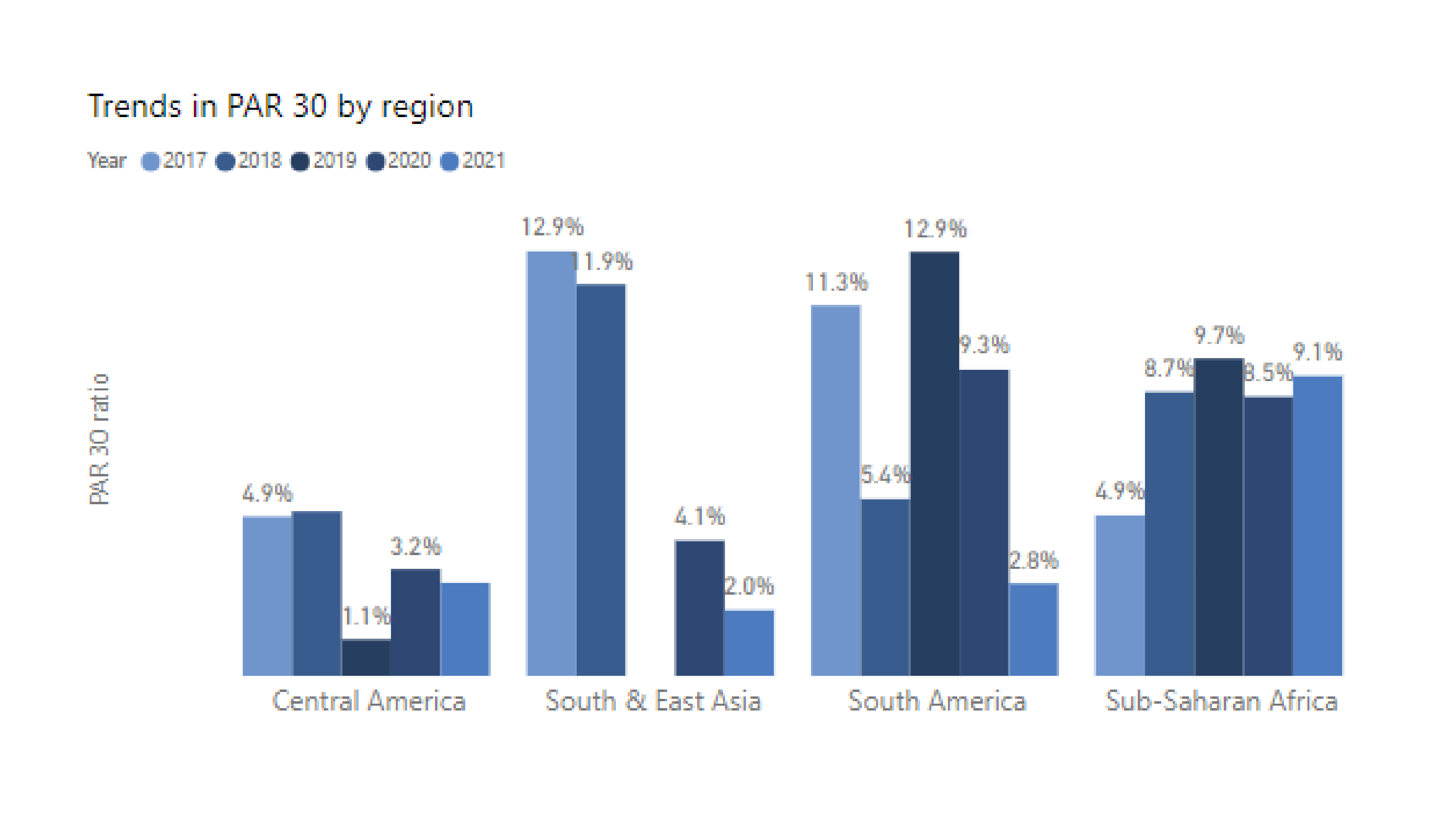

In 2021, portfolio-at-risk greater than 30 days (PAR30) dropped to 7.4 percent, from 8.1 percent in 2020 value. However, trends differ by loan size and region. PAR30 doubled for loans less than $250K and fell for loans larger than $2M+, with PAR30 for loans less than $250k increasing mostly in Sub-Saharan Africa.

While PAR30 declined, the overall share of outstanding write-offs was 6 percent, with the largest share of write-offs coming from Sub-Saharan Africa. This is an indication of old loans being written off from the data set and a possibility that risk associated with COVID-19 challenges or other events is not yet reflected in the data.

When we asked CSAF members to indicate the reasons for loan delinquency, they tend to highlight factors specific to the enterprises, such as management capacity. However, they also emphasize that these challenges are amplified by uncertainty and volatility in the operating environment, particularly related to climate, market, and political factors.

Joining Forces to Contribute to the Sector

After a few years of data collection, CSAF members realized that while market demand was high, it was difficult to meet. The data confirmed that despite the intentions of the group to meet the finance demand of many agricultural SMEs in developing markets, CSAF lenders increasingly served existing borrowers active in cash-crop value chains through short-term trade finance products at larger loan sizes ($500K+), to ensure impact while maintaining lenders’ financial sustainability.

After several discussions on challenges to serve earlier-stage agricultural businesses with lower loan-size requirements and working in less-developed value chains, CSAF members recognized that they were facing similar constraints. After conducting a CSAF financial benchmarking study that demonstrated the elevated risks and lower returns of serving this “missing middle” agricultural SME segment, Aceli Africa was created as an innovative approach aiming to bridge the finance gap for agri-SMEs in East Africa by incentivizing lenders to serve higher-risk market segments while amplifying impact. This is a clear testimony of CSAF’s aim to facilitate dialogue and shift lending behavior among lending practitioners, mobilize stakeholders to develop new solutions that serve excluded agri-SMEs, and engage the broader industry in bringing these solutions to scale.

This is a clear testimony of CSAF’s aim to facilitate dialogue among lending practitioners, mobilize stakeholders to develop new solutions that serve excluded agri-SMEs, and engage the broader industry in bringing these solutions to scale.

In addition to finding new approaches to serve agri-SMEs, CSAF lenders have made progress in tracking impact through aligning on standardized social and environmental impact metrics focused on farm- and enterprise-level practices. However, given the impact of climate change on the livelihoods of smallholder farmers and the importance of climate finance, lenders recognize the urgency for the development of new climate-focused solutions to advance green finance initiatives.