Topic

Series

A quantitative review of the current status of financial inclusion globally, based on the two Findex datasets and supplemented by data from the EIU Global Microscope 2014, UN, World Development Indicators, IMF, Alliance for Financial Inclusion, and the GSMA State of the Industry.

Key Findings

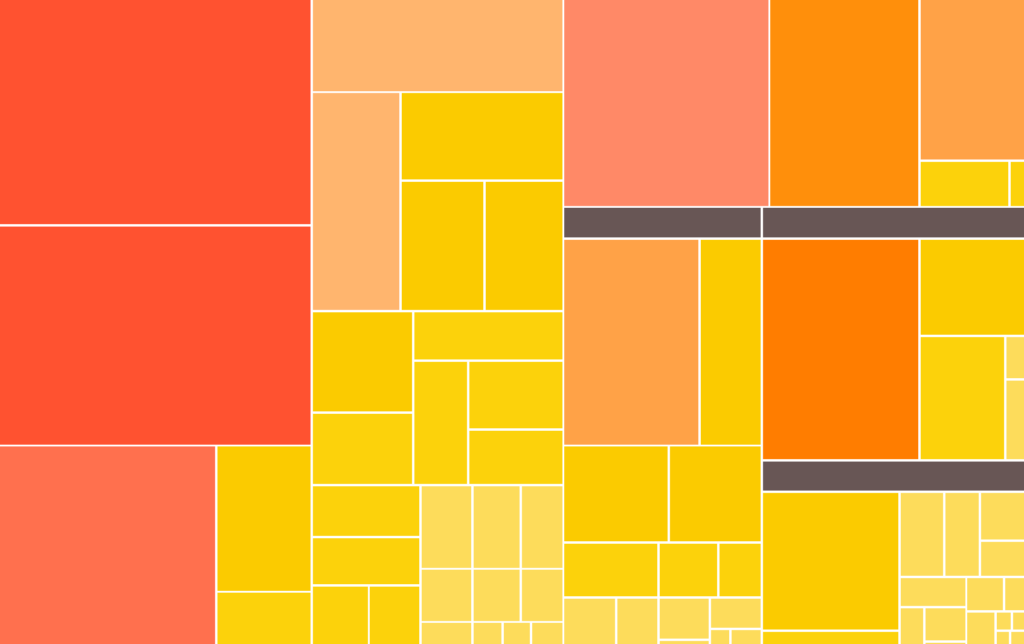

The world – every region, income level, and “slice” of the global population – is moving toward greater financial access.

According to the World Bank’s Global Findex data, the number of financially excluded people globally dropped from 2.5 billion to 2 billion in the three years from 2011 to 2014. At this rate, by 2020 the gap will have closed significantly, with 1 billion excluded adults remaining. With an added push, the World Bank’s goal of universal access to some type of financial account by 2020 seems within reach.

Financial exclusion will look much different in 2020 than it looks today.

Exclusion will be more hidden—in harder-to-reach population segments, in slow-growth countries, and in inadequate products that are not actively used to improve lives. Emphasis needs to turn to “leaving no one behind” and to offering services that make a real difference.

Universal financial access is a first step toward full financial inclusion.

According to CFI, Financial inclusion is a state in which everyone who can use them has access to a range of quality financial services at affordable prices, with convenience, dignity, and consumer protection, delivered by a range of providers in a stable, competitive market to financially capable clients. The purpose of promoting financial inclusion is to enable people to use financial services to better manage their lives. A fully included person is an active user of quality financial services that bring significant value to their lives. Progress on access to an account must be accompanied by further efforts to achieve deeper inclusion.

Although the number of accounts has grown, many of these accounts are not in active use.

In low and middle income countries, the percent of account holders who deposit or withdraw more than three times per month remains very low, a direct contrast to the active usage patterns seen in high income countries. Accounts in these countries tend to be limited in purpose (e.g. a vehicle to receive a salary or benefit payment which is promptly cashed out). Work is needed to make accounts more useful to more people.

Progress on inclusion requires building and maintaining an enabling ecosystem including policy, regulation, and industry infrastructure.

In recent years the world has made strides on technology change, solidified government commitment and action, and increased quality and use of public goods like credit reporting systems, physical infrastructure, and digital infrastructure. These improvements increase both access and ease of use of financial services.

Our hope is that this report provokes further questions.

Which regions are advancing faster than others and why? Which countries are moving quickly, slowly, or not at all? How significant is the contribution of mobile phones to increasing account access? Who will still be excluded in 2020, and where will they be located? How can the push to financial inclusion retain a focus on quality and value for the customer?