- Sections:

Introduction

Financial services are going digital. Digitization will change the way financial institutions organize themselves to relate to their customers, and it will dramatically change how customers experience financial services. These changes will be especially profound for traditionally underserved customers who are the targets of financial inclusion efforts.

The good news is that digital delivery models make it possible — and profitable — for banks to serve many people who were previously excluded because their incomes were too low or their locations too remote to reach through high-touch models. The high operational costs associated with physical buildings and staffing only makes sense if the branches break even and provide a satisfactory return within an acceptable timeframe. Low-income customers with thin credit histories borrowing small amounts of money have long presented a challenge to the analog way of doing business. Thus, serving the underbanked customer segment through digital channels presents an opportunity —by lowering operational costs and increasing customer engagement—to transform financial inclusion into a sustainable business. Additionally, digitization allows thin-file customers to have their creditworthiness assessed through alternative scoring models that incorporate other types of behavioral records.

When done effectively, the returns to digital transformation can be significant. For example, DBS Bank, a financial services group in Asia named “world’s best digital bank” by Euromoney in 2018, has seen digitization contribute to rising shareholder value. DBS customers who process more than half their transactions remotely bring in more revenue than traditional customers. Two-thirds of DBS’s gross profit currently comes from digital customers. A DBS staff member told us, “The cost-to-income ratio for digital customers is just 34 percent, compared to 55 percent for traditional customers. The return on equity from digital customers is, impressively, at 27 percent.” Numbers such as these make it attractive to reach new customer segments. But if the transition from face-to-face to digital is to succeed, financial institutions will need to understand and address the special characteristics of these segments and get the digital customer journey right — for both their own operations and the customers’ experience.

Walking vs. Flying

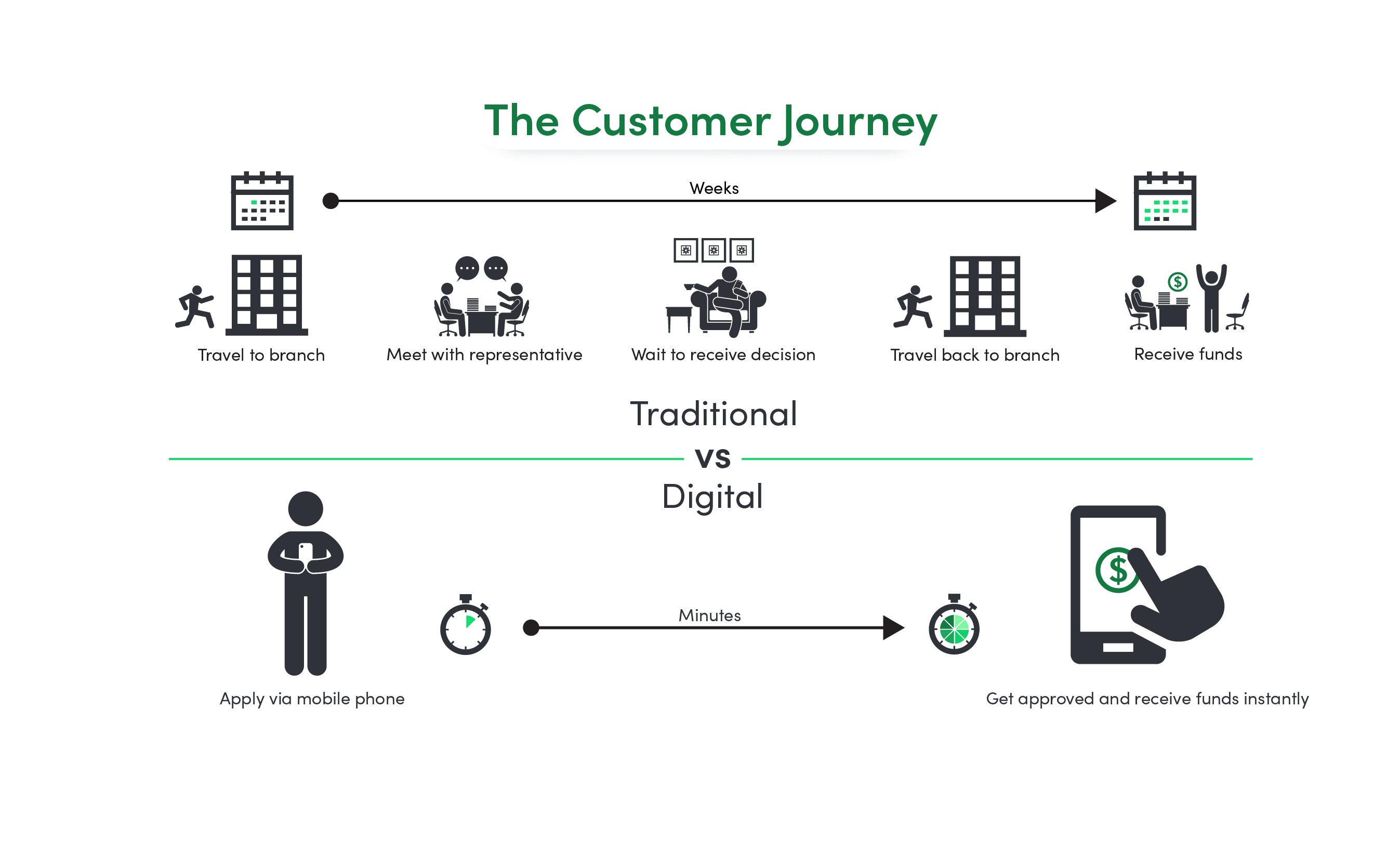

For customers, the difference between a traditional and a digitized customer journey can be as dramatic as the difference between walking and flying in an airplane. The traditional customer journey includes traveling to branches to talk with a customer service representative, assembling pages of paper documents to meet KYC requirements, and then waiting for days to receive decisions. With digitization, customers can discover and apply for products on their phones and receive funds into mobile wallets, all in a matter of minutes.

The difference between a traditional and digitized customer journey can be as dramatic as the difference between walking and flying in an airplane.

In order to produce such a streamlined journey, financial institutions must address technical and operational challenges and regulatory issues. And, as we discuss in this report, the journey they construct needs to work well for customers—especially when those customers are new to their services. Digitization can bring enormous gains in speed and convenience to customers, but it can also create gaps as it shifts from familiar, person-to-person interactions to interactions that take place on a digital device.

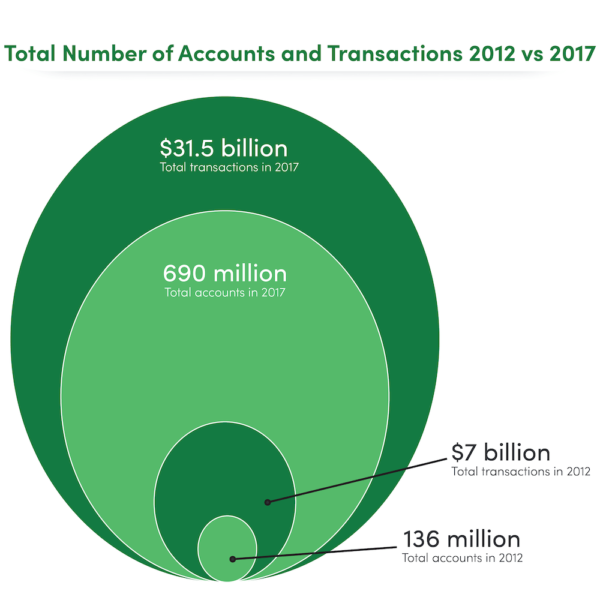

During the interviews we conducted for this report, it became abundantly clear that the mobile phone plays an essential role in fostering the digitization of customer journeys, particularly in the case of products that cater specifically to low-income segments. Indeed, the increased penetration of mobile phones and mobile money services among low-income segments has highlighted handheld mobile devices as the appropriate tool to finally incorporate financially excluded individuals into the financial sector. GSMA’s Mobile Economy 2017 report highlights the growth trends of mobile money transactions. Between 2012 and 2017, mobile money transaction value increased by 350 percent to $31.5 billion, while the number of transactions increased by 428 percent to 1.8 billion.

How are mainstream financial institutions creating effective digital customer journeys for lower-end clients? In this report, which is based on interviews with senior staff members from fifteen financial institutions in the financial inclusion space, we explore the challenges of digital transformation in each phase of the customer journey: discovery, onboarding and continuing use. We provide examples of how innovative financial institutions are addressing these challenges with creative solutions for emerging customers.

Discovery

[Stage One]

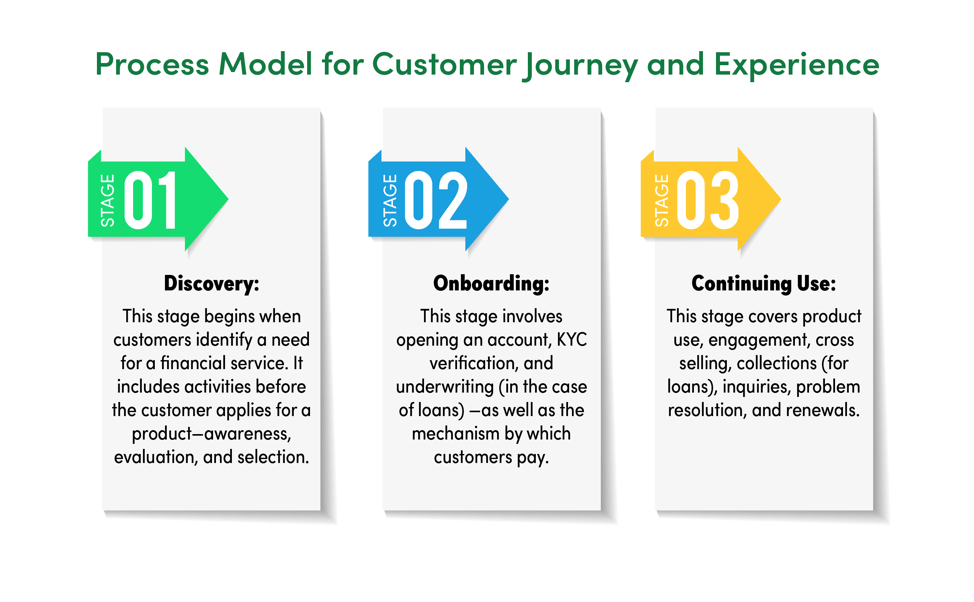

The discovery stage begins when customers identify a need for a financial service. Broadly, it incorporates three steps by the customer: developing an awareness of potential options, evaluating those options, and selecting the most appropriate product. Companies compete for customers’ attention in this stage in an attempt to build brand awareness and communicate value.

One of the pre-digital era challenges banks faced targeting lower income segments in emerging markets was the relative ineffectiveness of conventional marketing techniques on those segments. The target clients of financial inclusion efforts are generally less literate than the overall population. Moreover, they often lack the confidence to approach financial institutions, fear that the institution does not want them as a customer, and discount marketing messages. They often think, “That’s not for people like me.”

One of the obstacles hindering financial inclusion is the fact that underserved customers have traditionally distrusted financial service providers. According to the Global Findex Database 2017, 16 percent of adults without an account at a financial institution cited distrust as their main barrier to opening an account. Digital awareness and marketing campaigns may reach a big audience at low costs compared to traditional methods. However, to create trust among underserved segments, financial institutions need to make concerted efforts to improve how they are perceived by the unbanked.

With digitization, messages can be delivered directly to clients’ phones and tablets in simple terms or with images. For customers in the digital ecosystem, much of this happens through targeted advertising: companies compete to deliver targeted ads to specific handsets at critical moments as customers browse the internet or use social media.

Underserved customers don’t believe products are for them, but targeted digital messages can overcome this.

These channels overcome an access to information challenge and may make it less costly to raise awareness. As underserved clients connect to the internet and develop digital footprints, companies will be increasingly able to reach them with these methods.

That Human Touch

However, our interviews suggest that, to be effective, digital models must be combined with elements of human touch that customers still prefer or find more comforting. This is especially true for customers new to digital experiences. While targeted advertising is useful, it cannot address many of the concerns clients have when evaluating and selecting products.

As described in CFI’s Uniting Tech and Touch: Why Centaur Products Are Better for Consumers and Providers, consumers with limited exposure to digital financial services find it especially important to speak to a person when they are first learning about a product. Rather than scrolling through FAQs, customers can ask questions in their own words, which builds confidence. A guiding hand may be especially helpful for underserved clients who are unaware of the range of available products, lack the digital savviness to evaluate products, or mistrust financial institutions. Many customers interviewed for our Tech and Touch study said that their very first question is whether a new brand or service is legitimate. To be convinced, they want to speak to a person they can look in the eye.

Many of the financial institutions we interviewed for this paper use tech and touch during the discovery stage. Several institutions reported that offering a human touch to prospective customers is critical to boosting adoption, and some of the products with the highest rates of adoption add human elements to primarily digital experiences.

Discovery Case Studies

Consider SimSim, a mobile wallet application developed by FINCA Microfinance Bank Limited in Pakistan and the fintech Finja. Customers can download the free application to their mobile devices. If they have a national identification card, they can sign up for a branchless banking account in less than a minute. Users can use SimSim to send and receive money, pay bills, and receive discounts at their favorite retailers. The challenge FINCA Pakistan faced was how to move people from hearing about the product to downloading it.

FINCA promotes SimSim using digital marketing techniques like targeted ads and optimizing their webpages for search engines, but to break through the inactivity barrier, their most successful client acquisition strategy is the flash mob.

FINCA stages flash mobs to focus excitement on one specific merchant who accepts payments using SimSim. On a given morning or afternoon, they tell everyone in their system and on social media that FINCA and SimSim are going to be at a particular shop, and that everyone who comes to make a purchase before a certain time will receive a discount or a free item. FINCA’s staff help customers sign up during the flash mob, accompanied by music, dancers, banners, and giveaways. In addition to those arriving after hearing about the flash mob from social media notifications, the energy around the shop also draws walk-ins.

This approach has helped FINCA build awareness and expand the product. “We try to create this exciting moment to draw business to the merchant who is using our system and sign up as many potential clients to our platform as possible. [We want to] show them how to use it and try to get them actively transacting,” said Keith Sandbloom, Vice President and Regional Director for Latin America and the Caribbean at FINCA. The flash mobs have “really helped client uptake of the SimSim wallet. You can very clearly see the impact of these flash mobs on the client uptake graphs. New client signups go through the roof. When you don’t have any [flash mobs], uptakes are just a flat line.”

The relationship between the fintech EarnUp and the non-profit organization GreenPath, both in the United States, provides another example of the potential of integrating human touch into digital customer journeys. Customers who sign up for the service sync their various loan accounts to the platform, and the application works to set money aside and optimize loan payments so customers can get out of debt faster. About two years ago, EarnUp was facing a challenge. They knew they “had the technology to provide meaningful long-term engagement but lacked a channel to reach the low-income customers that needed it the most.”

It turned to GreenPath, a financial counseling organization. GreenPath offers individualized, phone-based financial counseling, working closely with customers to build their knowledge of the financial tools and strategies available to help better manage their money. GreenPath reaches its clients both through its website, but more importantly, through partnerships with banks and credit unions. GreenPath recognized that EarnUp would be a perfect tool for many of the clients it advises. In a report on their partnership, GreenPath said, “We immediately sensed the potential for a partnership that could address strategic challenges on both sides. At GreenPath, we were grappling with how to serve more of the customers who came through our doors. EarnUp was trying to broaden its customer base, particularly among the types of people we were aiming to serve better.” Their partnership is leveraging GreenPath’s direct relationship with clients to build awareness of EarnUp’s offerings, launching customers on a digital customer journey. The initial deployment the institutions conducted together showed promising financial outcomes for users of the EarnUp platform.

Onboarding

[Stage Two]

Once a person decides to apply for a product, the provider initiates a series of activities to establish the customer’s credentials and eligibility and set up the account. This stage also involves underwriting decisions for credit products, providing detailed information about product terms and conditions, and signing contracts. Most of this process used to involve paperwork, for the obvious reason that it traditionally required customers to sit with staff to fill out paper forms and check documents.

In its traditional form, the onboarding stage can be especially difficult for underserved clients. The prospect of opening an account the same day was often low due to insufficient documentation, such as lack of proof of income (especially hard to obtain for people working in the informal sector). According to the 2017 Global Findex survey, nearly one quarter of adults without an account at a financial institution cited a lack of documentation as a reason. When documentation is completed on paper, a customer may have to travel to and from a financial institution several times, which is time consuming even in urban environments. Approximately one-fifth of the Findex respondents without accounts also cited distance to a financial institution as a barrier. For loan products, this stage is even more difficult for customers: the approval process can often take days or weeks, and understanding contract terms and conditions can be daunting, even for the well-educated.

Over time, onboarding processes have gone digital, as staff members were given tools to enter information directly into a computer rather than first writing it down in paper. Today, a fully digital onboarding process — in which customers can sign up for a product on their phones or computers from any location, often within a few minutes — is spreading. With fully digital onboarding, the customer gains convenience and speed, while the provider reduces personnel costs.

In response to these barriers, financial service providers are working to make the onboarding process easier for clients wherever possible by creating tools that allow customers to complete portions or entire onboarding processes digitally. In our interviews, we found that financial institutions are moving toward digital onboarding, though not all have fully reached that destination. There are a number of examples where the process occurs entirely from a smartphone, and others that still require some face-to-face element.

In countries with digitized national identification systems, know your customer (KYC) can be fully digitized.

One of the most helpful advances in this stage concerns processes. In countries with digitized national identification systems, KYC can be fully digitized through provider links to the national identification database. However, in a number of instances, the national identification system has not been fully implemented or streamlined sufficiently to allow for onboarding to take place remotely. The role of government in establishing an enabling environment to promote financial inclusion and digital financial service adoption was a major theme in many of the interviews conducted.

Onboarding Case Studies

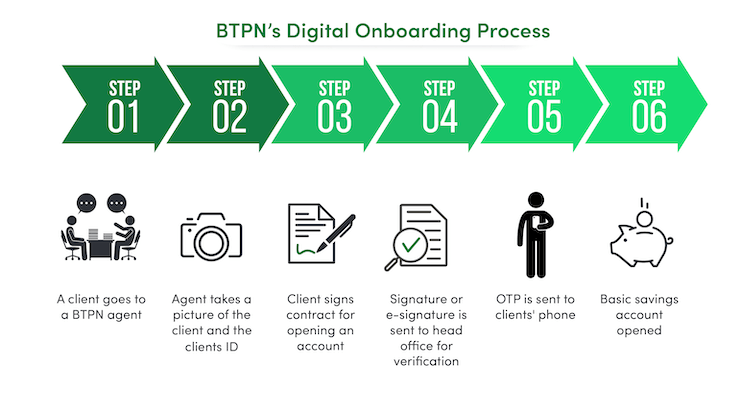

BTPN in Indonesia, for example, relies on agents. The bank is working to ease the barriers of client on-boarding for its basic savings account—BTPN Wow!—designed for the financially excluded. The product operates primarily through agents rather than branches, giving customers many more points of access. The agent takes a photo of a client’s identification and records his or her phone number. Clients provide an e-signature and verify their account opening by utilizing a onetime password. The entire process takes from five to ten minutes.

One of the factors driving the success of BTPN Wow! is the Indonesian government’s desire to promote branch-less banking as part of the country’s national financial education strategy.

The fourth-largest mobile bank in Poland, mBank is digitizing its customer onboarding process by partnering with the fintech LiveBank. LiveBank uses video chats, optical character recognition (OCR), biometrics, and digital signatures to capture and verify customer information. As part of this process, mBank and LiveBank connect with Poland’s eGovernment portal, where they can link to the national identification system to verify identities.

Al Rajhi bank in Saudi Arabia relies on a similar system to enable digital onboarding. The government integrated the national ID system with the Saudi Credit Bureau (SIMAH). The IDs are a simple and secure way to verify customers in KYC processes, enabling digital onboarding. When customers want to open a bank account, they call the bank and provide their national ID number. The bank provides an initial username and password and verifies the account opening using a one-time password sent to customers’ phones. After signing up, customers can pick up their debit card from any designated Al Rajhi location. At the kiosk, the bank uses biometric finger scanning to complete the account opening process. For clients wishing to obtain a credit line, Al Rajhii can easily look up a borrower’s credit history and debt burden ratio through his or her ID number to assess credit worthiness, a process that usually takes a few minutes.

In Mexico, BBVA has been working for years to digitize the onboarding process in an effort to reach low-income customers without easy access to a branch. BBVA redesigned its application to make it easier for low-income customers to sign up for basic accounts remotely. However, at first, regulations in Mexico meant that a customer would still need to visit a bank branch to complete the onboarding process. That was until the government enacted new regulations that allowed for the opening of simple, balance-limited accounts with less complex KYC requirements. With the new regulations in place, BBVA was able to fully digitize its onboarding process for new clients.

Continuing Use

[Stage Three]

The continuing use phase includes product use, customer engagement, cross-selling and responding to inquiries or complaints, as providers work to build extended relationships with clients. Financial institutions hope that this will be the longest stage in the customer journey, and it is certainly the stage in which initial investments in discovery and onboarding pay off. However, as low account usage rates — particularly for mobile money accounts — suggest, it is also one of the most difficult for financial institutions to get right. According to the latest Global Findex, 20 percent of account owners worldwide reported having an inactive account, that is, no deposit or withdrawal — digital or otherwise — in the past 12 months.

Many FSPs that are just starting to cater to clients at the base of the pyramid struggle to build a relationship with clients. Learning about their financial lives and habits in order to continue improving and innovating their service offerings is challenging because they are thin-file customers, so records about their financial lives are scarce. Additionally, many clients of this market segment are interested only in a particular feature of the product that they have identified is beneficial for them and thus are thought to be less open to exploring other beneficial features. Because of this, FSPs face many challenges when trying to engage their clients in this segment.

In a traditional financial institution, contact with customers is limited to times when customers visit branches for transactions or inquiries, or to expensive phone or mail outreach. Digital systems allow for ongoing contact at a much lower cost, giving institutions the opportunity to develop a different kind of relationship with their customers. The digital footprints that customers leave allow companies to conduct a range of analytics, so that messages sent by SMS or other means can be highly targeted. Our interviewees reported using machine learning to cross-sell products at certain moments for the customer and using chatbots to provide customer service assistance. The digital relationship can also incorporate nudges, tools and reminders based on behavioral insights to encourage clients to save more, manage better their debts, keep closer track of their expenses, and build more accurate personal budgets. In this way, a bank can contribute to customer financial health.

Banks can also offer enhanced, tailored financial services to emerging customers through digital means. mBank is using machine learning to identify what managing director Jakub Fast calls “natural scenarios,” during which they can offer tailored financial services. For example, if their system detects that a customer is using his or her mBank card to pay for transportation to the airport, the customer might receive an offer for a travel insurance product. Or an additional line of credit might be offered to a customer with a good credit score who has maxed out his or her credit card during a transaction. Similarly, Bancolombia uses machine learning to analyze the savings behavior of its Ahorro a la Mano (“Savings on Hand”) customers to identify an approval limit for their Credito a la Mano (“Loan on Hand”) product. The customer can go through the complete customer journey for these products — from signing up for Ahorro a la Mano, to applying for and repaying credit from Credito a la Mano — digitally.

At financial institutions with digital offerings, examples like these are not particularly unique. The majority of institutions we spoke with mentioned the importance and use of some exciting new technology or the application of analytical tools to their data.

One area where human touch may still be needed is complaint resolution. Institutions are using email, chatbots, live chat and call centers to handle inquiries and complaints, and these mechanisms may take care of the great majority of inquiries. However, our research with customers in Kenya suggests that while they are comfortable with digital transactions, when something goes wrong they want to know that they can have ultimate recourse through a person. If most inquiries can be answered through automated means — inexpensively — the FSP may still be able to provide a human response for more difficult cases, while saving money overall on the complaints function.

What was most interesting in the examples we identified related to this phase was the degree to which innovative bank offerings relied on partnerships with technology companies to reimagine the customer journey. Such partnerships allow for rapid experimentation, take advantage of the technology know how of other companies, which may be more attractive than in-house development. BBVA, for example, runs an Open Innovation program, which supports its business verticals to find and integrate cutting-edge technology start-ups. The bank uses a variety of methods to identify partners, such as competitions where start-ups pitch their ideas to senior executives. The winners of those competitions are then put on a fast track to deploy their solutions as quickly as possible.

Continuing Use Case Studies

In 2016, DBS Bank launched digibank, an application it bills as “an entire bank squeezed into your smartphone,” according to its website. The company launched in India first because of its unique enabling environment. The country’s eKYC system, unified payments interface, and consent system for sharing client data enabled DBS Bank to launch a completely mobile banking experience.

DBS uses a conversational artificial intelligence platform to enhance customers’ experience after they open an account. DBS Bank is partnering with Kasisto, an AI platform, to interact with clients for everything from managing frequently asked questions to assisting with balance transfers and providing customers with insights into their own spending patterns. The platform can handle 82 percent of inquiries, allowing customers to get the answers they need quickly while minimizing operational costs for the company. The platform has roughly one million users in India, and DBS recently launched it in Indonesia. In Singapore, DBS Bank has deployed Kasisto’s platform through Facebook Messenger.

Emirates NBD in the United Arab Emirates has a range of digital offerings for a variety of client segments. Through their Facebanking service, customers can open accounts, video chat with bank staff, and view analysis of their earning and spending behavior.

One noteworthy feature is Emirates NBD’s commitment to including clients with disabilities. For example, to serve deaf customers, they have partnered with the technology company KinTrans. KinTrans uses motion-recognition technology to facilitate real-time sign language translation between a customer and frontline service staff. The aim is to equip 60 percent of its branches to serve deaf customers by 2020.

Takeaways

The case studies presented throughout this report offer important lessons about how mainstream financial institutions can create a successful customer journey in the digital age.

One important message is that it will likely be necessary to maintain some portion of touch even as the majority of transactions shift to tech. As the case studies in the discovery stage show, this is especially important in early stages of the customer journey, and to assist with complaint resolution. Quite possibly, as clients interact in a digital environment, they will become more comfortable locating and deciphering digital information and will rely less on the human touch to usher them along at key stages in their journey. However, as long as trepidation about new products and services still exists, the availability of a human touch element is needed. As Keith Sandbloom of FINCA International put it: “We want to maintain the [human] touch with our clients, but we [also] want to implement tech to offer new products through new channels that add convenience to our clients’ lives. When we talk about how our business model is evolving, we use a phrase we call ‘touchtech.’”

Maintaining some portion of human touch might be necessary even as the majority of transactions shift to tech.

Our case studies also show how policymakers and regulators play important roles, particularly in setting up the framework for smooth digital onboarding. The advent of national identification systems and changes in KYC regulation have allowed banks to launch fully digital customer journeys. Scans of photo IDs and/or biometrics, verified with uplinks to national databases, have replaced trips to branches and photocopies of national registration cards.

We have also seen that partnerships between financial institutions and fintech and other technology companies are important in facilitating the customer journey. Companies that have largely digitized their operations make use of predictive analytics to segment their clients and offer products and services in a targeted way. They are also using artificial intelligence chatbots to serve customers. Partnering with fintech and technology companies provides institutions with capabilities that are otherwise difficult to acquire. In our case studies, we highlighted a partnership that allows for communication between deaf customers and frontline staff and a conversational AI tool to that supports a digital bank. Developing even one of these solutions in-house is a time-consuming and costly process, and collaborations represent an efficient way for mainstream financial institutions to adapt to the digital environment and improve the customer journey.

Transformation from traditional to digital models is not easy. It requires deep rethinking of business models, rather than simply automating existing ones. The challenge is both internal (such as major changes in staff roles and upgrading in-house data analytic capabilities) and external (such as adapting to new regulations or forging new partnerships).

Transformation from traditional to digital models requires deep rethinking of business models, rather than simply automating existing ones.

Digital transformation takes time, upfront investment and ingenuity. However, the potential benefits make digital transformation models worthwhile, as mainstream financial institutions gain new customers and while reducing operating costs, and emerging customers enjoy faster, more convenient and more tailored financial products and services.

Acknowledgments, Interview List, and Endnotes

We thank all those who participated in our research — particularly the representatives from the nine financial institutions, fintechs and other entities featured in this paper who generously shared their experiences and insights with us. We also gratefully acknowledge the following organizations for their invaluable time and support: FINCA Microfinance Bank Limited (Pakistan), BTPN, GreenPath, Bancolombia, BBVA Bancomer, Emirates NBD, mbank, Al Rajhi Bank and DBS Bank. Please see the full list of interviewees below.

This report is part of a two-year initiative, Mainstreaming Financial Inclusion: Best Practices, which aims to help advance efforts of financial institutions to reach customers at the base of the economic pyramid. This initiative and this report were made possible with support from MetLife Foundation, and in collaboration with the Institute of International Finance. The views and opinions expressed in this report are those of the authors and do not necessarily represent the views of the MetLife Foundation or the interviewees. All errors are our own.

INSTITUTION

|

INTERVIEWEE |

TITLE |

| Al Rajhi Bank* | James Galloway | Advisor to the CEO |

| Turki AlDhfayan | Senior Director, Digital E-Channels | |

| Anil Pathak | Senior Director, Marketing | |

| BBVA Bancomer* | Carlos Lopez-Moctezuma | Head, New Digital Business & Global Director for Financial Inclusion |

| Bancolombia* | Pilar Cabrera Portilla | Director, Regulatory & Public Affairs |

| Juan David Correa | Analyst, Financial Inclusion | |

| Pilar Otero | Director, Regulatory & Public Affairs | |

| Myriam Botero Wickmann | Head, Financial Inclusion | |

| Carlos Ochoa | Investment Manager | |

| BTPN | Vita Sabrina | Customer Experience Lead |

| DBS Bank* | Neil Cross | Chief Innovation Officer |

| Emirates NBD* | Vikran Krishna | Head of Marketing & Customer Experience |

| FINCA International | Keith Sandbloom | Vice President & Regional Director For Latin America and The Caribbean |

| JP Morgan/ Financial Solutions Lab* | Anne Romatowski | Vice President, Global Philanthropy |

| mBank S.A.* | Jakub Fast | Managing Director |

The works cited below are in order of appearance, as hyperlinked text or image caption, from Introduction to Takeaways.

- “World’s Best Digital Bank 2018: DBS,” Euromoney, July 11, 2018, https://www.euromoney.com/article/b18k8wtzv7v23d/world39s-best-digital-bank-2018-dbs.

- “How Digitization Is Paying for DBS,” The Economist, March 8, 2018, https://www.economist.com/finance-and-economics/2018/03/08/how-digitisation-is-paying-for-dbs.

- “2017 State of the Industry Report on Mobile Money,” GSMA, https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2018/05/GSMA_2017_State_of_the_Industry_Report_on_Mobile_Money_Full_Report.pdf

- Katherine N. Lemon and Peter C. Verhoef, “Understanding Customer Experience Throughout the Customer Journey,” Journal of Marketing 30, no. 6 (November 2016): 69-96, https://journals.sagepub.com/doi/pdf/10.1509/jm.15.0420.

- Asli Demirgüç-Kunt, Leora Klapper, Dorothe Singer, Saniya Ansar and Jake R. Hess, “The Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution,” World Bank, April 2018, http://documents.worldbank.org/curated/en/332881525873182837/The-Global-Findex-Database-2017-Measuring-Financial-Inclusion-and-the-Fintech-Revolution.

- Alexis Beggs-Olsen, “Uniting Tech and Touch: Why Centaur Products Are Better for Consumers and Providers,” Center for Financial Inclusion at Accion, November 2017, https://www.centerforfinancialinclusion.org/uniting-tech-and-touch-why-centaur-products-are-better-for-consumers-and-providers-evidence-from-kenya.

- Amee Parbhoo and Coryell Stout, “The Tech Touch Balance,” Accion Insights, October 2018, https://content.accion.org/wp-content/uploads/2018/10/1122_TechTouch-RO6-Singles.pdf.

- “Pakistan’s First Free Mobile Wallet, SimSim, Received Regulatory Approval,” FINCA Microfinance Bank, May 30, 2017, http://www.finca.pk/news/pakistans-first-free-mobile-wallet-simsim-received-regulatory-approval.

- “EarnUp & GreenPath: What We Learned from a Nonprofit Partnership,” Earnup, March 19, 2018, https://www.earnup.com/earnup-greenpath-learned-nonprofit-partnership.

- “Building Successful Nonprofit-Fintech Partnerships,” GreenPath, 2018. https://www.greenpathpartner.org/Docs/Successful_Partnerships.pdf.

- Demirgüç-Kunt et al., The Global Findex Database 2017.

- “OJK Promotes Branchless Banking Program to Boost Financial Inclusion in West Sumatra,” Otoritas Jasa Keuangan, December 3, 2016, https://www.ojk.go.id/en/berita-dan-kegiatan/siaran-pers/Pages/Press-Release-OJK-Promotes-Branchless-Banking-Program-to-Boost-Financial-Inclusion-in-West-Sumatra.aspx.

- Beggs-Olsen, Uniting Tech and Touch: Why Centaur Products Are Better for Consumers and Providers.

- “KAI Banking & DBS digibank,” June 2017, https://kasisto.com/wp-content/uploads/2018/08/Kasisto_DBS-digibank_Case-Study.pdf.