Topics

There has been a lot of talk in recent years about the promise of fintech to help advance financial inclusion. This has been especially true during the pandemic: acceleration in digital adoption, spurring further growth in the inclusive fintech sector. Much of this growth has taken place in Africa, where fintechs raised $2.3 billion dollars in 2021, up from $830 million in 2020, helping to catch up with funding levels in South Asia and Latin America.

While inclusive fintechs are developing innovative ways to reach new customers, meaningful customer segments remain underserved.

With this growth, there also is more data and insights about fintechs and their customers. Last year, two reports, CFI’s Inclusive Fintech 50: Driving Innovation in an Era of Uncertainty and Catalyst Fund’s State of Fintech in Emerging Markets (in collaboration with Briter Bridges), leveraged such data to take stock of the industry’s progress. The reports arrived at similar conclusions: while inclusive fintechs are continuing to develop innovative ways to reach new customers, meaningful customer segments remain underserved and fintech funding remains concentrated.

The truth is that we are still in the early stages of bringing the power of fintech to bear on the challenges that low-income and vulnerable populations face. Advances have certainly been made, but the greatest gains only can be realized through intentional and collective efforts on the fintech frontier. This will help pave the way for strategies to turn these underserved markets into opportunities for growth.

Outreach to Underserved People

On the bright side, early-stage fintechs continue to proliferate. Last year, nearly 300 such fintechs applied to Inclusive Fintech 50 (IF50), an annual competition to showcase early-stage fintechs driving financial inclusion around the world. Expert judges selected 50 winners from this applicant pool based on established criteria of inclusivity, innovation, scale potential, and traction.

IF50 applicants have shown a continuous drive to innovate, demonstrated by their broad range of product areas, with varied models, partnerships, and customer acquisition strategies. The fintechs also are finding diverse ways to reach underserved people, such as through the provision of in-person digital skills training, use of agents, and product offerings that can be accessed without a smartphone.

Applicants are also designing solutions to address challenges in areas that are fundamental to people’s livelihoods – including climate resilience, health, and support for micro and small enterprises. For example, IF50 2021 winner Tugende uses asset finance, technology, and a customer-centric model to help informal sector entrepreneurs in Africa grow their businesses and access value-added services such as medical insurance. Eighty percent of IF50 2021 applicants reported that their solutions helped customers access essential services during the pandemic, such as healthcare, government relief, and clean energy.

Gaps in Inclusivity

Despite this progress, significant gaps in customer outreach remain. For example, only 23 percent of fintechs in the Catalyst Fund sample reported that women constituted more than 50 percent of their customer base. Moreover, 38 percent of the IF50 2021 applicants do not disaggregate client data by gender.

Catalyst Fund and IF50 both also found that most inclusive fintechs do not focus mainly on low-income people. In the IF50 sample, 41 percent of applicants reported primarily targeting low-income customers. More than 70 percent of startups in the Catalyst Fund sample reported that fewer than 25 percent of their customers live under the poverty line, although poverty rates in the countries where these startups operate are closer to 35-45 percent.

The Catalyst Fund data also showed that as startups grow, they tend to move upmarket. Particularly for early-stage startups looking to raise capital, showing strong acquisition numbers is imperative, and middle- and higher-income customers tend to be easier and cheaper to acquire.

Concentration in Funding and Geographies

The pressure to acquire more customers may be driven by the underlying scarcity of funding for early-stage fintechs. Although investment flows have grown dramatically in recent years, funding in emerging markets is concentrated among very few startups. Out of 101 Sub-Saharan African startups in the IF50 2021 sample, five accounted for 65 percent of the funding. In Latin America, five of 36 applicants received 83 percent of funding.

Not only is funding concentrated among a few startups, but those startups are also based in a select few countries. Sixty-four percent of total funding reported by IF50 2021 applicants went to fintechs based in five countries: Colombia, India, Mexico, Singapore, and the United States. In Latin America, four countries (Brazil, Mexico, Uruguay, and Colombia) accounted for over 99 percent of funding in the Catalyst Fund sample. Such geographic concentration particularly excludes countries with lower levels of financial inclusion. Of the 16 countries in the IF50 sample that received over $10 million, only three have financial inclusion levels below 40 percent. Similarly, fintech funding in Africa is concentrated in Kenya, Nigeria, and South Africa (87.9 percent), all countries with higher levels of financial inclusion and/or more developed fintech ecosystems.

Not only is funding concentrated among a few startups, but those startups are also based in a select few countries.

Deals are also concentrated in certain types of products: those in payments, digital credit, and neo banks, and those that require a smartphone. In contrast, savings and insurance fintechs receive less funding, as do models that leverage USSD or lower-tech accessibility. IF50 data found that funding to fintechs offering services that require smartphones was about 3.5 times greater than those needing only a basic or feature phone. This may be because lower-tech models cost more to operate and users cannot bear higher-margin pricing.

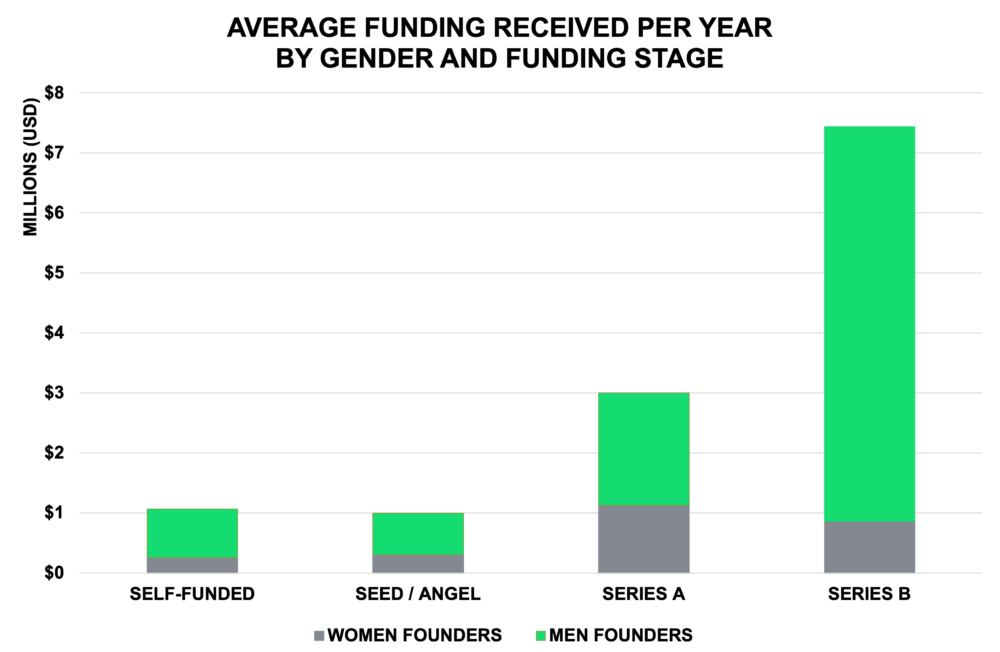

Investment flows continue to favor men, and along all stages of growth, men founders raise more than women founders. According to 2021 IF50 data, women founders, on average, raised one-third the amount raised by men founders.

Overall, the data demonstrates that the majority of inclusive fintech startups, particularly those servicing more excluded segments, continue to find it difficult to access investment capital. Being able to prove the business case of untapped markets is difficult, but Okapi Finance, an IF50 2021 winner, aims to demonstrate the potential by focusing on women merchants in Africa’s informal sector.

Looking Ahead

While there are opportunities for early-stage fintechs to build commercially viable businesses that are truly inclusive, more effort is needed from the broader ecosystem to ensure that innovative solutions can take hold. Startups are continuing to emerge on the frontier, but they need access to the visibility, resources, expertise, and networks that support their growth into sustainable and impactful companies.

Supporters of digital financial inclusion can help by directing greater attention to innovative startups in overlooked markets. Competitions like IF50 and those organized by Women’s World Banking and the Alliance for Financial Inclusion, and market insights provided by research organizations like Briter Bridges, also help to raise awareness. Incubators and accelerators, such as Catalyst Fund, can assist in de-risking less proven models and making them more market-ready via grant funding, mentorship, and other venture-building services. And finally, greater investment, particularly in the $250K to $1M range, can help to fuel early-stage ventures pioneering innovative solutions.

The application period for the 2022 Inclusive Fintech 50 competition will open Monday, June 27, and inclusive fintech startups – especially those at the frontier – are strongly encouraged to apply. The 2022 theme is “Making Digitalization Count.” IF50 is sponsored by Visa, MetLife Foundation, and Jersey Overseas Aid & Comic Relief.