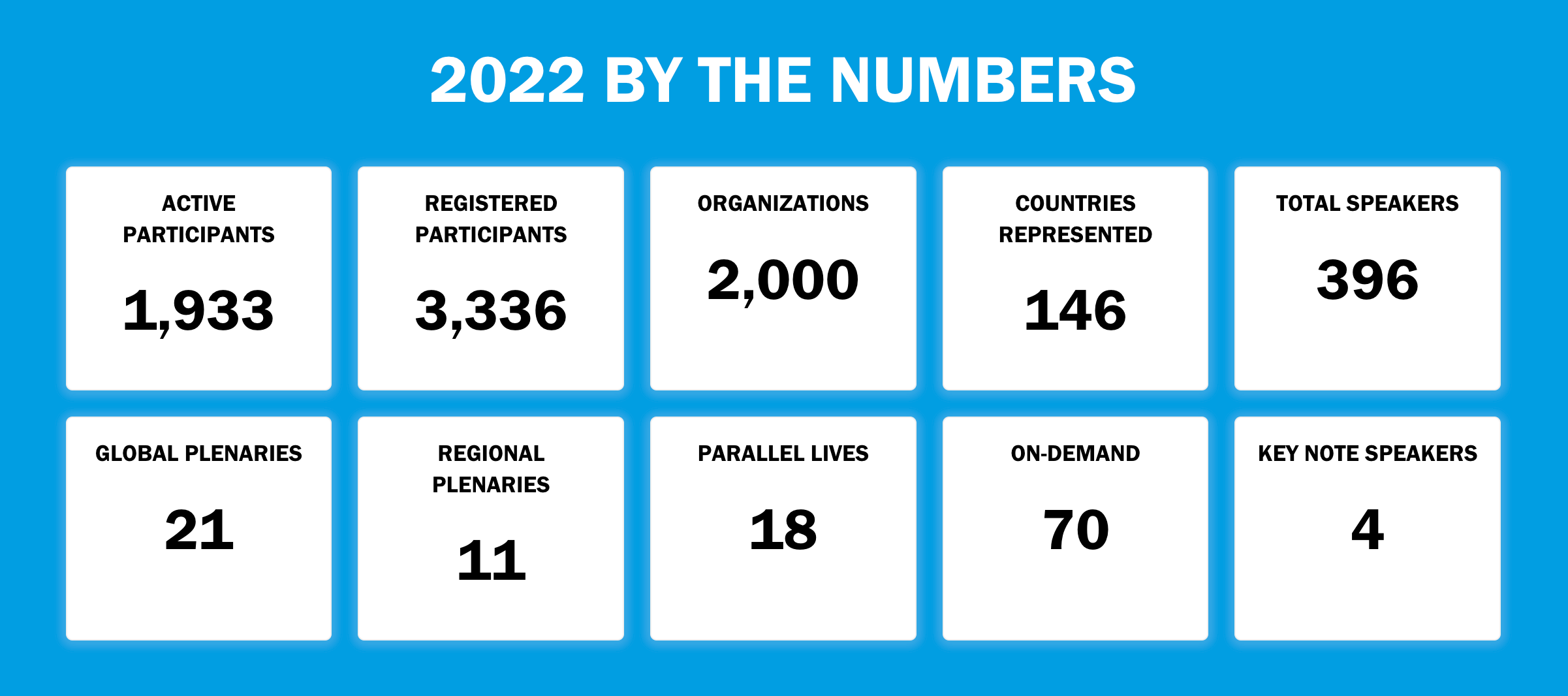

As each year comes to a close, it’s natural to reflect on the key moments and events that shaped the year. Beyond the political and economic events and trends – the war in Ukraine, the rise in inflation globally, the floods in Pakistan, and COP27 – the field of inclusive finance itself is reshaping its contours to meet the moment. We saw this very visibly in this year’s Financial Inclusion Week (FIW), the largest event we have hosted to date – with virtual participants from 2,000 organizations across 146 countries. The topics covered reflect the priorities of global actors in inclusive finance, pointing to the direction the field is going.

To me, the scale of this year’s FIW and the coming together of the minds of stakeholders worldwide during this difficult time signals an urgent need and momentum to accelerate our understanding of how inclusive finance must evolve to address global challenges. With over 50 hours of live content and 70 on-demand sessions, FIW has something for everyone. While it would be amazing to watch the hours of rich live and on-demand content oneself, we know few people have this luxury. We have been reflecting on this at CFI and will launch a blog series that highlights takeaways on key topics covered during FIW 2022.

FIW 2022 left me with several reflections on the state of the inclusive finance sector and what needs to be prioritized. While FIW covered many sub-topics, the overall theme for the week was “Inclusive Growth in a Digital Era,” exploring how our community can harness digital innovation to expand inclusive financial services and contribute to inclusive economic growth.

In hindsight, as I reflect on the content, I would revise the theme and say that this year’s FIW was really about: “How we can create shared prosperity in our digital era.” Many of the sessions at FIW highlighted that, despite digital financial services’ promise to create inclusive solutions, there are serious shortfalls in how the digital economy is evolving, and new risks and gaps are emerging. We learned that while access and usage continue to rise, indicators linked to resilience have worsened. Even more concerningly, numerous examples of fraud and online harassment were spotlighted during the sessions indicating that the digital economy has yet to pan out as the equalizer that we thought it would be.

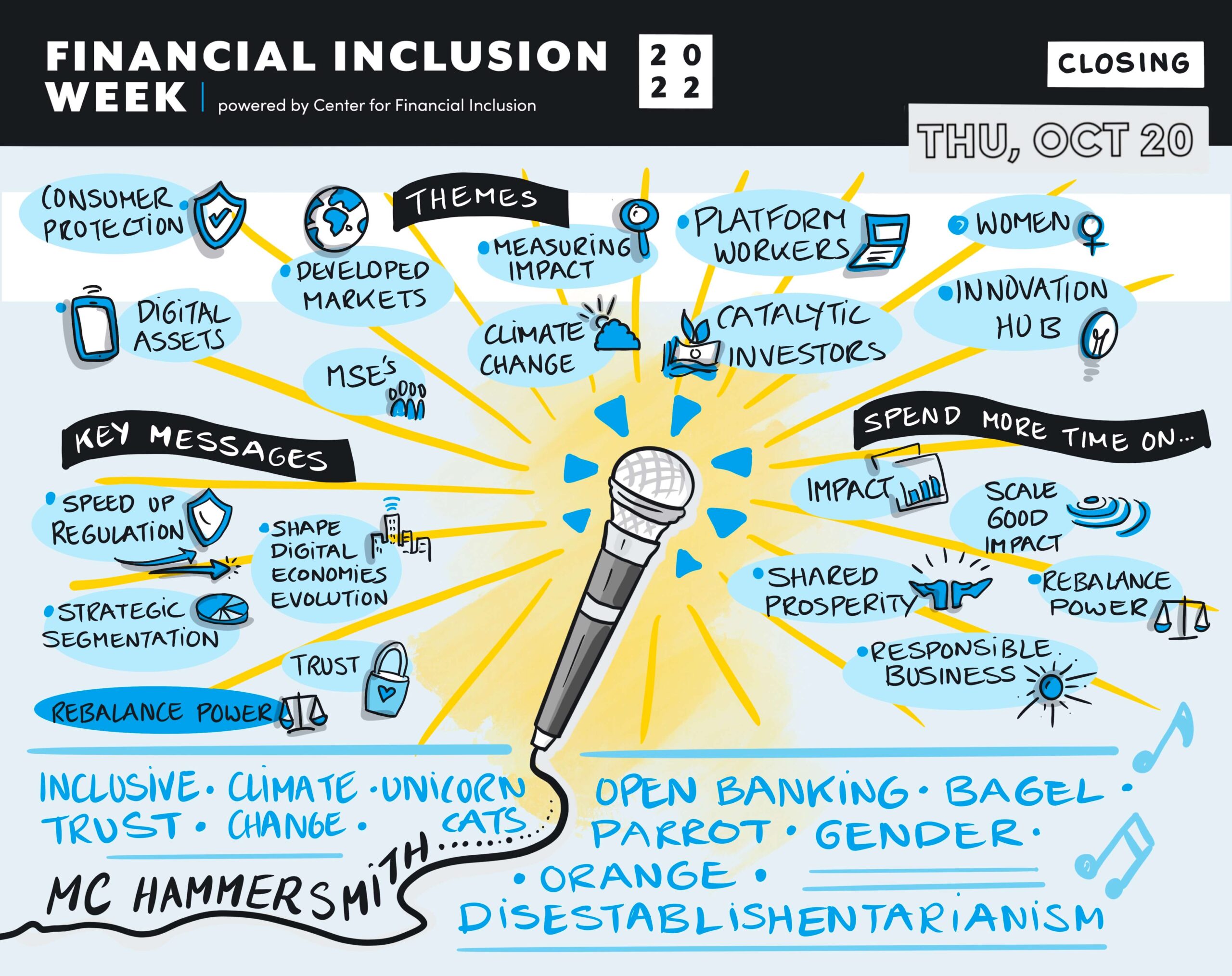

Some key messages I took away from FIW 2022 include:

The future of micro and small enterprises (MSE) on digital platforms needs attention.

In a joint session hosted by CFI and Mastercard Center for Inclusive Growth, panelists discussed the status quo – where platforms retain substantial bargaining power and most MSEs lack the skills or power to benefit fully from the economies of scale offered through platforms. While alternative business models, such as platform cooperatives or open networks, may be options worth exploring, integrating elements of these emerging models into today’s established business models is likely to produce the greatest benefits to MSEs and platforms alike. Sessions by CGAP on digital platforms and fintechs surfaced regulatory fragmentation, payment rails, and e-KYC norms as pressing issues limiting workers and MSEs from fully benefitting from the digital economy. Regulators, donors, investors, and other industry stakeholders should invest more explicitly to enable a rebalancing of power to favor MSEs.

Trust needs to be earned; regulators, providers, and consumer organizations each have a role in making that happen.

A session by Consumers International shared evidence on both existing and emerging consumer risks. These included significant increases in consumer complaints in Fiji and major issues around trust in digital finance in India, where 60 percent of digital finance users surveyed stated that they stopped usage because of trust issues. While several digital financial services users sought redressal through customer care channels, 20 percent of respondents in India never had their issue resolved.

Regulators can play a critical role in shaping market conduct. Another session hosted by SPTF provided compelling evidence of fraud and abuse in markets like Kenya and discussed what provider practices could help mitigate these risks. Fair Finance’s session brought up an example of how a regulator can step in to enable greater trust in the financial system for low-income consumers and businesses: they mentioned the Central Bank of Rwanda’s approach, where they are working to build trust via a consumer protection law, retaining oversight of financial consumer protection, creating tools to compare providers, and establishing instant complaints systems that allow consumers to submit complaints through email and social media.

These sessions reinforced the need for rigorous research, progressive regulation, and market conduct supervision that incentivize providers to be responsible and strong consumer organizations who can advocate on behalf of the silent majority in most developing markets. Donors and investors working to support market development must ensure that these fundamental guardrails are in place before they scale innovations.

Regulation and regulators are important in addressing gender inequity and creating trust.

Gender inequity is perhaps the gap that received the greatest attention during FIW 2022. Toronto Centre’s panel on Advancing Cybersecurity and Financial Inclusion highlighted the large gender gaps – such as access to technology – and the greater vulnerability, whether harassment, gender-based violence, or outright discrimination, and looked at what regulators are doing to counterbalance the system that is stacked against women.

CFI’s Edoardo Totolo delivered one of the four keynotes and highlighted both the opportunities and the risks posed by new embedded finance players. He emphasized the increasingly important role unregulated non-financial actors play in the design and delivery of financial services and the regulatory ambiguity around who is responsible for what. His keynote ends with a cautionary note to regulators and policymakers to clearly define the regulatory perimeters, articulate the role of third-party actors, promote interoperability and open architecture, and above all, create a level playing field.

One-size fits all solutions are insufficient; segmentation is necessary.

Several panelists emphasized that low-income customers are not a monolith and recognized that low-income consumers occupy different societal groups, each with its unique strengths, challenges, and starting points. A key takeaway from these sessions is that when we design without understanding the specific segment we are trying to reach, we will de facto design products and services for men. Instead, we must be intentional and create solutions that address specific consumer needs.

AXA’s session on developed markets, including Japan, the US, and France, provided a unique look at excluded segments and approaches providers were taking to be inclusive in these highly competitive and highly regulated markets. For example, French provider Nickel noted their rapid trajectory of delivering a simple product with very clear and fair terms and relying on distribution systems that leverage existing points of sale used by low-income consumers. In another session by Mastercard Strive, a panelist from Boost Nigeria noted that women-owned small businesses are not a homogenous retail segment. Recognizing that women business owners had varying levels of digital and financial capabilities, Boost adopted a range of strategies that tried to meet women where they were in their journeys. A session hosted by the Kashf Foundation noted that despite the progress prompted by the pandemic, the digital divide is a nuanced issue that merits attention. Affordability to broadband is perhaps the next frontier, particularly when women don’t always have full control of household income or phone ownership.

We need to focus on climate adaptation; prioritizing mitigation is not enough.

In his keynote, USAID’s Songabae Lee provided a realistic and sobering view of the limitations of development finance, noting that mobilizing capital is the current priority at the global level. Recognizing that private sector capital is best geared toward mitigation, while adaptation still requires grant funding, Lee urges the audience to take advantage of what’s currently open rather than beating on a closed door. The open door is to start by leveraging capital for mitigation and then work to advocate for and shift attention to adaptation.

A session hosted by BFA Global on the business case for climate resilience adopts a more optimistic lens, where investors start recognizing the need to move faster toward adaptation. The session delved into the experiences of multilateral development banks (MDBs) in financing climate initiatives that can be leveraged for earlier-stage ventures, highlighted the creation of the adaptation and resilience collaboration with 18 organizations, and the importance of data and measurement to help move this agenda forward. The urgency of scaling climate adaptation finance was also highlighted in a session organized by CFI, where panelists from SEWA, FSD Mozambique, and UNHCR unequivocally emphasized the threats and income shocks low-income communities and refugees were exposed to in the absence of solutions tailored to support adaptation and resilience building at the community level.

My colleagues will go deeper into some of these messages in the blogs to follow in this series. If you are interested in revisiting the recordings, all sessions from FIW 2022 are available online. Check out the full playlist here.

For curated session lists by topic, please see the links below for the playlists we’ve developed thus far.