The COVID-19 pandemic has brought increased attention to the need for universal access to clean water, sanitation, and hygiene. Water.org has been working with financial institutions since 2003 to develop financial products for low-income people who need improved access to water and sanitation, and who do not have the upfront funds to finance such an investment, but do have the ability to pay for it over time.

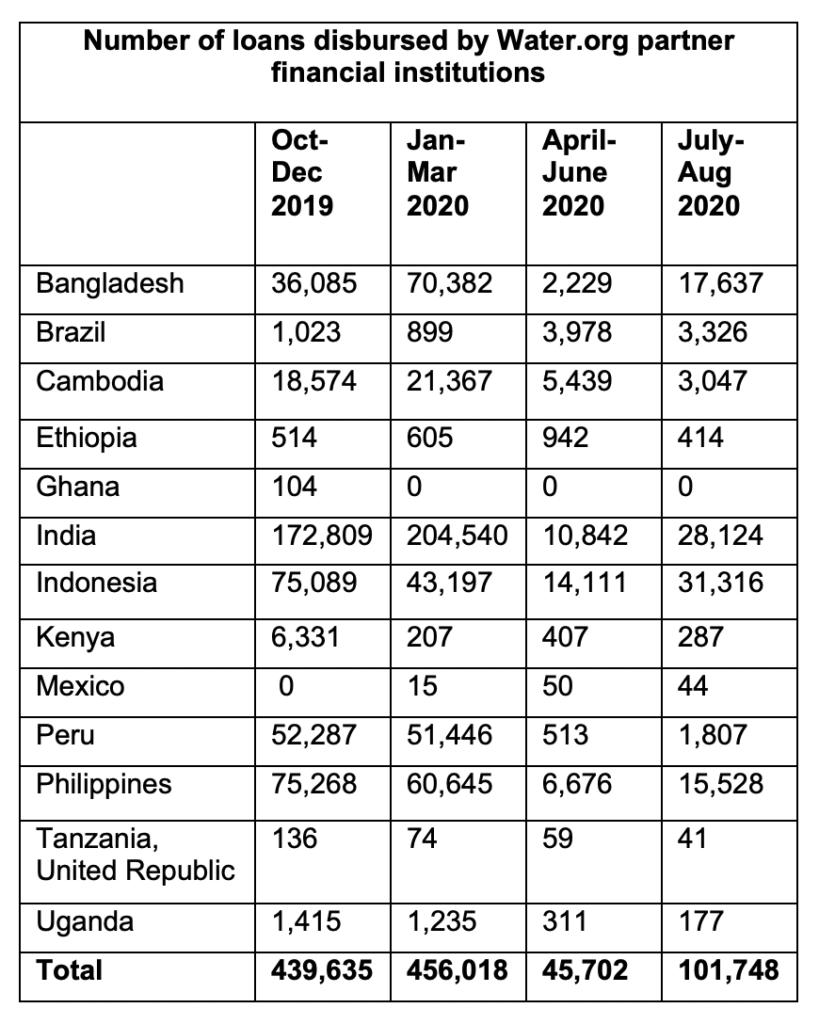

Like most organizations worldwide, our partners have been hit by the COVID-19 crisis, with lending coming to a halt in some places. As shown in the table below, the total number of loans disbursed between April and June, 2020, was only one-tenth of what it was in previous quarters. Depending on the country, initial signs of recovery appeared between May and August. From July, average monthly disbursements improved to one-third of those seen before COVID. Lending is still lagging, but numbers of loans disbursed are rising. Countries report that portfolio at risk (PAR) rates for water supply and sanitation (WSS) loans are consistent with those of other types of loans.

Once financial institutions emerge from the immediate crisis phase, we expect the increased awareness of how a lack of access to water and sanitation can not only be inconvenient, but life-threatening, to increase client demand for improvements. “COVID…. will leave people with having learned that there is a need to change their culture, they will need to continue washing their hands,” said Mary Munyiri, CEO of ECLOF in Kenya. ECLOF is a financial institution that partnered with Water.org in 2011 on the development of their water and sanitation loan products and has continued to offer these loans independently. “The level of cleanliness will have been heightened. When things settle down I expect people will come for WASH loans.” The Water.org Bangladesh office is seeing signs of demand already, with 7,000 households taking WaterCredit loans in July, even amid COVID-19 and a sluggish lending market in the country.

Ways to Diversify Products Offered

We expect more financial institutions to be interested in offering financial products for water and sanitation to meet this need, and to further diversify the products offered. This diversification may include:

- Broadening the value chain from a focus on household clients to making financing available to all the touchpoints that affect people’s ability to stay safe. This includes schools, clinics, local businesses, and water and sanitation suppliers. For those institutions already lending to small businesses, we may also see an expansion from a focus on businesses providing water and sanitation services to a wider spectrum of businesses looking to improve their own water and sanitation facilities, for the benefits of their employees and customers.

- Adding hygiene to the mix. We expect to see increased lending for sinks and handwashing facilities as well as water access and improved sanitation. According to Dick Pajarillo, Senior Programs Manager in the Philippines at Water.org, “The outlook for demand in the future is very high because of the high consciousness on the importance of handwashing, water, and sanitation to protect their families against future events against pandemics like this. Before, very few would just borrow for a sink. That will be more common now.”

- Incorporating water and sanitation into digital financial products. The focus on contactless service will spur greater digitization. In addition, water and sanitation represents an opportunity for digital lenders to serve the base of the pyramid market and to meet a critical need. We have seen early interest from a digital lender wanting to move down market through water and sanitation lending, and another interested in facilitating crowdfunding for loan funds for water and sanitation improvements.

- Changing loan product design to better meet consumer needs. Gram Uttan in India used to offer a water and sanitation loan only as a second or third round loan to its group lending clients. But since COVID, they have made it available as the first loan a new client may take. Banco da Familia in Brazil is offering loans to purchase and install water storage tanks as a means of addressing the twin crisis faced by clients in southern Brazil – COVID-19 and drought-induced water scarcity.

In the long term, we expect that COVID-19 will be one more disease, like diarrhea or typhoid, that can be minimized by access to safe water and hygiene. We will work with our financial institution partners to make that access easier than ever for the 785 million, globally, who lack safe access to water.