India’s fintech lending industry has grown rapidly since 2014, with the evolution of new models and approaches to lending. This rapid growth offers the potential for many upsides in the form of easier access to much needed credit and including hitherto excluded consumer segments who may not have the ability to prove their ‘creditworthiness’. In India, as in other parts of the world, the growth in digital lending has been accompanied by a variety of risks. Some of these risks – such as over-indebtedness, poor market practices of aggressive marketing and collection, and pricing – have long been associated with lenders and need to be addressed as a market conduct issue. However, the digital nature of fintech lending poses several new risks that, combined with traditionally known risks, create an environment of poor consumer outcomes and mistrust of the industry.

Fintech Risk Barometer Study

While there has been extensive media coverage around several of the fintech lending risks, these cases tend to be anecdotal and do not provide a sense of which risks are highest priority as the industry evolves. To better understand the multitude of risks the Indian fintech lending industry faces, the Fintech Association for Consumer Empowerment (FACE) and CFI partnered to conduct a risk barometer study. The resulting fintech lending barometer report is the first attempt at identifying how risks are perceived by various stakeholders associated with the fintech lending industry in India and is a crucial first step to documenting how risks evolve.

For fintech lenders, this report presents an opportunity to understand the landscape, identify the opportunities and dangers, and plan or correct their course of action. For regulators, supervisors, and policymakers, the survey findings signal what areas within the Indian fintech industry need to be more closely examined and addressed with urgency.

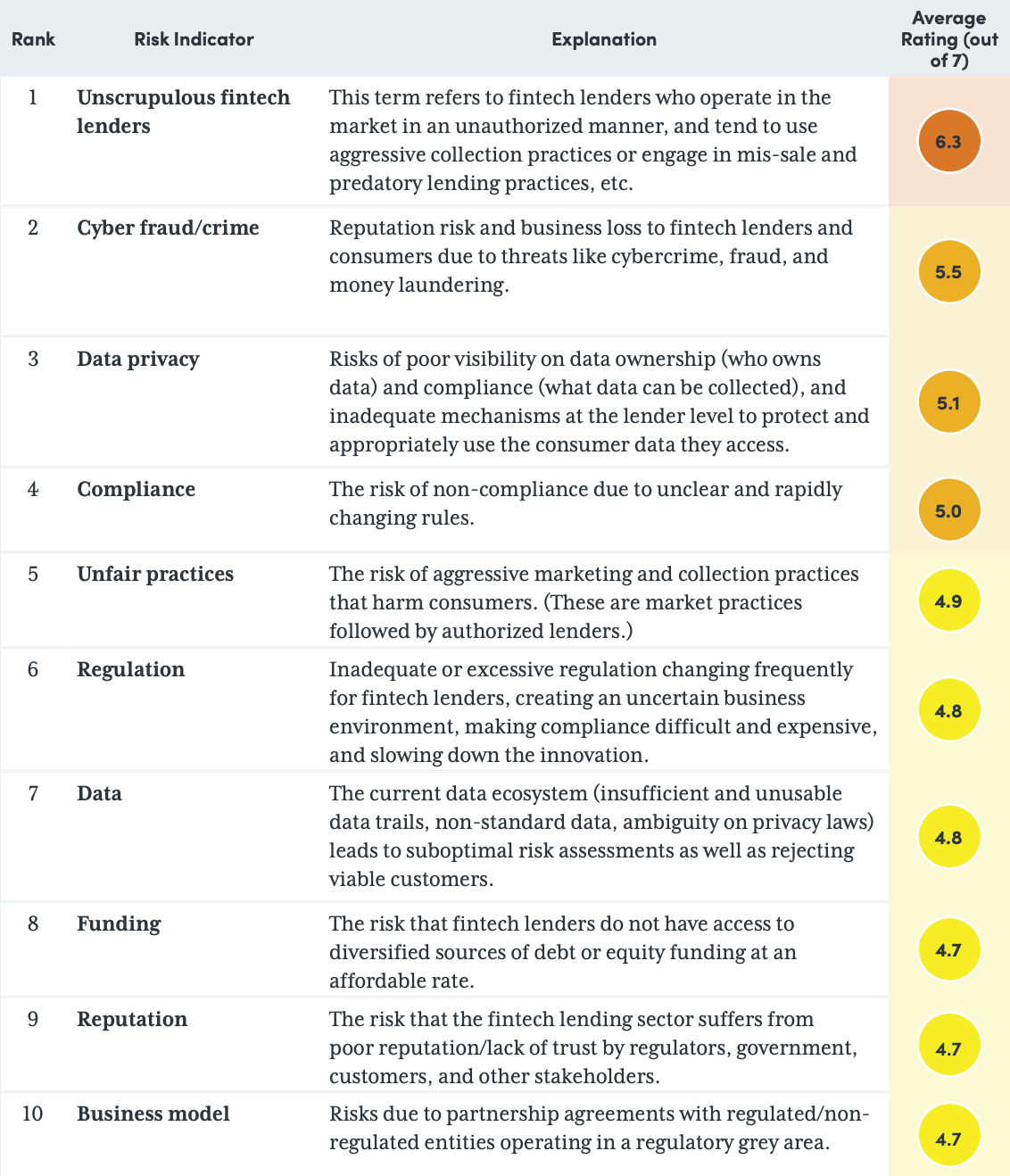

The fintech lending barometer study followed a mixed methods approach. First, a survey was used to gather initial perceptions of risks, which then was followed by a series of qualitative interviews with select respondents to further understand how emerging risks impact consumer lives. For each risk, the survey asked participants to rank 23 risks on a scale of 1-7, with one being the lowest severity risk and seven being the highest. The survey also captured comments and feedback from survey participants on these risks and the top three opportunities.

Top 10 Risks Identified by Survey Respondents

The top three risks identified were unscrupulous fintech lenders, rising cyber fraud and crime, and issues around data privacy. The report is being released at the Inclusive Finance India Forum 2023 and can be accessed here.

Consumer Protection Implications

Industry associations have an inherent advantage in gathering early insights on consumer complaints and experiences from their members and in getting inputs on market trends.

Kate McKee, former senior policy advisor at CGAP, who pioneered thinking on consumer protection for inclusive finance, often referred to the three legs of the ‘consumer protection stool’ – regulation, market monitoring and self-regulation, and building consumer awareness – where each of the three legs must be stable in order to responsibly and reliably provide for consumers. While the Reserve Bank of India has been proactive as a regulator in issuing guidelines on digital lending, there is a role to be played by industry associations like FACE and others in enabling market monitoring. Industry associations have an inherent advantage in gathering early insights on consumer complaints and experiences from their members and in getting inputs on market trends. For instance, they may hear about specific instances of fraud from their members which can erode the reputation of the industry in general. This provides associations with a unique opportunity to identify emerging risks and either escalate them to supervisors or establish responsible market conduct. This in turn can boost trust in businesses and offer long term value. For supervisors, this interaction with industry associations can help them stay abreast of market developments and assists with considerations for investing in appropriate suptech tools depending on the nature of risk identified.

A host of market monitoring tools exist and several are summarized in this toolkit by CGAP. However, effective market conduct supervision depends on timely identification of market risks and reviewing how these risks evolve with market growth. CFI’s consumer protection strategy focuses on strengthening market conduct supervision by researching emerging risks and working with partners who can elevate these risks to supervisors. This partnership with FACE is a step towards this goal and offers insights for industry associations of digital lenders in other markets.