This report examines how default unfolds and affects microfinance clients in Peru, India, and Uganda — three very different countries that represent the global diversity of microfinance. Since default is a particularly important issue for client protection, the study was launched to explore how microfinance institutions (MFIs) treat clients who are unable to repay their loans. It was motivated by a lack of information on the client-facing actions MFIs take when a borrower moves into default.

The study confirms that the quality of treatment clients receive during collections depends importantly on good practices within individual financial institutions, but it also found that treatment depends even more on the local environment. Humane collections can happen when a country has good regulators, a credit bureau that works well, and a culture that upholds fulfillment of debt obligations. When these features are weak missing, lenders are pushed by the demands of the market into harsh practices.

Default is particularly challenging because it pits the lender’s need for institutional survival against the difficult circumstances of the defaulting customer. The intent of this study is to inspire MFIs to reconsider their treatment of clients in default, and specifically to define acceptable parameters for humane treatment of clients during the default process. Clients who are facing default may very well be in the most precarious financial position of their lives. Therefore, the obligation falls squarely on MFIs to handle these clients with care.

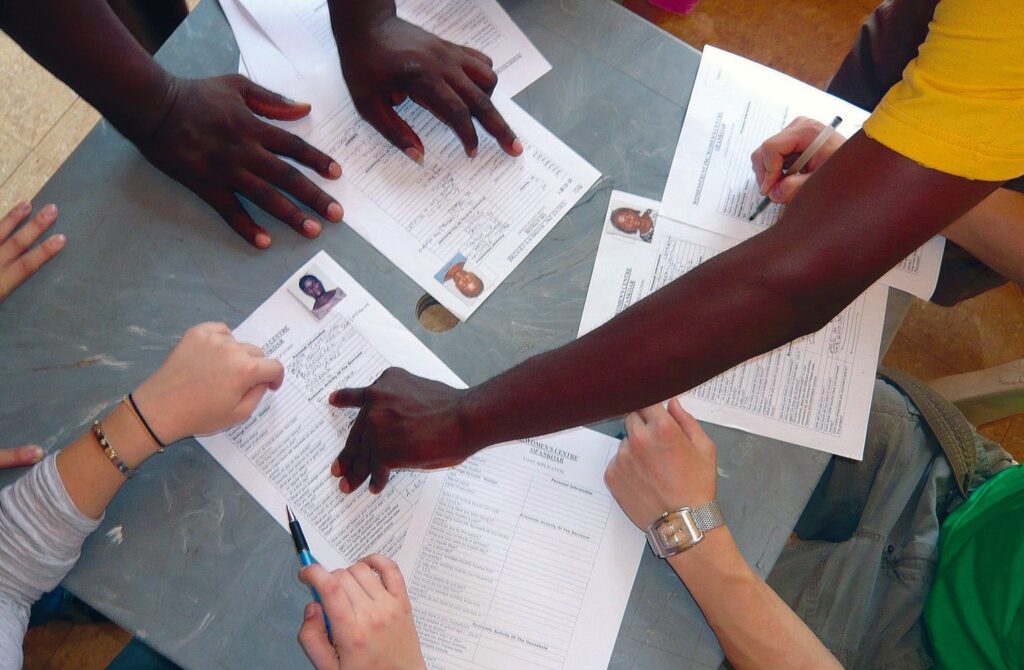

Smart Campaign researchers talked with managers and staff from microfinance institutions in Peru, India, and Uganda –markets with diverse legal systems, market conduct regulators, credit bureaus, and local actors. The research team dug deeply into three markets to challenge the notion that MFI responses to default are universal or standard.

The Smart Campaign recommends the following actions to improve client protection practices related to loan collections and default:

- Regulators, donors, and banking associations should work together to ensure that quality credit reporting systems exist and cover base-of-the pyramid clients

- Regulators should monitor and enforce market conduct norms for collections and reward financial institutions that perform well.

- Lenders that use group-lending methods must take responsibility to ensure that intra-group dynamics do not result in abuse of struggling clients. Lenders and regulators should develop greater clarity on the use of restructuring and flexible debt relief.

- Mediation and debt counseling mechanisms are needed that work for base-of- the-pyramid clients.