About Inclusive Fintech 50

Inclusive Fintech 50 (IF50) was a global innovation competition that identified and elevated cutting-edge emerging inclusive fintechs with the potential to drive financial inclusion. IF50 uncovered high-potential start-up fintechs that addressed some of the critical limitations in financial services delivery for underserved people.

1,000+

Over the four years of the competition, IF50 attracted more than 1,000 eligible applicants.

200

Each year, the competition selected 50 inclusive fintechs to be winners.

$620M

Past winners have collectively increased their funding by $620 million in the year following their win.

Dive Deeper

Featured Insights

Inclusive Fintech Funding in Times of Uncertainty: Lessons Learned and Challenges Ahead

Slowing economic growth, rising inflation, and climbing interest rates are straining the business models for inclusive fintechs, creating significant uncertainty and new funding challenges. This reality marks a sharp reversal from the boom in investment they enjoyed during the COVID-19 pandemic.

To better understand the outlook for the sector amidst these market changes, we interviewed past Inclusive Fintech 50 winners and fintech investors to learn how they are adapting to these uncertain times and the impact of the funding challenges on their business models and the low-income customers they serve.

Explore Winners and Insights

Past IF50 Competitions

THEME

Making Digitalization Count

Focusing on how fintechs leverage data and digital infrastructure to make products more inclusive and impactful for customers in underserved markets.

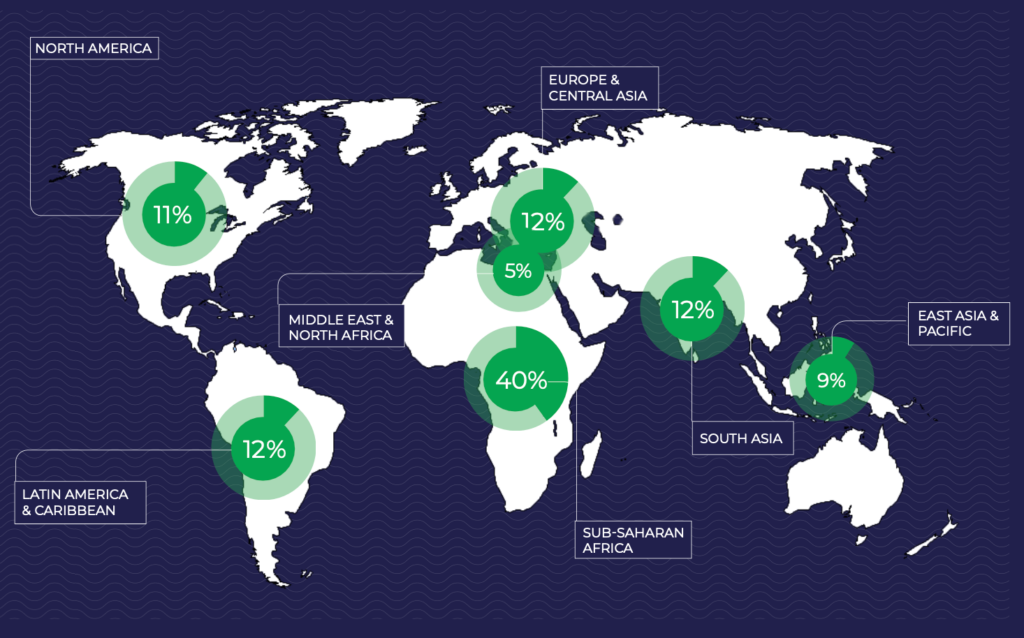

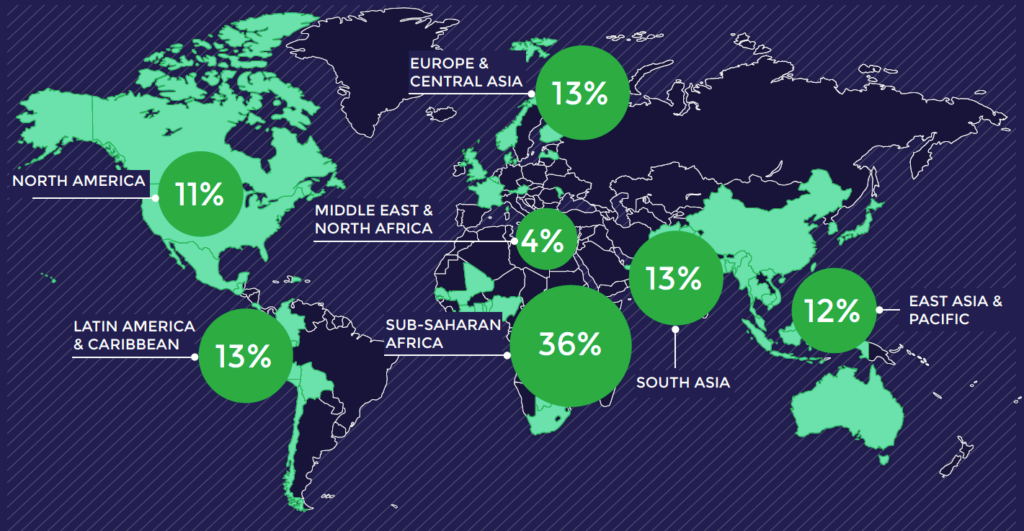

The 2022 IF50 insights report examines data from the 250+ eligible fintech applicants from the 2022 IF50 competition to better understand the state of early-stage fintechs. CFI analyzes all applications to identify trends and to find innovations with disruptive potential. The fintechs are young and small now, but as we’ve seen in past years, they grow to reach millions more people and raise millions more in investment. However, despite this tremendous outreach and potential, there are also areas that require attention: funding and gender gaps, inconsistent practices around data privacy and consent, and limited data collection for outcomes management.

THEME

Driving Innovation in an Era of Uncertainty

The COVID-19 pandemic has underscored the importance of having access to financial services, which act as a stabilizing force for low-income households and businesses. Fintechs play an important role in expanding access to these vulnerable populations, but these startups themselves need access to capital and connections. IF50 helps to provide visibility for these startups to investors and partners who can help them reach more people in need and increase their impact.

The 2021 IF50 insights report examines application data from nearly 300 eligible fintech applicants from the 2021 competition to better understand the state of early-stage fintechs and identifies several opportunities for further exploration. The IF50 application data signals continued progress on innovations to onboard low-income customers, despite the challenges posed by the pandemic. Nevertheless, there are two areas of concern: funding concentration persists and potential customer risks persist around data usage.

THEME

Driving Financial Inclusion Amid Crisis

Rapid changes driven by thep pandemic present a unique opportunity for fintechs and other digitally driven business models to step in and onboard new customers to meet this evolving demand.

This 2020 IF50 insights report examines data from the 403 eligible applicants from the 2020 IF50 competition to better understand the state of early-stage fintechs. Key insights from this data set are organized according to the four selection criteria: scale potential, traction, innovation, and inclusivity. While these insights are only a subset of the stories that this rich data set can tell, they provide a window into the nature and trajectory of the inclusive fintech industry as it adapts to a shifting and unpredictable global economy.

Elevating Early-Stage Fintechs Driving Financial Inclusion

Launching the Inclusive Fintech 50, the first global effort to spotlight early-stage fintechs driving financial inclusion.

The Inclusive Fintech 50 applicant pool provides new insights into inclusion-focused fintech, itself a subset of the fintech universe. By highlighting these high-potential companies, we hope to support the efforts of investors, banking partners, and other fintechs working towards a financially inclusive world.

Four key findings emerged from our analysis of applicant data. We believe these findings can help funders, investors, and fintechs in their financial inclusion efforts: funding is concentrated in several notable ways, measuring inclusivity is highly contextual, “innovation” is not limited to technology, and common definitions and standards are needed to bring clarity to the diverse field.