Topics

Program

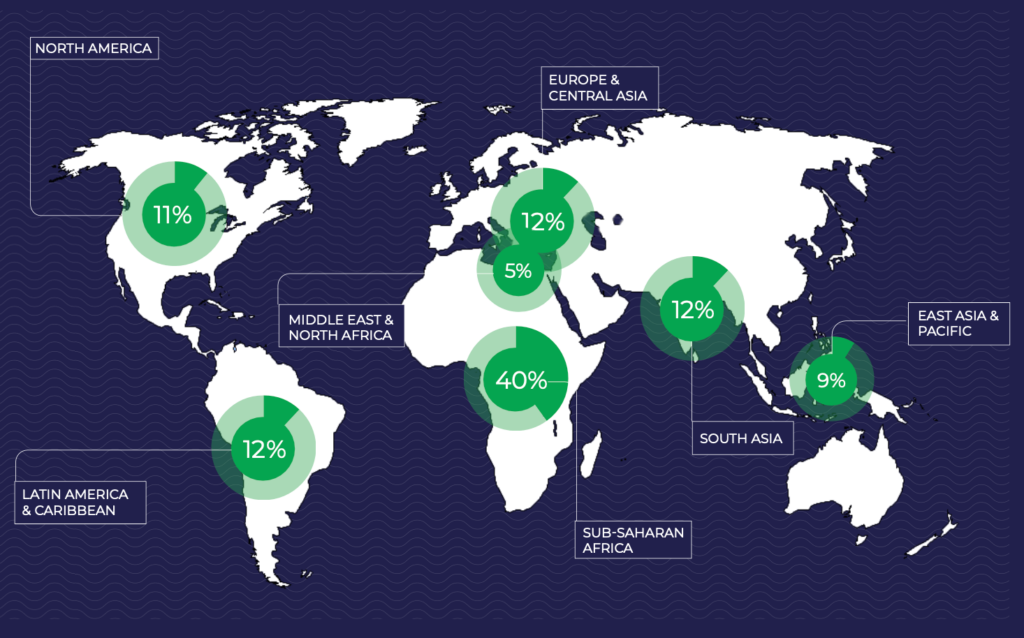

This report and infographic examine data from the 250+ eligible fintech applicants from the fourth Inclusive Fintech 50 competition to better understand the state of early-stage fintechs. CFI analyzes all applications to identify trends and to find innovations with disruptive potential. The massive scale that is only possible with digitalization matters greatly to the financial inclusion agenda, and this year’s IF50 applicants are already collectively reaching 54 million people, many of whom were previously underserved, across 101 countries of operation. The fintechs are young and small now, but as we’ve seen in past years, they grow to reach millions more people and raise millions more in investment. However, despite this tremendous outreach and potential, there are also areas that require attention: funding and gender gaps, inconsistent practices around data privacy and consent, and limited data collection for outcomes management.