- CONTENTS:

Why Consumer Rights and Responsibilities?

The Client Protection Principles provide a common framework for financial service providers (FSPs), policymakers, and clients to better understand and discuss consumer protection issues. While much of the Center for Financial Inclusion’s (CFI) work with the financial inclusion industry has focused on providers and regulators, there is a third crucial constituency: clients.

Client awareness and capability is a critical component of effective financial consumer protection. Clients have the right to demand fair treatment and lodge complaints with government authorities, but these rights mean little if they don’t know what constitutes lawful treatment or how to access complaints channels. Similarly, clients play a role in protecting themselves by practicing behaviors to maintain their privacy and safety. While FSPs can institute protective processes and regulators can craft policy safeguards, improving client awareness of their rights and responsibilities helps consumers play their part to support a sustainable financial system.

This report provides lessons learned from initiatives in Ghana, Uganda, and Benin to raise consumer protection awareness among clients through multimedia campaigns, digital tools and other outreach strategies. It covers country-specific consumer protection issues and the individualized campaigns to address these issues. We also offer five key takeaways to help inform future client protection and empowerment awareness building activities.

Our Approach

The rapid growth of digital financial services (DFS) has introduced new opportunities for first-time consumers, but not without some risk. Many markets lack the guardrails to address these new risks, increasing the urgency to improve client awareness of their rights and responsibilities. Against this backdrop, CFI conceived of consumer protection radio campaigns to educate and empower customers and help mitigate risks with educational programming.

The objective of this initiative was to experiment with and learn from different techniques to educate and empower clients. In many countries in sub-Saharan Africa, radio remains one of the most important widespread communications mediums, especially as internet and mobile connectivity has grown inconsistently or remains too costly. Ghana and Benin have some of the highest percentages of household radio ownership at 72 percent. In Uganda, household radio ownership is at 61 percent. Reported daily use of various media channels in Africa bears these stats out: 46 percent of Africans report accessing daily news through radio, 37 percent through television, while only 9 percent read newspapers. In contrast, mobile internet connectivity is only 24 percent in sub-Saharan Africa. Nevertheless, internet and mobile penetration are growing quickly in a few African countries, especially for urban citizens. In Ghana, mobile internet penetration is an estimated 45 percent.

This context of shifting media landscapes, both across and within countries, encouraged us to use this initiative to explore different communications channels including radio, social media, and traditional media to reach the target audiences. In addition to exploring these communication channels, we also experimented with storytelling techniques, from radio interviews to dramas and animated shorts. For each country, we took a four-part approach to determine the appropriate components and strategy for raising financial consumer protection awareness:

Radio Campaign Strategy

Engage National Advisory Council

In each country, we convened a National Advisory Council (NAC) comprised of leading experts on DFS, including policymakers, provider network representatives, consumer advocates, and researchers.

Determine Engagement Channels

Varying levels of internet and smartphone penetration across and within countries required us to tailor outreach for each country and target audience.

Establish Campaign Goals

We set educational goals for each campaign in consultation with the NACs to reflect the most important risks consumers face in each market.

Monitor Reach

In each country, we measured campaign reach through various types of monitoring, including social media and surveys.

Ghana: You Deserve to Know Campaign

In recent years, financial inclusion has increased in Ghana, especially with the expansion of DFS. Growing from an estimated 150,000 active users in 2011 to more than four million in 2015, access to DFS is steadily increasing the number of formally banked people. Despite this progress, consumer protection issues persist and continue to pose risks to clients.

Ghana’s inclusive finance sector experienced a fragile period with the collapse of numerous financial institutions and the dismantling of several Ponzi schemes, all of which forced the Bank of Ghana to revoke licenses from several institutions. In addition, mobile money risks such as fraud continue to put consumers in harm’s way. This situation has led to confusion and distrust among consumers and as a result, regulators in Ghana are putting consumer protection at the forefront of their agenda.

Against this backdrop, CFI, in partnership with the Financial Inclusion Forum Africa, conceived the You Deserve to Know campaign, to raise awareness of consumer protection issues while reinforcing the Bank of Ghana’s policies on consumer protection.

Financial Inclusion in Ghana at a Glance

58%

has access to formal financial services.

Source: Quartz Africa

40%

have mobile money accounts.

Source: Quartz Africa

4M

use digital financial services in Ghana in 2015, up from 150,000 active users in 2011.

Source: The World Bank

9%

in account ownership between men and women.

Source: The World Bank

Ghana’s Consumer Protection Landscape

To inform the design and content of the radio campaign, CFI partnered with the Financial Inclusion Forum Africa and assembled a NAC for Ghana. The NAC consisted of representatives from the Bank of Ghana, Ghana Micro-finance Institutions Network (GHAMFIN), the Consumer Partnership, the Ministry of Finance, and CGAP. Financial technology companies were also represented, including Dream Oval, Inclusive Financial Technologies, and MTN. Through desk research, fraud, transparency, client recourse, and responsible borrowing emerged as the dominant consumer risks in Ghana’s financial services landscape.

Microfinance lenders and DFS providers in Ghana identified fraud as a top consumer protection issue. In the rapidly growing world of mobile money, research conducted by the International Telecommunication Union found that 56 percent of mobile money users in Ghana have received a fraudulent or scam SMS, while 12 percent of mobile money users have lost money to fraud or a scam. “Consumers, especially those who are unfamiliar with formal financial services, may not be aware of the rights they have in the case of fraud, or find rules governing the liability of providers and customers confusing. The consumer may not even realize who the actual service provider is in cases where DFS are provided through agents or partnerships between multiple providers.”– ITU Focus Group on Digital Financial Services Godwin Tamakloe, Compliance & Analytics Senior Manager at MTN Ghana was interviewed for this radio campaign, and addressing consumers, he advised on how to identify potentially fraudulent schemes, where to report such cases, and available client recourse options in case of money loss due to fraud. On the digital front, he also advised clients on how to recognize fraudulent calls and messages and directed them to the relevant recourse channels and support resources.

To make responsible financial decisions, consumers need reliable and accurate information. The level of knowledge about financial institutions, services, and products among urban Ghanaian adults is What’s more, literate clients do not always understand pricing information or interest rates when taking out loans.

To address this, the Bank of Ghana released guidelines for transparency entitled, “Disclosure & Product Transparency Rules for Credit Products and Services,” which builds on the Borrowers and Lenders Act of 2008. This document informs clients about the treatment and services they are entitled to when purchasing a product or service, the type of documentation institutions must provide, information on cooling off periods, as well as details on terms and conditions they should receive from their provider.

To complement regulatory efforts, one episode of the radio campaign featured Kojo Baffoe-Eghan, CEO, VisionFund Ghana, to address the issue of transparency. Encouraging regulatory compliance, he advised financial service providers on how to approach credit decisions through a “5C Model” looking into client capital and repayment capacity, character and credit history as well as collateral options. The campaign also educated clients on loan terms and conditions and encouraged them to understand and exercise their rights.

Limited complaints and dispute resolution systems exist in the Ghanaian financial sector. As such, people are either unfamiliar with these systems or have little trust in their ability to provide recourse. To ensure customers have access to adequate complaints handling, the Bank of Ghana released the “Consumer Recourse Mechanism Guidelines for Financial Service Providers,” in February 2017. Focusing on financial service providers and mobile money operators, the guidelines outline recourse mechanisms financial institutions are obliged to implement in addition to client’s rights to redress and disclosure of such systems.

Vivian Mortey, Head of Transformation at Opportunity Ghana spoke in detail about this policy in a radio episode. Addressing FSPs, she outlined redress compliance requirements required by the Bank of Ghana, which include internal policies on recourse and units to manage the system, the issuance of traceable complaints, and the adoption of regular reporting on resolution of complaints to regulators. Clients were also encouraged to seek redress as laid out by the Bank of Ghana and directed towards accessing existing complaints channels and how to navigate these systems.

Responsible borrowing remains a client protection issue in Ghana fueled by over-saturation in the market, high instances of loan stacking, limited credit bureau utilization, and low client understanding of loan terms. In addition to fostering public confidence and trust through transparency, the Bank of Ghana also implemented the “Disclosure & Product Transparency Rules for Credit Products and Services,” to mitigate over-indebtedness. Radio episodes sought to familiarize the public with these measures and increase knowledge on two levels: educating clients on borrowing and dealing with loan defaults, as well as advising financial service providers on over-indebtedness mitigation.

Yaw Gyamfi, Executive Director at GHAMFIN, expanded on factors that lead to loan repayment challenges in the radio campaign, including limited client understanding of loan contracts and borrowing for non-revenue generating projects such as weddings, hospital bills, or home improvements. He addressed FSPs’ limited ability to assess client’s repayment capacity through credit appraisals. He also emphasized the role clients can play, encouraging them to better control their debt by understanding loan contracts and making use of loan officers for advice on available options if they default.

Dr. William Derban, Co-Founder and Chair, Financial Inclusion Forum Africa“CFI’s global expertise has helped identify and prioritize financial consumer protection issues for Ghanaian consumers. [CFI’s] consultative approach has facilitated dialogue among leading institutions in Ghana, and the #YouDeservetoKnow campaign is an opportunity to pass on those learning to consumers.”

You Deserve to Know Campaign

The goal of #YouDeservetoKnow was to reach as many listeners as possible and to test out the effectiveness of radio as a means of communicating with clients. The program was broadcast in two of Ghana’s dominant languages, English and Twi, and radio stations were subsequently selected for their reach and dedicated listenership in these languages. The English language audience on Citi FM averaged 218,250 listeners per episode, while the Twi version of the campaign aired on Adom FM, garnering an average of listenership close to 151,100 per episode. Though coverage was extensive, the audience of these radio stations is concentrated in urban areas, whereas rural clients are harder to reach due to limited radio station access.

To complement the live shows, five-minute radio dramas were created with a variety of characters experiencing the consumer protection risks identified at the outset. While highlighting risks, each drama also ended with lessons that consumers could take away. Each week, the program would begin with a short radio drama introducing the relevant theme, followed by an interview between the radio station host and an expert. The campaign spanned 13 weeks with three episodes dedicated to each of the four themes with a final compilation episode. Pre-recorded jingles aired in tandem with the radio dramas.

Listen to the campaign

You Deserve to Know Radio Campaign Playlist

Outreach Strategy

Outreach efforts for #YouDeservetoKnow began with a launch event in Accra attended by financial inclusion leaders and media representatives. Due to its placement on leading radio stations, the campaign received extensive media coverage, appearing in prominent news outlets such as Pulse, Graphic Online and Citi Newsroom.

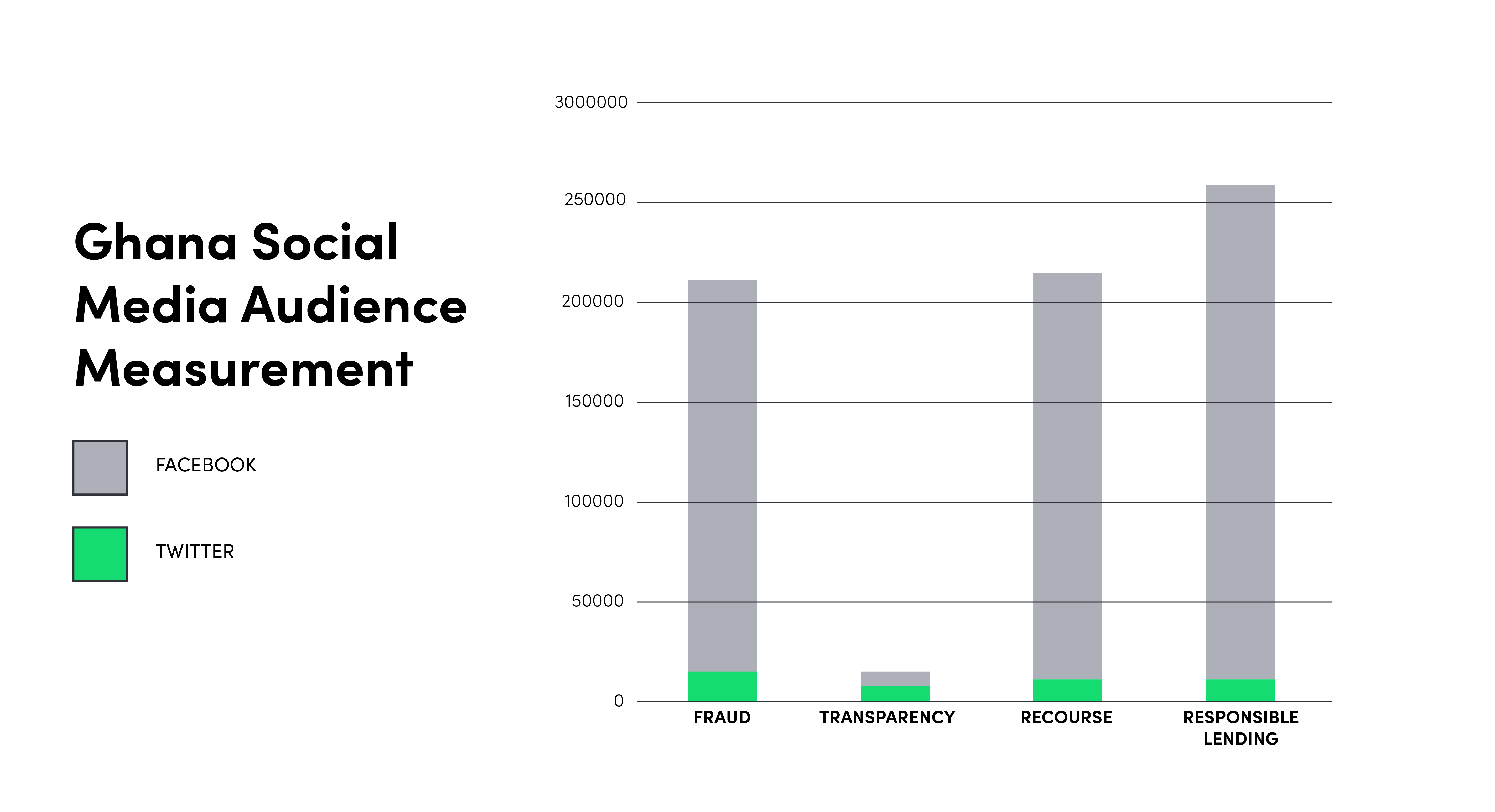

The marketing approach for the campaign primarily utilized social media, specifically Facebook and Twitter. The aim was to engage listeners not only with audio broadcast on radio, but also with visual multimedia content posted on social media in advance of each broadcast.

The campaign leveraged Adom FM’s 640,871 Facebook followers and Citi FM’s 1,143,902 Facebook followers and 987,300 Twitter followers. Working with a Ghanaian media firm called NoKhroma Collective, a combination of animated videos, illustrations, and calls-to-action were created to drum up interest in the radio campaign. Additonally, working with survey company Geopoll, we sent SMS blasts to 16,000 mobile subscribers in Ghana, encouraging them to tune in.

Watch the Series

You Deserve to Know: Animated Series

Listenership

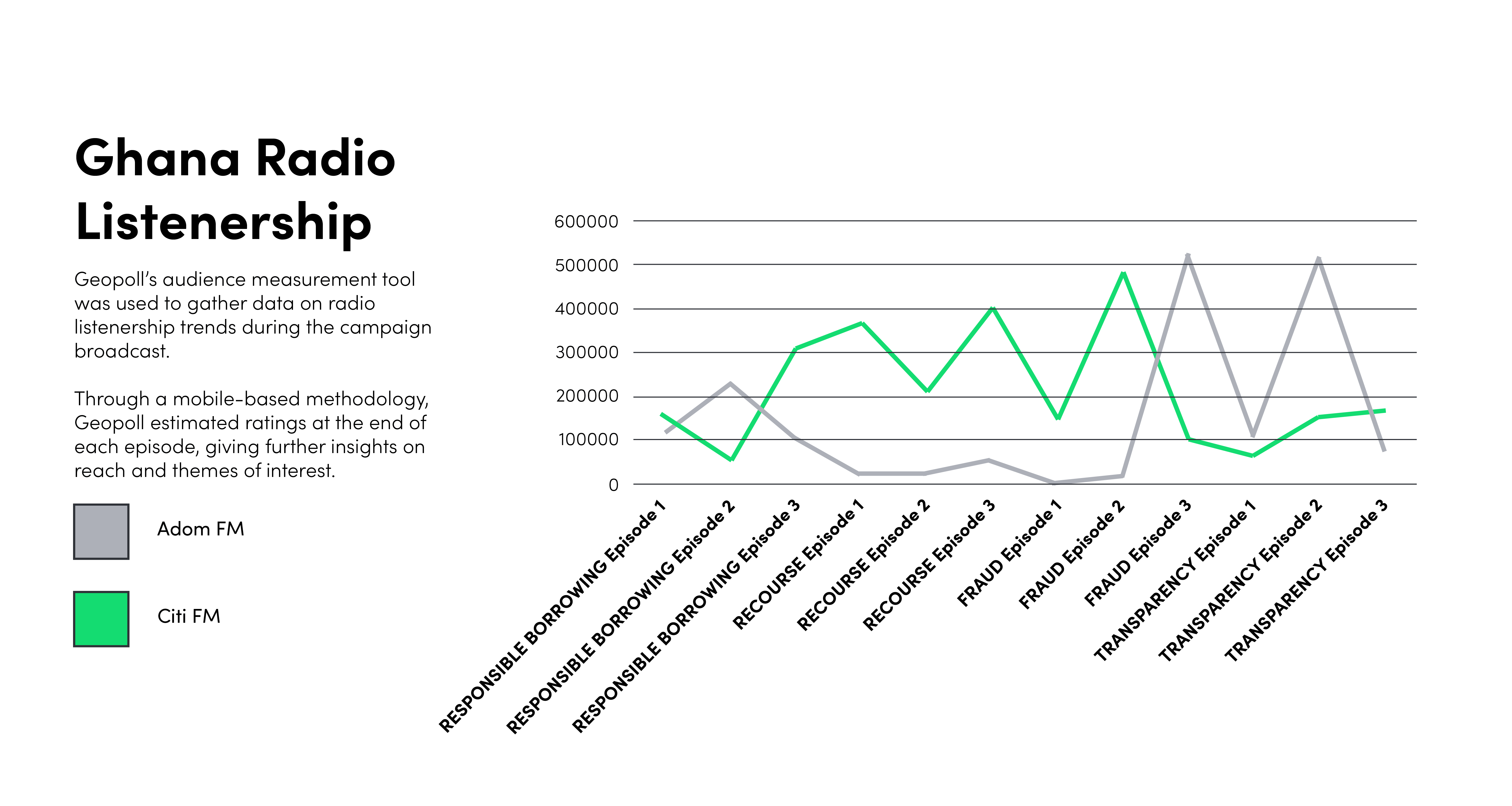

Geopoll’s audience measurement tool was used to gather data on radio listenership trends during the campaign broadcast. Through a unique mobile-based methodology, Geopoll estimated ratings at the end of each episode, giving further insights on reach and themes of interest.

With an average listenership of 218,250 people per episode during the span of the campaign, responsible borrowing, recourse and fraud were the most popular episodes on Citi FM. Adom FM generated an average listenership of 151,083 people per episode, with fraud and transparency as the most popular.

Behind the Scenes

Creating the Ghana Radio Campaign

Benin: A L’ecoute du Client Campaign

Benin’s inclusive finance sector has weathered a number of shocks over the last decade that have undermined consumer confidence, leading Beninese authorities to put a higher priority on improving consumer protection. Currently, only 38 percent of Beninese adults have access to a formal bank account. The growth of DFS has been inconsistent, with mobile money reaching 40 percent of the adult population, and only 16 percent in rural areas. Consumers still face issues of fraud and incomprehensibility as regional and national regulatory bodies lack enforcement mechanisms for consumer protection violations.

In 2010, Benin’s financial sector underwent a tumultuous period, as a government investigation uncovered the biggest Ponzi scheme in the nation’s history. The Investment Consultancy and Computing Services (ICC Services), an unlicensed financial institution, defrauded nearly 150,000 individuals of over US$260 million. Since this scandal, the Ministry of Finance implemented a zero-tolerance policy, employing regulatory safeguards such as tightened licensing requirements to hold financial institutions accountable. But as unauthorized microfinance institutions are increasingly saturating the market, regulatory bodies are finding it challenging to maintain supervisory control.

To contribute to ongoing consumer protection efforts, we designed the A L’ecoute du Client radio campaign as an educational tool targeting both clients and microfinance institutions (MFIs). Unlike the approach in Ghana, this campaign experimented with outreach tactics to reduce the cost of reaching different audiences across a fractured media landscape. Partnering with local journalists who worked for a variety of radio stations and news outlets in multiple dialects was a key part of our strategy to create additional content that would live beyond the radio episodes.

Financial Inclusion in Benin at a Glance

38%

have a formal account.

Source: The World Bank

29%

are female.

Source: The World Bank

643

are assigned per 100,000 customers.

Source: The World Bank

16%

own a mobile money account.

Source: UNCDF

Benin’s Consumer Protection Landscape

CFI’s 2015 Client Voices Benin research surveyed consumers to identify the risks, issues, and harms they face when accessing financial services, with a focus on low-income individuals. The report found transparency, fraud, recourse, and responsible borrowing as the main challenges affecting consumers in Benin.

To check that these issues still resonate in Benin today, CFI convened and consulted with a local NAC consisting of regulators, public sector institutions, and financial service providers to inform the campaign’s messaging. Members included representatives from UNCDF, Consortium Alafia, the Agence Nationale de Surveillance des SFD (ANSSFD), Djondo Management & Development (DMD) and Développement international Desjardins (DID).

The large number of unlicensed FSPs in the Beninese market poses a risk to consumers, as they struggle to differentiate between licensed and unlicensed providers. Consumers understand that legitimate providers collect savings deposits before granting loans to clients. Mirroring this process, many unlicensed institutions have collected deposits falsely promising future loans, only to disappear with clients’ money. Clients have expressed confusion about how to identify licensed providers and report fraudulent activities.

Louis Biao, Director General, ANSSFD, spoke to this issue during one of the campaign’s radio episodes to educate the public on how to identify licensed institutions.

The lack of basic information about terms and conditions of financial products emerged as one of the main issues clients face, according to our research. Of 1,733 clients surveyed, 33 percent reported not knowing how much they would pay for their loan in total, and only 12 percent reported knowing the interest rate on their loan. In addition, 17 percent were surprised by costs related to the loan process, and 15 percent did not know the exact amount of one of the fees paid. With low literacy rates in Benin, providers face an added challenge of effectively explaining terms and conditions so that clients fully grasp the commitment they are making.

During the radio campaign, Edgard Zola from the Office Central de Répression de la Cybercriminalité (OCRC) and Ignace Dovi from Consortium Alafia, educated consumers on the importance of understanding terms, conditions, and fees before signing up for a loan, and how to avoid common problems when transacting with MFIs.

With the introduction of digital finance to Benin in 2015, active users of these services increased from two percent to 40 percent in 2019, bringing along fraud as a major challenge. According to the OCRC, an estimated $900,000 has been lost through digital fraud. Fawuaz Moussougan from the Association Beninoise pour la Cybersecurité et la Promotion du Numérique advised consumers on best practices to avoid scams during one of the campaign’s radio episodes.

Client Voices Benin also revealed that clients struggled with recourse mechanisms. Eighty-six percent of clients reported that their provider did not inform them of where they could complain if they had a problem. Among those who knew where to complain, there was still confusion about which entity is responsible for resolving problems with the FSP. Although 14 percent of the survey respondents reported wanting to file a complaint, only four percent did.

In 2016, Consortium Alafia introduced a nationwide recourse mechanism to better assist clients in voicing grievances about financial service providers, particularly small- and medium-sized FSPs. The mechanism was designed to receive and categorize all complaints from clients by 1) simple complaints directed to a specific person at an MFI, and 2) serious issues or unresolved complaints redirected to the association for resolution with the MFI.

To boost consumer confidence in the process of recourse, the “A L’ecoute du Client” radio campaign featured Virgile Toffodji from MTN and Ignace Dovi from Consortium Alafia to educate consumers on existing recourse mechanisms.

Benin is in the early stages of implementing a credit bureau and few institutions report consistently. Building the credit history database has been slow because of customer consent legal requirements to collect this information. Without reliable information on credit history, providers must rely on other methods to determine creditworthiness of potential borrowers, however a systemic check is still lacking.

Under the principle of transparency, providers should disclose loan terms and conditions so that clients can make informed decisions. However, clients also have the important responsibility to borrow wisely, by borrowing for projects that will allow them to repay without difficulty and by avoiding loan stacking (i.e., the practice of taking out a loan to repay another loan).

Valerie Houssou, general director of Alide, addressed both clients and providers on the following principles: 1) clients should only take out loans that help them finance a specific/business projects; 2) clients should be able to repay their loans without difficulty or pressure; and 3) institutions need to check for credit history, repayment capacity, and evidence of loan stacking.

A L’ecoute du Client Campaign

The campaign partnered with Radio Tokpa because of the station’s broadcast coverage in Southern Benin, where there is a high concentration of MFIs that serve the target audience. The program aired in French and Fon, Benin’s dominant languages. The French language program was broadcast on the segment “Caravane du Matin” and the Fon version on “Contact Fon.”

The campaign also featured one-minute public service announcements to share institution contact information that consumers could use to lodge a complaint or verify that a provider is licensed. Each week, A L’ecoute du Client began with these public service announcements introducing the relevant theme, followed by an interview between the radio station host and an expert. For eight weeks, the radio station hosted two live episodes each week in both languages.

Listen to the campaign

Benin Radio Campaign Playlist

Journalist Competition

With guidance and insights from local media consultants, 19 Beninese journalists, speaking various dialects, were selected to compete in the creation of unique educational content, aired on their respective radio shows.

To kick off the competition, the journalists attended a one-day training on the Client Protection Principles and Client Voice findings. They were then tasked with creating 15-minute radio productions on one of the four themes of the campaign: fraud, transparency, recourse, and responsible borrowing. Journalists were also challenged to find innovative ways to further educate consumers.

A panel of in-country judges made up of NAC members selected the winners of the competition during an award ceremony in Cotonou, Benin, attended by regulators and representatives of financial service providers. In total, participating journalists submitted over 54 entries, in four languages (French, Goun, Mina, and Dendi). The winning entry from Jessica Gauthe included two radio programs, one television news report, a Facebook Live event at the Dantokpa market, and content shared on Facebook and WhatsApp.

The journalist competition allowed us to multiply our outreach efforts in a more cost-effective, sustainable way. While the A L’ecoute du Client campaign ran for only eight weeks, these journalists now have consumer protection training that they continue to share with their peers in addition to covering stories that raise awareness of consumer protection in Benin.

Behind the Scenes

Creating the Benin Radio Campaign

Louis Biao, Director General, Agence Nationale de Surveillance des Systèmes Financiers Décentralisés“Consumer protection in the microfinance sector in Benin has become more than a reality thanks to our partnership with CFI. This collaboration has improved regulatory processes for MFIs and greatly contributed to the stability of the financial ecosystem.”

Uganda: Protect That Cash Campaign

Financial inclusion is on the rise in Uganda: 58 percent of adults have access to financial services in 2018, compared to 28 percent in 2009. This improvement was largely driven by the uptake of mobile money services, which launched in Uganda in 2009.

In light of this progress, the Bank of Uganda (BoU) is aiming beyond access towards the goal of “reducing poverty and enhancing the economic security of families through usage of affordable financial services.” Consequently, the BoU launched the National Financial Inclusion Strategy in 2017, demonstrating its commitment to financial literacy and consumer protection. Despite regulatory efforts, the proliferation of digital financial services has also led to consumer harm in the areas of product and service transparency, mobile money fraud, risk of over-indebtedness, and access to recourse mechanisms.

CFI partnered with the Association of Microfinance Institutions Uganda (AMFIU) to implement the #ProtectThatCash radio campaign. The aim of the campaign was to complement efforts by the BoU to educate consumers on their financial rights and responsibilities and help mitigate consumer harm.

Financial Inclusion in Uganda at a Glance

46%

are “financial included,” defined as individuals who have an account in their name with a full-service financial institution.

94%

had a mobile money account in 2017.

15%

between male and female registered account users (54% male and 39% female).

Uganda’s Consumer Protection Landscape

To guide the final installment of the radio campaign series, CFI, in partnership with the Association of Microfinance Institutions of Uganda (AMFIU), assembled a NAC with leaders from the Global Banking Alliance for Women, New Faces, New Voices (Uganda chapter), the Consumer Education Trust (CONSENT), and the Bank of Uganda.

We organized a workshop in Kampala to inform the design and content of the Uganda radio campaign. This brought together members of the NAC, media, and financial institution representatives, as well as staff from the Communication for Development Foundation Uganda (CDFU) who were contracted to design and implement the radio program. At the conclusion of the workshop, the 20+ participants identified fraud, responsible borrowing, transparency, and mobile money security as the main consumer protection challenges Ugandans face.

As mobile money account ownership exceeds bank account ownership in Uganda, the mobile money market has become a breeding ground for fraudsters. According to Microsave, an average of one hundred mobile money users lose money every week from fraud, with many more cases that likely go unreported because customers do not trust the handling of such cases. The 2013 Agent Network Accelerator survey for Uganda identified “risk of fraud” and “dealing with customer services when something goes wrong” as the two biggest challenges agents face.

A common consumer risk in this area is PIN security. This affects both mobile money agents, whose mishandlings can lead to client harm and clients whose unawareness can lead to stolen funds. Although mobile network operators attempt to curtail this problem by training agents and advising clients, further consumer education is needed.

We invited Sandra Elizabeth Namazzi, corporate account manager at MTN Uganda to speak about mobile money security for the Protect That Cash radio campaign. She provided listeners with the following advice:

- Never share your PIN with anyone and never mention it out loud

- Change your PIN regularly, especially if you are suspicious

- Do not use PINs that are easy to guess, like 00000, 12345, and birth date

- Report stolen SIM cards to police as soon as possible and block your SIM card

- Never share your PIN with the mobile money agents

False promotions is another common fraudulent tactic in Uganda taking advantage of mobile network operator (MNO) marketing and advertising strategies. This tactic involves fraudsters impersonating MNOs who call or text customers claiming that they have won a prize. Customers are then asked to send a facilitation fee to a specific mobile money account. After following up with their MNO about their prize, customers realize they have been defrauded and the mobile money account to which they had sent the “facilitation fee” is no longer traceable. MNOs have attempted to mitigate this risk by increasing awareness of the official phone numbers through which winners would be contacted.

Kimera Henry, Director at Consumer Education Trust (CONSENT) and Ibrahim Bbossa, Public International Relations Officer at the Uganda Communications Commission (UCC), were invited by the campaign to discuss this harm. On the show, these experts advised consumers to be alert to such scams and always verify the legitimacy of a promotion through the UCC.

In 2013, the Bank of Uganda released its Mobile Money and Transaction Guidelines to streamline consumer protection within MNO operations. Transparency features prominently in these guidelines, and consumers are encouraged to obtain documentation outlining clear terms, conditions, and relevant fees associated with opening a mobile money account and conducting transactions. The guidelines also require mobile money agents to clearly display the following information:

- The identity of the mobile money service provider(s)

- The agent’s unique identification number

- All applicable charges and fees

- A written notice that no charges or fees are levied at the agent location

- Customer service contact information

- A statement that the agent does not carry out transactions on behalf of customers.

Agents are also required to provide an oral explanation of all terms and conditions to consumers in their preferred language, if they are unable to read these terms.

Tony Manina, head of risk and compliance at Airtel Uganda, spoke to Airtel’s application of the guidelines in a Protect That Cash episode. He also addressed the risks associated with mobile money transactions, such as consumers accidentally sending funds to the wrong person, and guided listeners on the process for transaction reversals.

In 2019, IPA conducted mystery shopping visits to over 1,000 financial institutions in Uganda. The study revealed that customers received inconsistent information depending on how experienced and familiar with the lending process they were as customers as well as on which loan officer they were dealing with at the time. Although the Bank of Uganda introduced the Financial Consumer Protection Guidelines mandating product transparency, the study revealed that many financial institutions remain non-compliant.

To educate consumers on their right to information, the campaign invited Edward Bindhe, Communications Officer at the Uganda Micro Finance Regulatory Authority (UMRA) and George Wilson Ssonko, Financial Consumer Empowerment Head at the Bank of Uganda. They shared f the following tips on an episode of Protect That Cash

- Consumers should take the initiative to ask and understand the whole process before they sign loan documents

- A loan can be cancelled during the cooling off period

- Providers should explain transaction details in a language clients understand

- If clients feel they are not being given all the relevant information, they can end the relationship with the provider or complain about the provider to proper authorities, including the UCC, the telecom company, or BOU

- Customers should confirm receipt of their money before they end their session with the provider or agent, e.g., before “leaving the counter”

Regulation of digital lending by non-banking financial institutions remains low in Uganda. Institutions outside of the central bank’s supervision are not mandated to report borrower data to the Credit Reference Bureau. It is estimated that half of Ugandan borrowers tend to take out loans to For vulnerable clients, this borrowing behaviour, coupled with client’s confusion about loan terms and conditions, make them prone to over-indebtedness. Regulatory safeguards are needed to ensure digital lenders disclose terms and conditions, assess the risks of loan stacking, and help mitigate against over-indebtedness.

The campaign invited George Wilson Ssonko, Financial Consumer Empowerment Head at BoU, and James Ssaka, Communications Officer at the Financial Intelligence Authority (FIA), to speak on the topic. Addressing consumers on the live show, these experts shared the following lessons:

- Understand the terms and conditions that come with any loan

- Comparison shop between lenders to see which product best suits your needs

- Do not accept a loan if you feel you cannot meet the requirements

- Borrow within your means

- Pay back on time to avoid being blacklisted

- Do not borrow to pay back another debt

Uptake in digital credit has also given rise to an unintended consequence in the East Africa region: increased sports betting and digital gabling. To curtail this issue, Uganda’s government has banned registrations for new betting companies and will not renew existing licenses. However, since the practice remains for the time being, we invited Godfrey Arinaitwe from the National Gaming Board to educate listeners on the risks associated with digital borrowing for sports betting.

Protect That Cash Campaign

The 2018 Finscope study found that women in rural areas of Uganda are disproportionately represented among those without access to formal financial services. Thus, the Protect That Cash campaign had a narrow target audience, focusing on women in Western and Central Uganda. In order to maximize geographic reach, the campaign engaged two nationally broadcasted radio stations: Radio Simba with an estimated listenership of 2,823,020 and CBS with 4,126,040 listeners. Both programs broadcast in Luganda.

#ProtectThatCash started with a short drama designed with a female protagonist named Naki to resonate with female listeners. The drama was followed by an interview between the radio station host and an expert. Listeners were also given the opportunity to call in with questions during the live show.

NAC feedback identified the need for greater access to reliable recourse channels. Specifically, consumers often did not know where to go to complain or resolve disputes with DFS providers. In response, the campaign advertised AMFIU’s toll-free hotline to consumers through multiple media channels. The campaign also utilized CDFU’s toll-free hotline as a support tool for consumers for the duration of the campaign. These toll-free hotlines were advertised at the end of each drama and on the live shows. The radio program spanned eight weeks, during which the CDFU and AMFIU toll-free hotlines remained accessible to provide listeners with more information and counselling. Listeners shared some of the following concerns:

Mobile Money Security

“I shared my PIN with my eldest daughter because that is also my bank account. If something happened to me, I don’t think the service provider would look for my children to give them my life savings. I have never heard of a mobile money service provider looking for relatives of a deceased person to give them money that could have been on their account when they passed away. Who takes their hard-earned savings?” – CBS FM listener

Transaction Reversals

“I once sent money to a wrong number but realized after two days [later]. By the time I contacted customer care, the money was gone and there was nothing they could do to help me. They only encouraged me to report the matter to police.” – Radio Simba FM listener

Fraud

“[The] majority of people have at one point received calls from fraudsters. I have also been a victim to such calls many times. What is UCC doing about these thieves that are stealing from hardworking Ugandans?” – CBS FM listener

Transparency

“I wish the government would ensure that loan documents are translated into the local languages to enable everyone understand the loan conditions. Many of my counterparts have fallen prey to money sharks because they actually do not understand the details in the documents where they are appending their signatures.” – CBS FM listener

Responsible Digital Borrowing

“I have on several occasions fallen victim of irresponsible borrowing. I have been borrowing a substantial amount of money because my girlfriend says she wants internet bundles and I do not want to look like a failure. I do small consultancies for several clients and most times they pay me using mobile money, which gets deducted as soon as it reaches my account because I fail to pay my debts in time. This affects my business because I at times do not have money to buy spare parts, yet the clients have already [paid for the work]. I will now be careful to avoid irresponsible borrowing.” – CBS FM listener

Sports Betting

“Betting shouldn’t even be considered a form of business, but rather a cancer that needs to be cut off as soon as yesterday. The youth are the most affected by betting… Betting is a destructive behaviour that has led many Ugandans to theft, [and] high levels of stress to the extent of having suicidal thoughts or actually committing suicide.” – CBS FM listener

Outreach

The Protect That Cash campaign disseminated SMS messages in Luganda, using the AMFIU client database of 2,035 contacts. Messages were sent a day prior to the radio program to remind listeners to tune in.

Protect That Cash Text Messages

Privacy

Your mobile money password should be kept secret to guard against loss of your money. Tune in to [radio station] tomorrow from [time] for more information. #protectthatcash

Financial Capability

Correct information to your bank or agent helps you make informed decisions and avoid errors. Tune in to [radio station] tomorrow from [time] for more information. #protectthatcash

Transparency

Before you sign any document with your bank, ensure you understand the terms and conditions of the contract. Tune in to [radio station] tomorrow from [time] for more information. #protectthatcash

Over-indebtedness

Borrow only if you have the capacity to repay to avoid being blacklisted or lose your property. Tune in to [radio station] tomorrow from [time] for more information. #protectthatcash

Fraud

Always follow up with the company that claims to have a promotion to verify the legitimacy of the message on your phone. Tune in to [radio station] tomorrow at [time] for more information. #protectthatcash

Over-indebtedness

Borrow responsibly and live happily. Do not borrow to clear another debt. Tune in to [radio station] tomorrow from [time] for more information. #protectthatcash

The campaign also opted for print advertising by creating posters to garner interest. A total of 78 posters were distributed to mobile money agents to display on their kiosks. Each poster included the consumer risk to be addressed that the week and the CDFU and AMFIU toll free numbers.

One need that arose while designing the campaign was to engage agents in the conversation. This was done through mobile money agent groups on WhatsApp.

The campaign also engaged two community monitors whose responsibilities were to monitor radio broadcasts of the program, ensuring that the programs aired as per broadcast schedule, and to speak to community members to hear their stories and gauge reactions to the campaign. The CDFU toll-free line was also used to engage with listeners and hear their feedback. The lines were available throughout the duration of the campaign during business hours. The following is a breakdown of caller trends by gender, age range, and issues discussed.

Radio Simba listener“After listening to the [Protect That Cash] drama, I have learned to be careful sending cash. I have learned that I have to confirm both names of the person I am sending money to and also to call the person immediately after the transaction to check that he/she has received the money.”

Consumer Protection Awareness Campaigns: Five Lessons Learned

Our pilot consumer protection campaigns in Ghana, Benin, and Uganda helped us evolve our approach to radio and multimedia campaigns. Across the three markets, regulators, industry associations, and consumer advocacy groups expressed demand for continued awareness-raising initiatives, particularly focused on educating consumers about their rights and responsibilities. Feedback from clients during the campaigns highlighted persistent questions related to transparency, product safety, and fraud, as well as the need for advice on seeking appropriate redressal from financial service providers. Above all, we learned there is no one-size-fits-all approach to raising consumer protection awareness among clients.

Radio is a key information source in African countries and listenership data gathered from the campaigns showed substantial coverage, with over two million listeners reached per show. Calls from listeners during the live shows and on the toll-free hotlines, in addition to feedback given to community monitors, demonstrate the potential for audience engagement through this medium. We believe that radio can be an effective channel in rolling out future awareness campaigns, and we offer the following recommendations for how to design radio-based awareness campaigns.

Lesson 1: Local Partnerships are Fundamental

Selecting partners that are representative of a country’s media and financial services landscape ensures a diversity of expert opinions and local insights. Our approach to each campaign began with forming local advisory councils, which included regulators, FSPs, media, and public sector institutions. These advisory councils weighed in on the goals and design of the campaigns.

Working with a local implementing partner was also helpful in getting a read of the landscape and managing the broadcasts on the ground. In Ghana, partnering with the Financial Inclusion Forum Africa was vital in managing relationships with radio station hosts and experts, and sourcing the right consultants for content production. In Uganda, engaging with the Communication for Development Foundation Uganda (CDFU) allowed for a centralized process to contract and monitor radio stations, guide experts, and produce the dramas. In addition, the Association for Microfinance Institutions of Uganda (AMFIU) provided quality checks of our scripts and materials, drove marketing efforts to get people to tune in through relationships with mobile money agents, and helped to target publicity effectively in local dialects. In Benin, we collaborated with two individual media consultants to reach out to their local networks and devise and drive interest in the journalist competition.

Our partners shared ownership over the content and success of the campaigns, which has led them to explore ways to repackage and continue to make use of the content. The Bank of Ghana and the Uganda Communication Commission (UCC) both expressed interest in taking the program forward by using campaign content as an educational tool for their clients. Journalists in Benin continue to engage their respective audiences.

Lesson 2: Tailor Your Message to Your Audience

Market insights and analysis of local consumer protection risks were essential to ensure that campaign messaging was relevant. Through workshops led by the CFI team, NAC members identified thematic areas specific to the local markets. For instance, the Benin campaign spent an episode on how to identify legitimate, licensed FSPs because clients had specifically identified this challenge in our survey research. For the Uganda campaign, analysis from AMFIU’S complaint database and market interventions shed light on the risks associated with mobile money penetration. Consumers expressed uncertainty navigating the digital landscape, which surfaced the need to create awareness on consumer protection among mobile money agents.

Lesson 3: Know Your Audience

To select effective engagement channels, it is important to identify and understand your target audience. Experimenting with outreach methods, the campaigns employed various channels to reach intended audiences.

The Ghana radio campaign’s aim was to reach as many clients as possible. As such, the campaign relied heavily on Facebook and Twitter, as well as SMS dissemination to reach a wide audience.

In Benin, the campaign targeted MFI clients and utilized a decentralized approach with the journalist competition. Nineteen journalists engaged in the competition and disseminated content on their individual local radio stations, expanding our audience to millions more listeners. The journalists also created a Facebook page to continuously engage audiences. Finally, the journalists went into marketplaces to further educate consumers on their rights. Using a diverse set of local journalists and their channels was an effective and sustainable approach in reaching the target demographic.

The Uganda campaign sought to focus on female mobile money clients in rural areas and made use of traditional approaches such as radio, disc jockey engagement, and advertising. Mobile money agents also displayed posters on their kiosks to create awareness among the target audience. In addition, SMS messages were disseminated to contacts listed in the AMFIU client database a day prior to the live shows.

Lesson 4: Ensure Message Clarity and Consistency

Clear branding and messaging guidelines are important to share with partners in order to avoid misrepresentation. The campaign employed various message-alignment tactics to ensure information consistency. For all three campaigns, radio hosts were trained on the Client Protection Principles. Hosts and experts were also given talking points ahead of the live shows to ensure structured discussions. Audience engagement messages shared via SMS, social media platforms, and print ads were also vetted by CFI. In Benin, journalists were trained on the Client Protection Principles prior to the competition. In Uganda, hotline counselors managing the toll-free hotlines were also trained on the principles and provided with an FAQ guide to help answer caller queries. Community monitors were also sensitized prior to campaign roll out.

Lesson 5: Innovate to Innovate and Measure Reach

We employed various cost-effective monitoring and evaluation tools to measure campaign reach. Radio stations are set up to measure their audience and provide listenership estimates, so that worked well for all three campaigns. Additional resources allowed for Ghana’s campaign to make use of Geopoll’s audience measurement tool, which provided further insights into demographic trends. Audience engagement was also measured through built-in analytics tools provided by social media and SMS dissemination platforms. Utilizing CDFU’s existing hotline, the Uganda campaign documented hotline caller trends, which were broken down by region, age, gender, and topic. This was a cost-effective approach to understand how the campaign was resonating with listeners.

As developing markets work towards responsible financial inclusion, increased efforts to empower clients on their rights and responsibilities is needed to foster a healthy financial ecosystem. We hope that future initiatives can build on these consumer awareness campaigns and. The success of these initiatives will rely on sustainable partnerships and creative tactics to reach consumers in their own voice.