The saying that is often attributed to Einstein is that insanity is defined as doing the same thing over and over again and expecting different results. While it’s been contested that Einstein said these words, it is nonetheless a saying that deserves reflection.

In responsible finance, we can feel stuck in this cycle of insanity. We continue to see the same old risks, and new risks are constantly emerging — yet our toolbox is not keeping up. This cycle is most vivid when meeting with clients.

When visiting the northern wetlands in Colombia, I met a small business owner — let’s call him Juan — who recounted his experience with identity theft. A large financial institution approached Juan about taking out a loan for a pool table he planned to put in the beer hall that he owned in his village. After speaking with the bank agent and, presumably, applying for the loan, he never saw the agent again nor received the money. When visiting the branch to find out what had happened to his loan, he discovered that the bank records showed it already disbursed his loan, even though he had never received the funds. He tried to resolve the issue with the bank, but the cost of travel to the nearby town where the branch is located, the expense of taking time off work, and not understanding how to resolve this issue created massive hurdles for Juan. Similar challenges apply to millions of other low-income people around the world.

We continue to see the same old risks, and new risks are constantly emerging — yet our toolbox is not keeping up.

During a recent trip to Kenya, I spoke to drivers of several ride-hailing apps who had borrowed funds to buy their vehicles. While the loans allowed them to become drivers, they struggled to meet their basic needs before platform companies demanded their earnings for loan repayment. A new tactic many drivers deployed was limiting the money they kept in their wallets and requesting that riders pay in cash. This approach helped them cover basic living costs and fuel expenses so they could work. Prioritizing loan repayment over basic earnings for living undermined the drivers’ trust in the platform companies where they worked. During the pandemic, researchers in Brazil found that scammers had deceived a highly vulnerable group of people — beneficiaries of government cash transfer programs — by creating fake apps mimicking the government’s government-to-person (G2P) program on the Play Store. By confusing recipients, scammers could gain access to people’s identity data because the individuals believed they were registering for the G2P program. Not only did beneficiaries lose access to their government transfers, but they also became vulnerable to abuse of their data, potentially harming their ability to benefit from other government initiatives in the future.

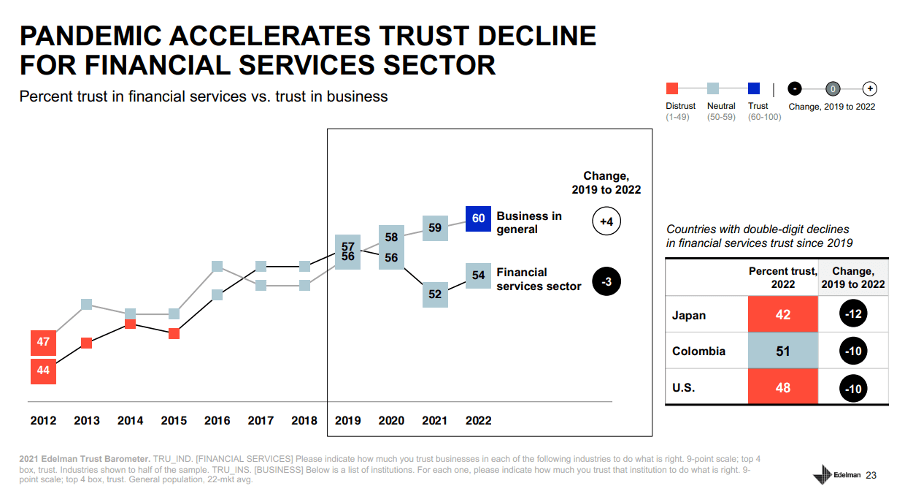

Growing Distrust in Financial Services Industry

Stories of fraud, a lack of recourse, and irresponsible practices abound. Therefore, it’s no surprise that there is growing distrust of financial institutions across developed and developing markets — a fact echoed in a global report by Edelman. For example, since 2019, Colombia experienced a 10 percent decline in trust in the financial services sector.

While the digital economy increasingly allows more people to participate in the financial system, it’s also enabling fraudsters to find new and innovative ways to take advantage of people who cannot keep up with the fine print and loopholes typically found in product user agreements. These scammers are modern-day charlatans preying on people’s vulnerabilities. Regulators and supervisors, meanwhile, are struggling to keep up with the rapid changes and protect the financial system from scams and irresponsible practices. Which risks should regulators prioritize? How can they keep up with the harm that consumers experience daily?

Let’s Stop the Cycle of Insanity and Think Afresh

Breaking out of the cycle of insanity means that the inclusive finance sector must do things differently. Sessions at the upcoming Responsible Finance Forum (RFF) will assess the sector’s achievements over the last decade and determine where to refocus our collective efforts. RFF has undergone a transformation process, broadening the stakeholders around the table and the scope of responsible finance to address all emerging risks that low-income people face. Partners have spent the past year identifying concrete solutions to old and new risks. BTCA, CGAP, and CFI have been leading working groups on responsible recourse, responsible digital credit, and responsible AI, respectively. They will reveal their findings and discuss their insights at the RFF 2023 convening in July. The three-day event will also dedicate time to home in on two emerging risks that demand greater attention: cybercrimes and climate risks.

What more can we do to remove responsible finance from the cycle of insanity? We need to consider the incentives that guide provider behavior and our roles in unleashing harm or enabling responsible practices. Here are a few of my thoughts on how we can improve ecosystem incentives.

Donors who fund innovation must balance funding for risk monitoring and supervision.

For every dollar spent on innovative tech solutions, donors should put in equal funding to support regulatory and supervisory capacity, develop market conduct tools, and implement consumer research to better understand and help mitigate potential harms.

Consumer protection by design.

Ensuring companies use data responsibly, disclosures that customers can understand, and interfaces that help customers make informed decisions — these are not afterthoughts. Organizations should not provide funding for innovation without attention to consumer protection and responsible data practices in the design process.

Scaling and strengthening consumer advocacy organizations.

Consumers have so little power and so little voice. Governments and donors must help rebalance the scale by empowering consumer advocacy organizations. While this is a long-term investment, it is nonetheless essential.

RFF convenes July 5-7, 2023 in Bengaluru, India, under the theme of Shaping a Responsible Digital Finance Ecosystem. Visit the RFF website to view the full agenda.