Financial Inclusion Week (FIW) 2022 took place in October during an important time for climate discussions. In 2022, there were deadly floods in Pakistan and Nigeria, tropical storms in Central America, and an ongoing drought in the Horn of Africa – to name only a handful of devastating climate-related disasters which have created a backdrop of urgency to address climate change. In early November, COP27 focused the world’s attention on the urgent need for climate action. In December, CFI hosted a Responsible Finance Forum (RFF) convening focused on the intersection of climate risks and consumer protection. And in the last quarter of 2022, CFI was also in the process of finalizing our multi-year strategy for climate work.

While the urgency of climate change is not new, what has changed in the past year is our understanding of what financial services can – and can’t – do to help low-income and vulnerable people respond to various climatic risks.

The inclusive finance sector has stepped up to this challenge and 2022 marked an important year. The European Microfinance Platform’s Green Inclusive and Climate Smart Finance Action Group (GICSF AG) published its updated Green Index. The CIFAR Alliance has continued to build an industry agenda for the role of digital finance in climate resilience (including a session at FIW on democratizing access to carbon markets). CGAP integrated climate into their new strategy and they ended the year by publishing a new taxonomy of climate-responsive and climate-supportive financial products. At COP27, AFI published its Inclusive Green Finance Roadmap, and inclusive green finance is a key priority for UNSGSA Queen Máxima as well as many other development actors.

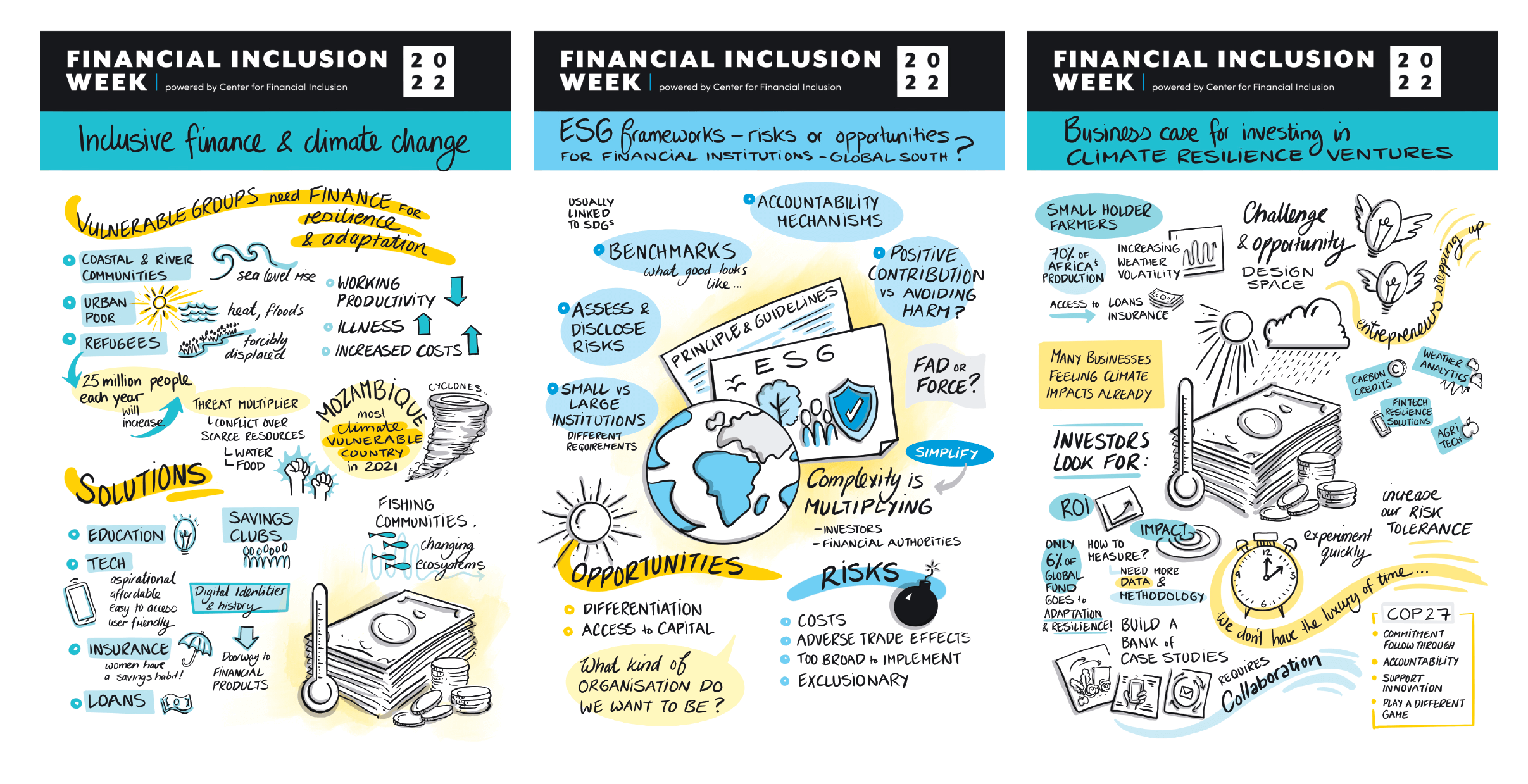

The importance and urgency of climate change was clear to attendees joining the many FIW 2022 sessions that covered climate and green issues. In CFI’s global plenary, we brought together a diverse group of stakeholders to discuss how the impacts of climate change are complex and highly variable. For example, fishing populations in the Philippines, poor urban women in Gujarat, and refugees in Uganda are all negatively impacted by climate change, and panelists described how financial services need to be able to support them all.

Fishing populations in the Philippines, poor urban women in Gujarat, and refugees in Uganda are all negatively impacted by climate change, and FIW 2022 panelists described how financial services need to be able to support them all.

Among the FIW sessions related to climate, there was general agreement that the current state of financial systems is not going to be enough to meet the needs of climate-vulnerable populations, and that we need more innovation and better systems for responsible investment. Catalyst Fund chaired a fascinating panel on the business case for investing in climate resilience ventures. One of my favorite sessions of the week was chaired by David Porteous, exploring whether ESG frameworks were for purpose from the perspective of financial institutions in developing nations. And looking ahead to 2023, the organizers of SAM 2023 explored the links between inclusive finance, agriculture, and food security in Africa.

We are hoping that a lot of the promise of 2022 turns into action and investment where it is needed most.

So, what about 2023? At CFI, we have already started on our climate work and recently released our latest research on green inclusive finance and the ways it can impact low-income and vulnerable populations. We aim to build on this and go deeper into the role of inclusive financial services in responding to specific climate risks, like extreme heat or flooding. We are hoping that a lot of the promise of 2022, such as the commitment to funding for loss and damage at COP27, turns into action and that we can turn some of our ideas and concepts into real world action and investment where it is needed most.

View FIW 2022 Climate Change Playlist

View the full Climate Change Playlist from FIW 2022.

Financial Inclusion Week 2022 had over 3,300 registered participants from 2,000 organizations across 148 countries. With almost 400 speakers and 125 sessions, FIW 2022 was the largest event to date. All sessions from FIW 2022 can be viewed here.

And be sure to save the date for FIW 2023 which will take place October 16-19, 2023.