Nearly two billion people across the globe lack access to formal financial services and approximately 90 percent of these people live in developing countries. They are excluded mainly due to four predominant barriers preventing accessibility:

- Living in rural areas

- Reduced access to digital technology

- Distrust in banks

- Lack of financial and digital literacy.

Over the last four years, Comic Relief and Jersey Overseas Aid have been working together to tackle financial exclusion to make sure no one gets left behind. In 2017, Comic Relief and Jersey Overseas Aid launched a joint program, Branching Out: Financial Inclusion at the Margins, that supports eight organizations through 19 different grants working towards financial inclusion in Zambia, Rwanda, and Sierra Leone. Since the launch of the program, hundreds of savings groups have been created, helping more than 124,000 people gain practical tools to better plan for the future, achieve long-term goals, and prepare for emergencies. Things were looking up.

Then the unexpected occurred in early 2020. COVID-19 presented – and still presents – a real danger to those who were already at the margins of society.

The challenges created by COVID-19 had a catalytic effect on accelerating FSPs’ shift to digital delivery of financial services.

In light of the pandemic, the Branching Out program commissioned a study, Resilient and Inclusive Financial Services Delivery During COVID-19, through the Toronto Centre. The study examines crucial lessons learned in responding to the pandemic in 2020-21. The program interviewed organizations striving to support vulnerable people to gain access to financial services during this trying time to prevent vital progress from being undone.

The study revealed two major findings:

- Digitalization is key for resilience.

- Providing practical tools and guidance to financial services is needed now more than ever.

The report also shows that the challenges created by COVID-19 had a catalytic effect on accelerating financial service providers’ (FSPs) shift to digital delivery of financial services. When face-to-face service delivery was significantly reduced due to COVID-19 health protocols, resilient FSPs and countries (those experiencing little to no contraction in business) were those that were able to implement new measures to reduce in-person contact.

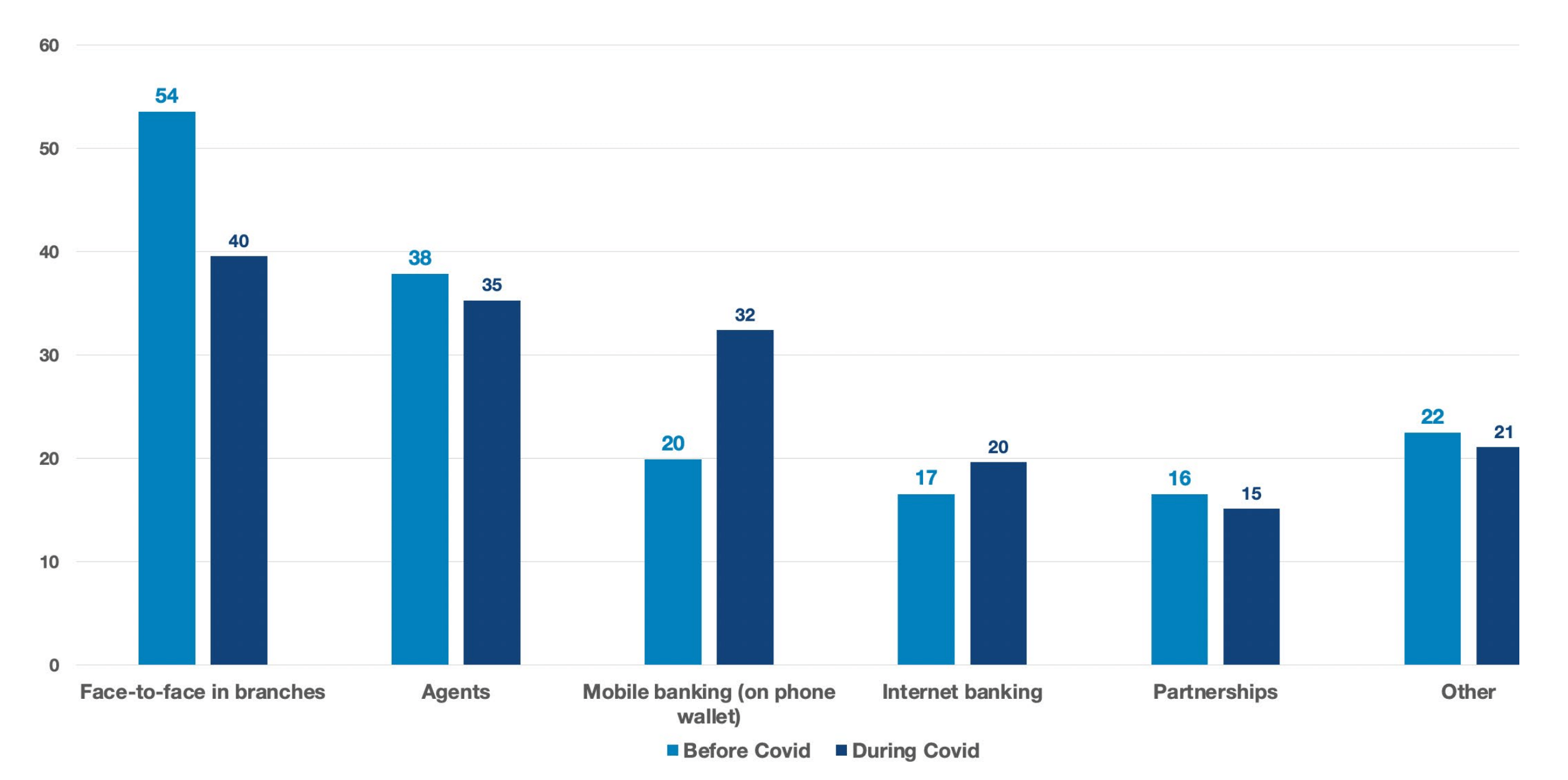

The table below illustrates the changes in delivery channels used by FSPs. The y-axis indicates the percentage of FSPs surveyed (the total respondents also included a smaller number of supervisors and associations). Respondents are based in Zambia, Rwanda, and Sierra Leone.

Percentage of FSP Respondents Using the Delivery Channel Type

(Credit: Toronto Centre)

The uptake of digitalization in each of the countries we surveyed was slow before the pandemic. This could be due to the barriers individuals face, such as:

- Limited access to the technology needed for digital access, especially for women and those in rural areas

- The level of digital literacy, low before COVID-19 in all three countries, presented a barrier for some groups, especially for women and rural populations

- Issues of trust and concerns around data privacy and transparency were hindrances to quick adoption of digital delivery channels.

Progress of digitalization and infrastructure at the country level seemed to influence which delivery channels were emphasized during the pandemic.

During the pandemic, progress of digitalization and infrastructure at the country level seemed to influence which delivery channels were emphasized. For example, FSPs in Zambia saw a rise in usage of mobile banking services from 26 percent pre-pandemic to 36 percent during the pandemic. In addition to this, Zambia FSPs used agents more to navigate the social distancing restrictions and to reach localized communities – as it was deemed more effective than bank branches.

In Rwanda, the uptake of mobile banking before the pandemic was similar to that of Zambia, though Rwandan usage was bolstered by government efforts towards creating a “cashless society,” which further promoted non-face-to-face services. Rwanda FSPs, therefore, focused their efforts on mobile and internet banking.

In Sierra Leone, internet banking rose from 7 percent to 17 percent during the pandemic – the largest increase seen in the report. However, because the country had faced similar challenges during the outbreak of Ebola, FSPs also managed to maintain a high level of face-to-face delivery, due to having the existing infrastructure to adhere to COVID-19 restrictions, such as social distancing and strict health and safety protocols. The experience that health authorities in Sierra Leone gained from the Ebola outbreak helped them prepare for COVID-19 even when little information was available.

What Does the Digitalization of Financial Services Mean for Those at Risk of Financial Exclusion?

The report found that in many cases the digitalization of financial services, accompanied by greater digital literacy and accessibility, has been a promising development in inclusive finance. Consumer associations revealed that one of the greatest impacts of this transition has been in access to repayment modalities which would otherwise have been impossible and could affect customer access to future credit as well as FSPs’ willingness to lend to affected groups.

There is a real danger that more people could be left behind if these barriers aren’t addressed.

However, while digitalization can be seen as a natural progression that has been bolstered by the conditions created by the pandemic, barriers persist, including a lack of internet access and low financial and digital literacy. There is a real danger that more people could be left behind if these aren’t addressed.

Steps Needed for Continued Progress in Financial Inclusion

Comic Relief and Jersey Overseas Aid identified the following steps FSPs and regulatory bodies should take to continue making progress in financial inclusion:

- Support the shift to increased digitalization to ensure it expands the reach of financial inclusion.

- Increase communication at the policy level and share risk assessments with FSPs to allow for proper planning and strategy.

- Set supervisory expectations for FSPs, through best practice guidelines, on the enhanced risk management measures that FSPs should take in ramping up non-face-to-face delivery.

- Enhance information-gathering for effective supervision of these delivery channels as FSPs try out innovative approaches.

Comic Relief and Jersey Overseas Aid’s aim has always been to ensure that those in the most rural communities don’t get left behind when it comes to accessing financial services. As a result of this report and its findings, the Branching Out program will continue its vital work to support more people to understand and take control of their finances, get back on their feet, and plan for their future.