The year 2020 will forever be remembered for COVID-19 and the changes that have ensued as a result. Each day we read about how COVID-19 is impacting low-income people, micro-and small enterprises, the financial sector and low- and middle-income countries; but more than just reading about it, we are all simultaneously living through the impact it is having on our day-to-day lives.

For me, as I reflect on the past year, I can’t help but be thankful for staying gainfully employed, quickly and seamlessly adjusting to working from home, and adjusting CFI’s work program to collect data and do our research using virtual tools. But the results of our research are a daily reminder that my lived experience is very different than the lived experience of the majority of people in developing countries. CFI’s research with micro and small enterprises in Nigeria, India, Indonesia and Colombia is showing the hardships that these often informal firms are going through.

Early in this pandemic, we wrote about what made this crisis different from any other. The systemic nature of the crisis and the lack of clarity on its duration stood out and made this crisis a test of a lifetime. What have we learned from the responses to COVID-19 undertaken around the world and has inclusive finance risen to the occasion?

Cash Transfers for the Most Vulnerable

In June of 2020, I wrote a blog post about the limits of individual action and market solutions. I made the case that this pandemic was different and that the duration of the lockdowns, the loss of incomes and jobs, the overall contraction of the economy and, in turn, demand for goods and services meant that public policy had to play a bigger role in the COVID response than in other prior crises.

This has been playing out in real time and it’s been incredible to see the enormity of the response across the globe. CFI’s brief on social payments features many examples of how governments were able to step up cash transfers to individuals and firms to help them withstand the enormity of the shock on their lives. The World Bank tracks the number of social protections measure undertaken around the globe, and in its most recent count in September 2020, it identified measures in 212 countries or territories, covering 1,179 social protection measures. Of these, 158 countries have opted for cash transfers and 93 have offered in-kind food or food vouchers. Combined, 1.8 billion people have benefited from cash and in-kind transfers, of which 1.3 billion were cash recipients. This represents a 217 percent increase, globally and on average, in social transfer payments compared to pre-COVID levels.

We must build upon digitized cash transfer programs to build systems that can be leveraged in future crises.

While we don’t know precisely how many countries opted for digitized cash transfers, CFI’s research shows that many countries expedited regulatory measures to enable contactless distribution and rapid opening of transaction accounts. Undeniably there will be hiccups with such rapid shifts to digital channels, and more research is needed to better understand how and whether vulnerable people have been able to fully avail of this unprecedented outpouring of assistance. As we continue to investigate and hopefully refine these programs, we must also build upon them to ensure that this is not just a one-off logistical operation, but an opportunity to build systems that can be leveraged in future crises. Even more importantly, providers and others involved in these programs should focus on the beneficiary experience so that users see value in using these new accounts. Only when a service creates value in people’s lives will it displace what they are already using.

And What About Micro and Small Enterprises?

Cash transfers have been a lifeline for vulnerable people around the globe, but there are fiscal limits to how much this instrument can solve all COVID-19 wreckage. Cash transfers support the economy by putting money in the hands of people who will buy basic goods and services. This does support aggregate demand in the economy, but it has not been sufficient to preserve or create new jobs. For this, we need to rely on micro and small enterprises (MSEs), which, according to ILO’s research, employ seven out of 10 people globally. Medium and large firms are important drivers of employment, but for our purposes we focus on informal firms that serve and employ low-income people.

Yet when we look at how the COVID-19 response has addressed the needs of MSEs, the picture is precarious. CFI’s research shows that many of the MSEs in the samples we’ve researched are struggling. Half of them have had to lay off more than 50 percent of their workers, and revenue has been hit hard. When it comes to coping strategies, we see big differences across the markets which could be explained by differences in the samples themselves (gender breakdown, rural/urban breakdowns, etc.), but also in macro-level conditions, government responses, and a myriad of other factors. Although our samples are not nationally representative nor directly comparable, the MSEs we surveyed are customers of microfinance institutions in some of the biggest markets in the world, and therefore tell us something about the engines of employment in the developing world.

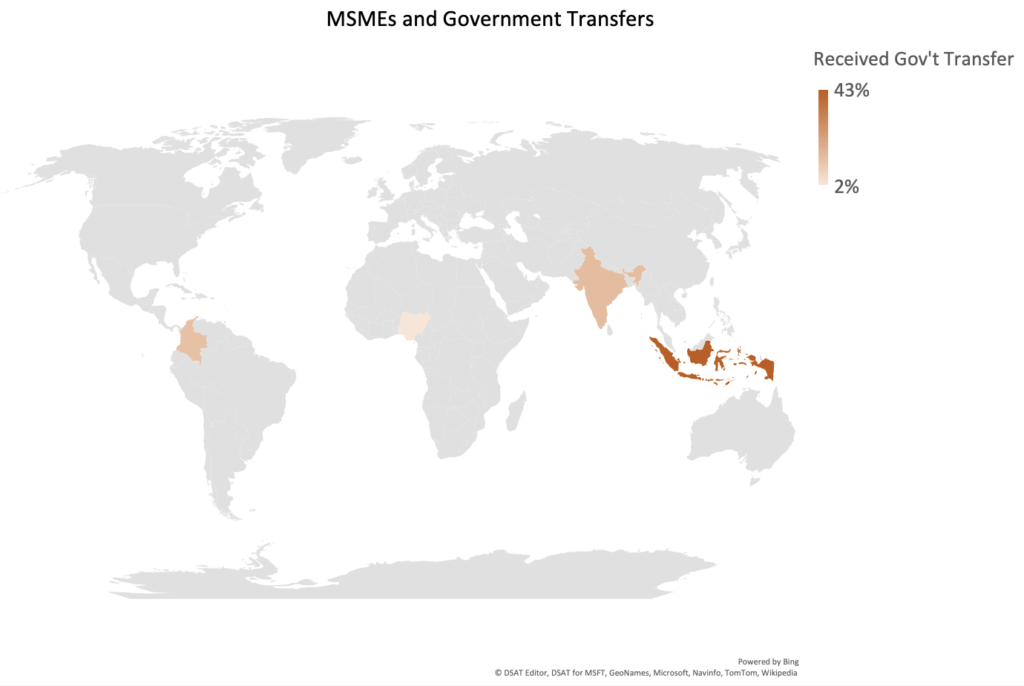

When it comes to government transfers, we see that 43 percent of the owners of MSEs in our research in Indonesia benefited from this support. This drops to 2 percent in Nigeria, and 13 and 14 percent in Colombia and India, respectively (see map).

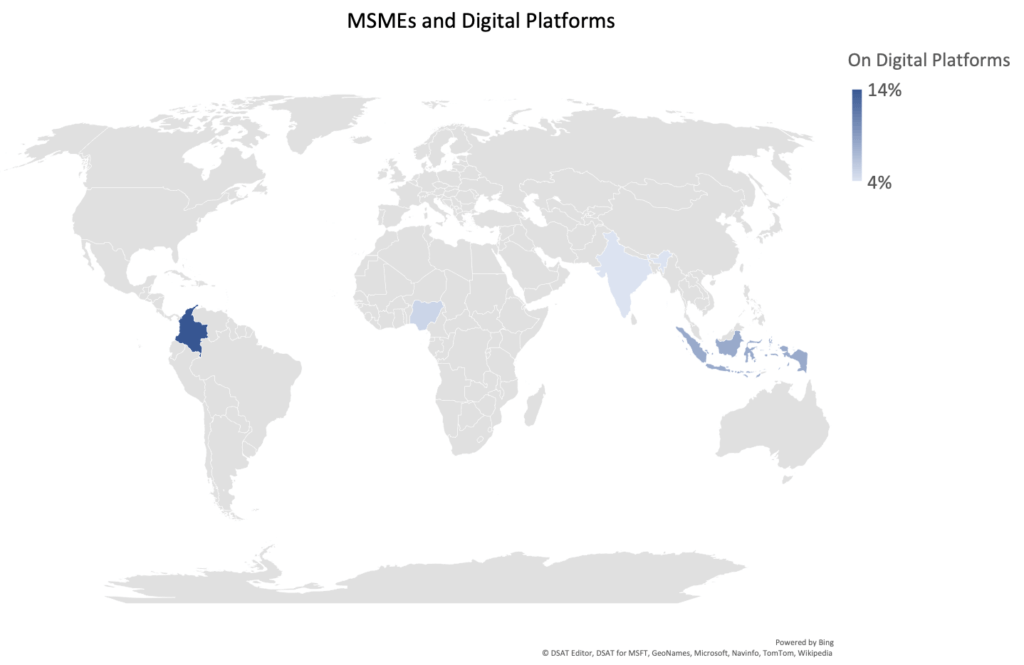

The benefits of the digital economy have been magnified under COVID, but have these benefits trickled down to MSEs? Our research shows a mixed bag. Few MSEs in our sample have leveraged digital platforms to sell their products. Colombia is the only country in our sample where more than 10 percent of MSEs started to sell on digital platforms as one way of coping with the pandemic.

Our data shows that MSEs are adapting to market conditions in more analog ways. For example, many have added delivery services – 20 percent in Indonesia, 38 percent in Colombia, 60 percent in India and 28 percent in Nigeria. But more often, MSEs are cutting workers and their employees are working longer hours; they are offering customers credit, not repaying their loans, offering discounts, or increasing their prices. You can explore the full dataset here.

Institutions That Serve MSEs

Supporting MSEs does not necessarily mean direct government transfers. In the long term, micro and small enterprises need access to capital, payments and other financial services accessible to them when they need it. They need access to new markets; and they need access to knowledge and services that improve their efficiency and reduce their operating costs. MFIs, cooperatives, fintechs, social platforms, and ecommerce platforms are all increasingly addressing one or more of these needs. While there are signs of hope, much more can be done to support MSEs to survive and thrive post pandemic.

Microfinance Institutions

MFIs serve an estimated 140 million people. Early in the pandemic, there was widespread concern that liquidity constraints could wipe out many of the financial institutions that serve low-income customers and MSEs. CGAP’s Global Pulse Surveys have shown that fears were exaggerated. However, moratoriums around the world have put both repayments and new lending on hold. Once moratoriums end, will these institutions resume lending? Will their clients repay? Will their clients be able to repay? CFI’s research with MSE clients of MFIs shows that many have already skipped loan repayments as a coping strategy, from 55 percent of respondents in Nigeria and Colombia, to 47 and 48 percent of respondents in Indonesia and India, respectively.

Once moratoriums end, will these institutions resume lending? Will their clients repay? Will their clients be able to repay?

CFI’s engagement with the Microfinance Coalition — a group of 14 microfinance networks that have come together to advocate for microfinance institutions to regulators, investors and donors — indicates that the future of these providers rests on how investors, both debt and equity, manage their responses to the crisis. As MIV loans come due, will they roll over their loans? Will they increase their lending, despite covenant infractions? The largest MIVs have taken a coordinated approach and signed an agreement to avoid a pre-emptive approach by one or more that undermines other investors. This is a good sign, but it has not yet been tested. As closed-end MIVs need to exit, will equity shareholders buy them out? Will new quasi-equity structures come in to smoothen these transitions?

Both MIVs and the Microfinance Coalition want development finance institutions (DFIs) to step in. DFIs have been busily serving their own investees (read these interviews with CDC, EIB and USDFC), and several have been in discussions to seek a collaborative response, although nothing yet has been made public. Experience from the 2009 financial crises revealed that the DFI-led emergency facility, the Microfinance Enhancement Fund, was too slow in the making and did not serve its original intent of shoring up liquidity when MFIs needed it most. In light of that, it might be too optimistic to expect that DFIs will be able to structure something in time, although many of us still hope for this outcome.

The institutions the Microfinance Coalition represents serve 80 million clients in 69 countries, 23 of which are least developed countries. While united in their advocacy, there is a great deal of nuance among their experiences and that of other MFIs beyond these networks. In some countries, MFIs that rely on local debt markets are less susceptible to cross-border capital. And in some markets, like India and Egypt, the regulators’ responses have allowed MFIs to operate despite the moratoria. MFIs that take deposits have also indicated that in some markets, deposits are up, not down, something that’s counterintuitive but has happened many times before in prior crises. Early signs show that MFIs are likely to be more resilient than expected, and those that have diversified funding sources, such as deposits and local debt, are likely to weather this storm better than non-bank lenders with cross-border debt obligations.

Fintechs and Platforms

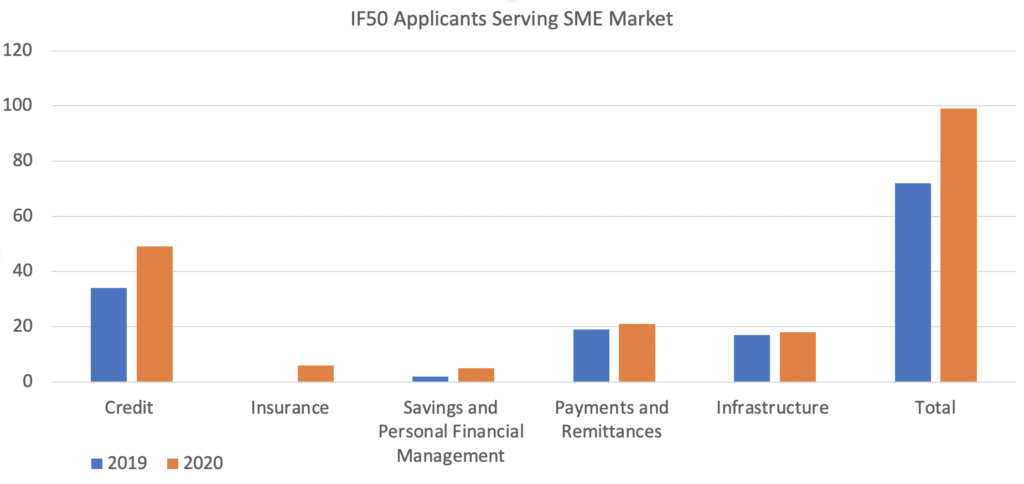

Unlike in the 2009 financial crisis, today there are more diversified sources of capital, markets and business services for MSEs, including those offered by fintechs and big tech platforms. The Cambridge Centre for Alternative Finance conducted a rapid assessment of fintechs globally and found that, on average, fintechs grew in the first two quarters of 2020, by 13 percent and 11 percent respectively. Customer bases and transaction volumes of fintechs operating in emerging and developing markets grew faster than fintechs in developed markets; however, we don’t have sufficient information to assess whether MSEs or low-income people more generally are being served. Data from the Inclusive Fintech 50 competition, which narrows the lens to fintechs that serve low-income people and small firms, finds many more fintechs identified MSEs as their primary target market in 2020 than in 2019, signaling that fintechs see an opportunity for growth with this segment. Most of these fintechs offered credit services, but an increasing number also offered insurance to MSEs (see graph below).

It is difficult to unpack the data on platforms and its potential impacts on MSE. Research by i2i in Africa finds that platforms grew by 18 percent in 2019 across the continent, but it is unclear which types of firms are driving this growth. The largest of these platforms — Jumia, Takealot, and Konga — represent ecommerce, which could bode well for small producers selling on them. Anecdotal evidence in some countries could be indicative of something bigger happening with MSEs moving to digital platforms. For example, in Indonesia, platforms like Bukalapak indicated that they have registered 3 million new merchants in the first seven months of 2020.

So What?

As I reflect on all of these developments during 2020, I think there is much to be thankful for. There is also some concern that the aggregated results may not be enough to cushion the pain of the pandemic for low-income people and MSEs in developing countries. On the positive side, government transfers to 1.8 billion people has bought some time. But the more fundamental and structural support that enables firms to retain their workers — and to recover — are not yet visible.

We have a lot to do in 2021.