When the temperatures in a wheat field pass a threshold of around 104 degrees Fahrenheit (40 degrees Celsius), the seed starts to break down. Photosynthesis stops working, and growth stops. Wheat cannot grow in these temperatures. For the farmers of that wheat, reduced production means reduced incomes. During India’s 2022 heatwave, farmer incomes were reduced by as much as 50%.

Periods of extreme heat can have a similar impact on urban environments. When summer temperatures reach a certain level, the livelihoods of many vulnerable groups – construction workers, day laborers, waste recyclers, miners, food vendors, and market traders – are hit. Working outside in the middle of the day becomes impossible. Foot traffic falls as people stay inside. Jobs that involve working around heat sources, like cooking and welding, become increasingly dangerous.

Understanding the negative impacts of extreme heat on household finances

The health implications of working in extreme heat are well known. Prolonged exposure to extreme heat can lead to heat exhaustion, cramps, dehydration, nausea, sunburn, dermatological issues, and other heat-related illnesses that impact health and the ability to work. The macro-level financial costs are also reasonably well-understood; for example, it is estimated that extreme heat and humidity could cost India’s economy USD $150-250bn, or 4% of GDP, by 2030.

To understand what inclusive finance can achieve, we need a better understanding of how extreme heat impacts incomes and expenditures.

However, we know less about the impact of extreme heat on household finances. To understand what inclusive finance can achieve, we need a better understanding of how extreme heat impacts incomes and expenditures. I was excited to talk to Mahila Housing Trust (MHT), a grassroots development organization based in Ahmedabad, Gujarat, India. MHT provides microfinance and other services to groups of low-income urban women. Ahmedabad and the surrounding area are one of the hottest places on the planet, and its population is highly vulnerable to extreme heat. In response to the 2022 heat waves, MHT conducted focus group discussions with its members and found evidence of how extreme heat periods impacted incomes and expenditures.

On the income side, extreme heat had a significant negative impact on family income. This outcome was true for both home-based and non-home-based workers, particularly women. Home-based workers — making papad, rolling beedi, sewing clothes — tended to avoid working in hot afternoons, thus reducing their productivity. As a result, the average loss of income was 2,650 rupees (USD $33) over the five-month period.

As another example, the Arsht-Rock Resilience Center detailed how extreme heat impacts the income-earning potential of women in the informal economy in Delhi:

In the Old Ahmedabad, New Delhi textile market, female workers pack and sew bales of clothes and transport them by carrying the parcels or using pedal rickshaws or carts. They are paid by parcel delivered. This work only begins after 1:00 p.m., which leaves them no option but to work in the scorching heat. They cannot miss a day’s labor without risking forgone wages.

At the same time as extreme heat causes incomes to fall, it causes expenditures to increase. For example, women interviewed by MHT had to spend more on electricity to run fans. In addition, they bought more cold drinks for their families to stay cool and hydrated. Additionally, without adequate health insurance systems, every medical treatment caused by extreme heat has a financial cost.

Climate change is increasing the probability and severity of extreme heat

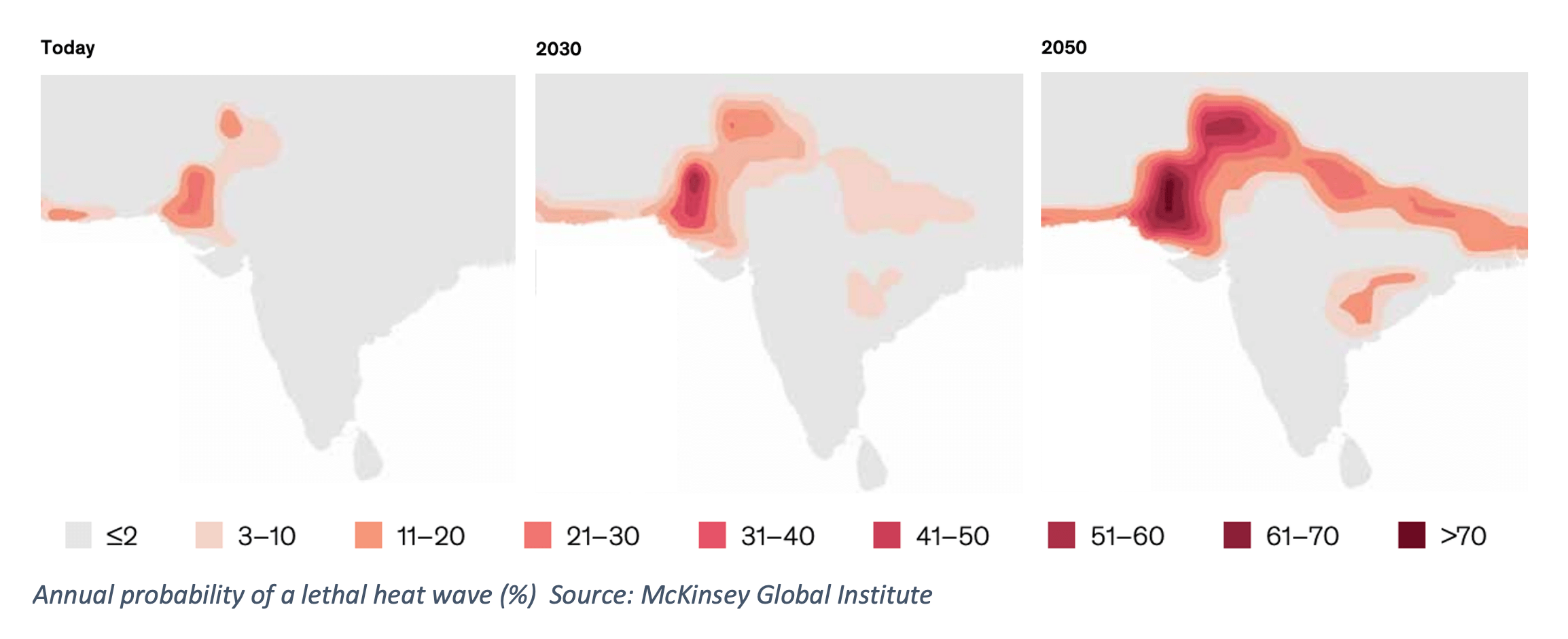

March 2022 was the hottest in India since records began 122 years ago. Temperatures are the highest in urban areas, where a concentration of heat-absorbing buildings, concrete, and limited green spaces creates a “heat island” effect. High temperatures in India and Pakistan are not new, but climate change made the 2022 heat waves 30 times more likely. As highlighted by McKinsey, the probability of a lethal heat wave in South Asia is projected to grow dramatically over the coming decades.

The situation has been most acute in South Asia and parts of the Gulf — such as Kuwait and southern Iraq — but this is a global phenomenon. Extreme heat threatens lives and livelihoods across parts of Southern Africa, West Africa, and richer countries like the USA and Australia. Some estimates show that by 2050, between 700 million and 1.2 billion people will live in areas with a non-zero chance of lethal heat waves — not factoring in air conditioner penetration. Furthermore, like most aspects of climate change, extreme heat will disproportionately impact those already economically and socially marginalized: women, informal workers, refugees, and people of color.

Small loans can help people adapt to extreme heat

The staff at MHT have been thinking about this for some time, and in the past five years, they have begun offering their members small loans to buy heat-reflecting white paint or roof panels to reduce heat absorption in their homes. These low-cost innovations — which can cost as little as USD $75 — can reduce indoor temperatures by up to 5 degrees at the peak of the day. As such, they can be the difference between normal functioning and extreme discomfort while influencing the likelihood of elevated health risks. In addition, MHT supports other passive cooling adaptations, such as potted plants and increased ventilation.

To cope with rising temperatures — without exacerbating the situation by increasing the use of ineffective air conditioners — it is essential to invest in sustainable cooling technologies at every level. For example, in 2019, India’s government launched the India Cooling Action Plan (ICAP) to boost investments in energy-efficient, climate-friendly cooling solutions that do not cause a spike in electricity demand. However, further investment in sustainable cooling options is necessary, and a 2022 report from the World Bank outlines the role of concessional finance in supporting climate investment opportunities.

As households, businesses, and other organizations adapt to extreme heat, many financial service providers will also find the need to adapt.

As households, businesses, and other organizations adapt to extreme heat, many financial service providers will also find the need to adapt. For example, I recently spoke with another microfinance institution (MFI) in Ahmedabad that has experienced a spike in depositors a few minutes before closing; traders are waiting for the heat to abate before depositing their cash. As a result, the MFI extended its business hours into the evening to accommodate those unable to visit during the sweltering afternoons. Due to this extension, staff members work into the evenings, and cashing out must happen after dark. This behavior shift increases security risks and changes the nature of banking, which has historically been a daytime activity with strictly regulated business hours. Extreme heat will change how financial services are delivered, and the systems must adapt.

New forms of parametric insurance can help build resilience

Promoting adaptive behavior is important, but the residual risks are a loss of income, increased expenditures, and health costs. However, parametric insurance can help mitigate these risks. One form of parametric insurance is extreme heat index insurance, a relatively new concept that borrows from years of work on parametric insurance for another climate-related shock: irregular rainfall. Similar to rainfall index insurance, heat index insurance is a risk transfer solution that triggers an automatic payment to members’ bank accounts when extreme heat thresholds are forecast or reached and it is deemed unsafe to work.

MHT developed a heat index insurance that supports low-income urban women and is piloting a new program in the summer of 2023. Market research conducted by MHT found that women would be willing to pay up to $2 per month for this insurance and designed the triggers to cover up to a few days of lost income. Early evidence from the pilot suggests that the necessary preconditions for such a product are:

1. A clearly defined index and data sources

2. A strong local distribution channel

3. A strong capacity to deal with basis risk

As with all such innovations, it will need calibration. For example, should this cover only extreme or very high heat? How localized is the data, and how is the basis risk managed? How effectively can this work at the micro-level? Moreover, what is the role of subsidy/social protection in such schemes? The rising temperatures will soon create the conditions to test this product, answering some of these questions.

Over the long term, financial services will need to support transitions to new livelihoods

Extreme heat will render many jobs unviable, forcing people to seek new livelihoods. In 2019, the ILO estimated that by 2030, heat stress would lead to the loss of 34 million jobs in India, mostly in agriculture and construction. Those workers will need somewhere to go. Along with some regions of the Gulf — such as Kuwait and southern Iraq — parts of north India will be the first in the world to experience heat waves that exceed the limit of human survivability. As a result, people will migrate to new locations and livelihoods, and the number of climate refugees will necessarily increase. Extreme heat will fundamentally alter geographies and demographics, and financial services must support these transitions.

A call to action

Temperatures are already rising across South Asia. In Kolkata, they have already passed 104 degrees Fahrenheit (40 degrees Celsius) — the temperature at which wheat seeds start to break down. Moreover, this year will likely be an El Niño year, bringing higher late-summer temperatures and a deficient monsoon.

There is little that the financial sector can do to mitigate these temperatures, but they can help people build adaptive capacity, become more resilient, and transition to less vulnerable livelihoods. However, this will take some ingenuity. Financial service providers will need to understand their customers better and focus on how extreme heat and other climate risks affect real micro-level financial factors, such as incomes, expenditures, and assets and risk management of different low-income and vulnerable segments. Only then can financial service providers start to build financial products — and a financial system — that is truly responsive to climate-related risks.

The author would like to thank the Mahila Housing Trust staff for their insightful and valuable contributions to this blog post.