New data from CFI’s survey of micro, small, and medium enterprises (MSMEs) in Lagos, Nigeria, show the staggering impact of COVID-19. Since the first confirmed case of COVID-19 in Nigeria in late February, 9 percent of the 737 businesses in the sample have closed; the number of employees has declined by 51 percent compared to its high point the preceding year; and 80 percent of businesses have seen their profits decline.

The data also show MSME owners’ households in a precarious position. More than half of business owners said their household is currently not covering their expenses from earned income, and if their income were to dry up, nearly 60 percent would be unable to pay for essentials within a month. Food insecurity is high, too – one-third of respondents reported they or someone in their household has gone to bed hungry in the past two months because there has not been enough money to buy food.

This survey is part of CFI’s multi-country effort to understand the impact of COVID-19 on the financial health of MSMEs and is the first of six longitudinal surveys in Lagos. Broadly, the survey seeks to understand which businesses are shuttering their operations and why; how the performance and practices of operating businesses have changed; what financial tools MSMEs are using and whether their use is correlated with businesses’ resilience; and how changes in these livelihoods are related to changes in household well-being. The initial survey aimed to establish a retrospective baseline for firm performance and financial tool use in addition to capturing changes in behavior and outcomes since COVID-19 arrived in Nigeria. Future surveys – which will occur every two months for the next year – will track these indicators over time.

From June 16 to July 15, 2020, CFI conducted phone interviews with a random sample of Accion Microfinance Bank (AMfB) clients living in Lagos. AMfB is participating in Accion’s partnership with Mastercard, which supports the digital transformation of financial service providers. CFI completed interviews with 737 respondents, 55 percent of whom were women. Two-thirds of the businesses in the sample were micro-enterprises (1 to 10 employees) while another quarter were sole proprietorships. Most business were well-established, with an average operating age of 13 years. There was a healthy mix of businesses, including grocers, school operators, and manufacturing businesses.

CFI is presenting its data from this survey effort in this data dashboard. The dashboard is a living document – it will be updated as CFI refines and conducts new analysis, and as new data from other surveys becomes available.

Survey Insights

Nine percent of businesses have closed since COVID-19, but owners are confident they will reopen again.

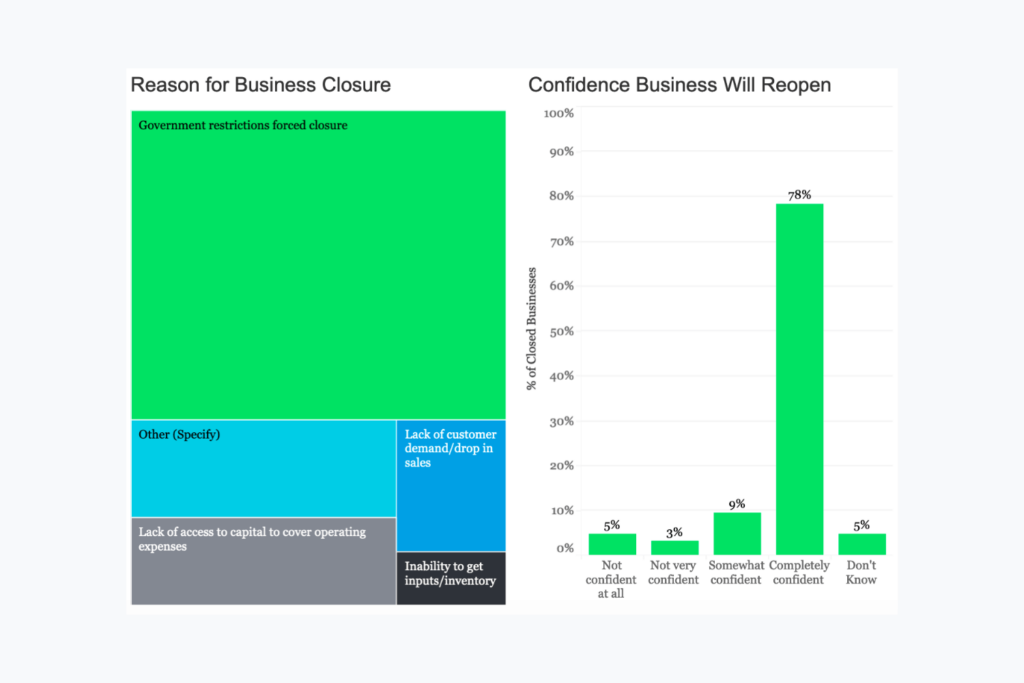

The data show that 64 of the 737 businesses in the sample shuttered their operations since COVID-19 arrived in Nigeria. Of these, 40 of the businesses closed because of government restrictions on their businesses. School operators were disproportionately affected. Of the 44 school operators in the sample, 52 percent reported not operating. Of all the other types of businesses – like grocers, tailors, or electronic stores – with an n of 10 or more in the data, only the share of restaurants that have closed cracked double digits at 12 percent. At the time of the survey, these entrepreneurs were confident that they would reopen their businesses when government restrictions are lifted.

Total employment is down by 51 percent. Closed businesses are a major contributor to the decline, but nominally small losses incurred by microenterprises are adding up.

The survey asked respondents to report the largest number of staff – full-time, part-time, and seasonal –they employed at one time in the 12 months preceding coronavirus. They included family members if they were paid a wage. Against that benchmark, employment has plummeted. Prior to coronavirus, MSMEs in the sample employed 3,001 people. At the time of the survey, that number had dropped by 51 percent to 1,468 people.

Two major patterns are contributing to the decline. First, business closures are a significant driver of net job loss, largely because so many schools, which are major employers, shut down. A mere seven percent of the entire sample – representing 53 closed businesses – accounted for 44 percent of net job losses, and closed schools accounted for nearly 80 percent of that. Second, many microenterprises have lost a nominally small number of employees (on average, just more than one), which collectively has a significant impact on employment. The 463 operating micro businesses have lost 550 employees, roughly a third of all jobs lost.

Those job losses are symptomatic of the drop in profits that 80 percent of MSMEs are experiencing.

Prior to COVID-19, 63 percent of businesses reported their profits increased compared to the year before, but the pandemic has halted that progress. Eighty percent of businesses reported their profits have fallen since the start of the pandemic. Including the businesses that have closed, half of all businesses said they can no longer cover their operating expenses. If there is any consolation, it is that most businesses – even those with a negative cash flow – reported a modest runway before needing to shutter operations. Based on how things were going at the time of the survey, 72 percent of operating businesses estimated they could manage for at least another 3 months before shutting down.

MSMEs are employing a variety of coping strategies to keep their businesses afloat.

Businesses were coping using a diverse mix of strategies. For instance, in addition to the dramatic reduction in the workforce, owners are cutting employees’ hours and working longer hours instead. About 11 percent of owners increased prices, 38 percent reduced prices, and 28 percent had done both. Similarly, 32 percent of respondents stopped selling to customers on credit while 29 percent started doing so. Meanwhile, the number of people making savings withdrawals since the pandemic began outpaced the number of people making deposits by just more than two-to-one. For reference, this ratio was effectively one-to-one in the year before the pandemic began.

Many owners’ households appear to be on the precipice, with an inability to cover expenses and indications of food insecurity.

Predictably, given their businesses’ performance, owners’ households appeared to be struggling. Fifty-six percent of owners said their household could not cover all their expenses with the combined income household members are earning. If income were to dry up completely, the cushion for the households appears to be very small – 60 percent of owners said their households could cover expenses for a month or less. Households’ financial struggles are having very real impacts: roughly a third of owners reported someone in their household had to go to bed hungry at some point in the past two months because there was not enough money to buy food.

Summary and Next Steps

Collectively, this preliminary analysis of CFI’s survey data suggests MSMEs in Lagos are being walloped by COVID-19. The general slowdown in economic activity resulting from restrictions on movement has led to a dramatic reversal of MSMEs’ fortunes. With profits declining, owners are slashing jobs and resorting to a mix of strategies to keep operating. While they expect to be able to do so for a few months, their households stand to suffer more in the near term as expenses of essential items outpace the income available to pay for them.

While the sample is not statistically representative of MSMEs in Lagos, this information adds to the growing set of data available from Bankable Frontiers Associates, insight2impact, and the World Bank, among others, examining the impact of COVID-19 on households and livelihoods in Nigeria. In a future blog post, we’ll examine the learnings from the collective pieces of work in-depth, but each indicates severe economic stress consistent with this data. For instance, both the insight2impact and World Bank data indicate food insecurity occurring at similar rates to what was seen in this survey. Additionally, CFI will examine what policymakers can do to help mitigate these concerning findings. Whatever the intervention, it must happen quickly. In the meantime, business will struggle and dinner plates will be empty.

This survey is part of our partnership with Mastercard Center for Inclusive Growth to understand the impact of COVID-19 on MSMEs.