The recent results from the Global Findex 2021 show global gains in account ownership and in account usage in 2017—good news given the widespread financial impact of the pandemic. Today, 71 percent of adults in developing economies have a financial account. Yet the findings on financial well-being show that there is more work to do.

71% of adults in developing economies have a financial account, yet the findings on financial well-being show that there is more work to do.

As the type of risks facing low-income consumers evolve, including rising food and fuel prices, and climate shocks increasing in frequency and intensity, we need an expanded definition of responsible finance in which all stakeholders – providers, policymakers, investors, donors, and more – are not just reacting to client protection risks but also anticipate and proactively work to build resilience, mitigate risks, and improve the financial well-being of consumers for the long term.

Improving how we measure consumer outcomes is critical for an expanded definition of responsible finance. A sway of new research – recently discussed in the Responsible Finance Forum – has shown that while access to finance is growing globally, financial health and well-being are stagnating or even declining.

The Global Findex 2021 introduced a new set of metrics on financial well-being. The data measures three dimensions of financial well-being: (a) managing unexpected financial events (financial resilience); (b) experiencing limited financial stress; and (c) having the confidence and capability to independently use financial products. The data suggests that while there have been gains in account ownership and in account usage since 2017, there is a need for more emphasis on all three components.

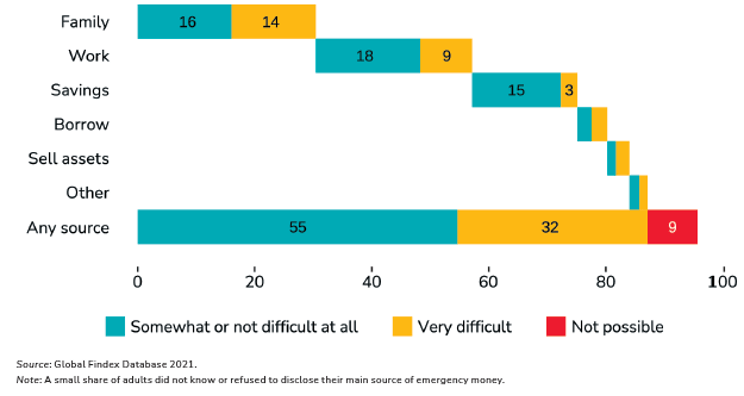

55 Percent of Adults in Developing Economies Are Resilient to Financial Shocks

The Global Findex survey measures “resilience” as the ability to access money equal to 5 percent of gross national income—or about $3500 in the US and 350 Rupees in India– within 30 days without much difficulty when faced with an unexpected expense. In developing economies, only 55 percent of adults could do so. For comparison, that share is 79 percent in high-income economies. Resilience is an increasingly important dimension of responsible finance as extreme natural disasters are estimated to push 26 million people into poverty each year, and the financial sector industry has a role to play in promoting adaptation, resilience, mitigation, and transition of livelihoods affected by climate change.

Women and the poor are less likely than men and richer individuals to be resilient.

Women and the poor are less likely than men and richer individuals to be resilient. One reason is that both women and adults living in poorer households are more likely to rely on family/friends as their front-line source of emergency money. Yet friends and family are among the least reliable sources of money in every developing economy region. There are a number of reasons for this. One is that family and friends may be confronting the same sources of financial stress at the same time, as is the case during the COVID-19 pandemic, or with a natural disaster such as a drought, flood, fire, or earthquake, or in a systemic economic downturn. In contrast, the Global Findex finds that personal savings are the most reliable source of emergency money.

Adults in developing countries identifying the source of, and assessing how difficult it would be to access, emergency money (%), 2021

The Majority of Adults in Developing Economies Worry About Finances

The objective reality of not having enough money—or not being able to obtain necessary funds in time to address emergencies—contributes to the more subjective sense of feeling financially worried. In developing economies, more than two-thirds of adults say they are very worried about one or more common sources of financial stress: living expenses for old age; medical costs from a serious illness/accident; monthly bills and expenses; and school or education fees. Twenty-two percent of developing economy adults are very worried about all four of the specified issues.

In high-income economies, in contrast, only a fifth of adults say they are very worried about one of those four issues, and the share of adults who are very worried about all four is only 4 percent.

Medical expenses were the biggest financial worry for both men and women in every world region. The financial impacts of COVID-19 likewise register as a significant source of worry, particularly in low- and low-middle-income economies.

Limited Financial Experience and Ability Can Expose Consumers to Financial Abuse

Beyond resilience and stress, low financial ability makes it difficult for adults to navigate the marketplace for retail financial services. Both account holders and the unbanked display low ability in certain markets. The Global Findex 2021 found, for example, that 31 percent of mobile money account owners in Sub-Saharan Africa couldn’t use their account without help from a family member or a mobile money agent. About two-thirds of unbanked adults similarly said that if they opened an account (excluding mobile money) at a financial institution, they could not use it without help. This lack of financial ability makes current and prospective account holders vulnerable to bad information and to exploitation.

Low financial ability makes current and prospective account holders vulnerable to bad information and to exploitation.

Financial service providers can exacerbate that challenge—sometimes unintentionally—when their fees or terms of service are unclear; when they use aggressive marketing; and when they have poor dispute resolution processes.

One way in which low financial ability can affect account holders can be seen in the Global Findex 2021 finding that about 20 percent of wage recipients in developing economies paid higher fees than expected in order to receive wages directly into their account. In certain economies, that share is as high as 40 percent of wage recipients. We cannot know if the account holder simply didn’t understand the disclosed fee schedule, or if the fee terms were never disclosed. Either way, the fact that account holders are paying more than they expect to use services offers one example of how having an account and using it do not inevitably lead to well-being.

Encouraging Responsible Finance and Improving Financial Well-being

Economies tend to put the burden of financial well-being on the consumers themselves. Making progress will require instead that policymakers and the financial sector industry treat consumer well-being as a shared responsibility. The policy environment also needs to prioritize both consumer protection and attention to the shifting nature of consumer risks. As the nature of these risks evolve, responsible finance has an important role to play in improving resilience and reducing financial stress. This includes, for example:

- Encourage the design of high-quality products that help consumers build resilience and their capacity to prepare for, navigate through, and recover from financial shocks.

- Measure and evaluate how these solutions are resulting in changes in well-being.

- Ensure financial service providers clearly disclose product features and fees so that consumers understand what products are most suited for their needs, how to responsibly use these products, and when and how much they will be charged.

- Inform consumers about the risks of predatory financial practices and what they look like, in plain language and in a format that users can easily understand.

- Incentivize financial institutions to incorporate behavioral insights and design research into their products and services. For example, product design features that help people act on pre-established intentions (like building savings for an emergency or for a specific goal)

The vast progress of the past decade on increasing account ownership should be lauded. But these gains also mean that the remaining unbanked consumers are among the hardest to reach and the most vulnerable to financial exploitation. Taking steps now to reduce the barriers to financial well-being can improve the financial lives of existing account holders and prepare the financial ecosystem to benefit some of the most vulnerable in our economies.