Growth of digital financial services has accelerated since the outbreak of COVID-19 as distancing measures forced customers to access financial services remotely. Fintechs have fueled this massive growth by using innovative delivery channels or business models to provide financial services to previously unserved or underserved customer segments.

In 2021, CFI conducted research to understand how early-stage fintechs and their customers coped during the pandemic. Most research on resilience focuses on either fintechs or customers but fails to account for their interplay. Based on this insight, CFI created the PACT framework. PACT stands for Preparedness, Access, Capability, and Ties – four key dimensions that influence one another and contribute to the resilience of both fintechs and their customers.

Most research on resilience focuses on either fintechs or customers but fails to account for their interplay.

As part of our research in shaping the PACT framework, we spoke to investors to better understand issues of resilience considering COVID-19. Our conversations revealed that most inclusive fintechs survived the pandemic either by continuing existing business operations or adapting their business models to changing customer needs and to new external conditions, such as extensive lockdown measures. While we spoke with dozens of investors, we closely examined the investment processes of three impact-driven investors that fund fintechs working to expand financial inclusion and promote financial health. To do this deeper dive, CFI worked with a team at Tameo Impact Fund Solutions – an independent consulting firm providing services to impact funds, fund managers, and investors with the aim of promoting accountability and transparency in the impact investing industry.

Our conversations aimed to identify best practices for processes implemented throughout the investment cycle and which indicators should be monitored to support resilience. These discussions provided the basis for our analysis on how investors can help strengthen the resilience of both their investee companies and the fintech customers served.

In this blog post, we discuss inclusive fintechs’ investment process, how investors monitor and evaluate inclusive fintechs, and identify three actions that investors – and other stakeholders – should take to build resilience into their business models.

Investor Processes and How They Monitor and Evaluate Inclusive Fintechs

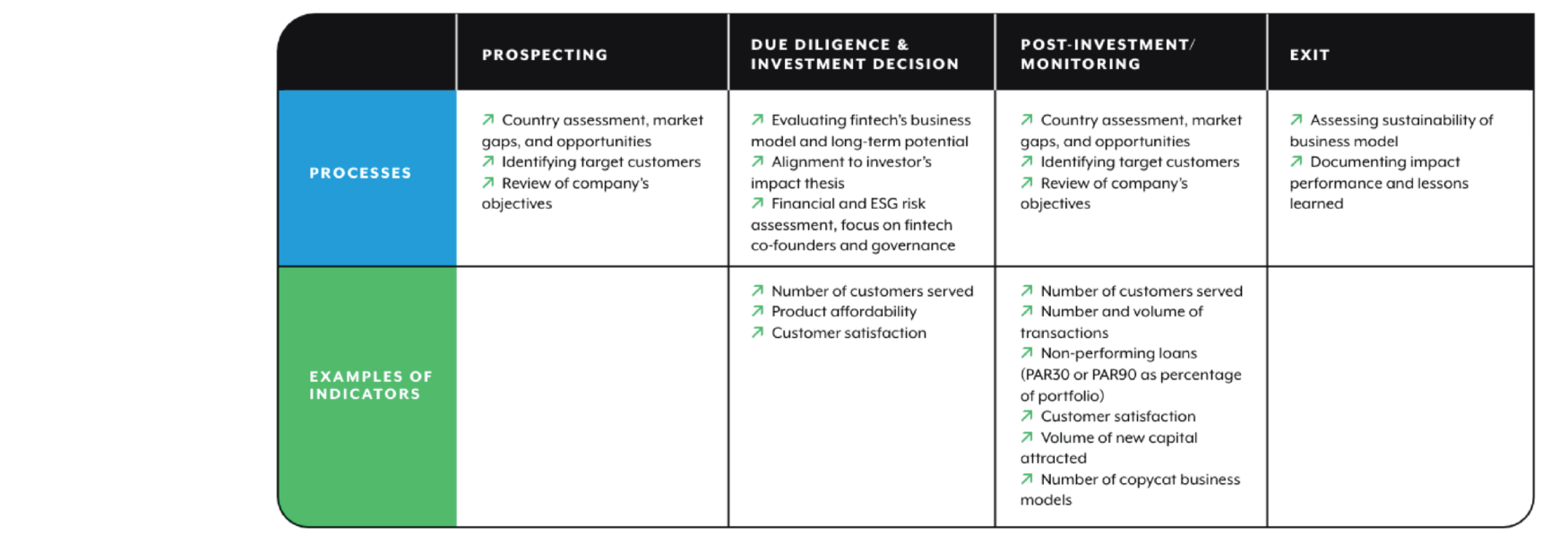

The three investment firms we spoke with invest at various stages in fintechs’ development – from seed stage to Series A. The firms’ investment processes can be broken down into four stages: prospecting, due diligence and investment decision, post-investment and monitoring, and exit.

All firms integrate impact management throughout their investment processes. The indicators monitored by the impact investors vary depending on the type of investment, but largely focus on growth metrics (e.g., number and volume of transactions, loans, accounts, etc.), and ability to reach target customers (e.g., number of customers/MSMEs served). Other indicators point to competitiveness (e.g., product diversity and pricing), and business risk and sustainability (e.g., proportion of non-performing loans, customer satisfaction, and profit metrics). Fintechs must be able to demonstrate clear impact objectives, and investors must be able to affirm these objectives through due diligence and monitoring.

The table below summarizes the four stages of the investment process and includes a few examples of indicators monitored.

The three impact investors noted that the fintechs in their portfolios were largely resilient with regards to their operations and performance during COVID-19, and very few companies in their portfolios were forced to shut down permanently because of the pandemic. One challenge for the firms was adapting to remote due diligence and less in-person engagement with their portfolio fintechs.

Where PACT Fits In

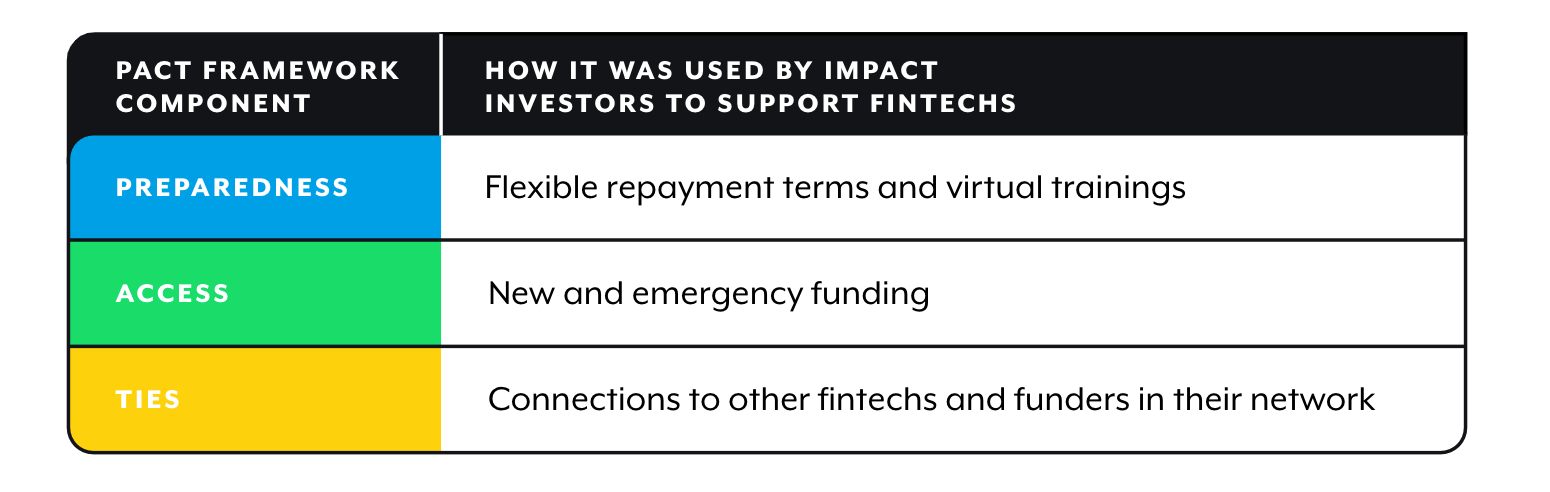

The table below outlines the support investment firms provided according to the PACT framework. The investors allowed for flexible repayment terms and virtual training, provided new and emergency funding, and helped fintechs and funders network and make connections.

Negotiating manageable or flexible repayment terms is difficult for startups that cannot afford to be “choosy” about their investors. Nonetheless, investors noted that the pandemic had changed their views on developing triggers and financing terms for future deals, opting for convertible notes and building in contingencies for shocks. Inclusive fintech founders who had long-established relationships with their angel investors were able to negotiate delayed payments.

In terms of access, many investors refocused their funding decisions on existing portfolio companies early in the pandemic. Bridge funding and/or growth funding from existing and new funders was essential during the pandemic. This access to capital was described by both funders and fintechs as a rollercoaster ride that was halted during the first three months of the crisis, then restarted slowly, again, with a preference for existing portfolio investees.

Connections to other fintechs and funders in their network were often the result of connections to board members, accelerator partners, associations, and fellow founders and mentors. Many investors created networks among their investees to share information and resources, and many associations and accelerators rapidly shifted into high gear to respond to stakeholder needs.

Actions to Build Resilience into Fintech Models

As the fintech industry continues to grow, it is increasingly important to understand how fintech affects customers, particularly those in vulnerable and underserved populations. Impact investors and fintechs, as well as research networks and academics, all have a role to play in improving our understanding of the customer outcomes linked to fintech services. Below are a few actions stakeholders can take:

1. Identify a clear theory of change that includes customer resilience metrics for different fintech business models.

The fintech industry is constantly innovating and offering customers a wide variety of services – including personal and business loans, payment services, money transfer and remittances, insurance, and savings, among others. Within each of these service types, fintechs offer a myriad of options in terms of pricing and product design. Furthermore, fintechs serve customers directly, serve other businesses, or improve the infrastructure for financial services.

Because fintechs offer such variety in their services, which may be linked to different impacts, it is important to identify a clear theory of change for different fintech business models. It is also critical to define the relevant indicators to monitor according to the fintech’s funding stage and its customers’ capabilities. For example, while mobile money access may be linked to household resilience, a small business loan secured with digital collateral is more likely to be linked to business outcomes rather than household resilience.

2. Demonstrate that resilient customers have higher business value.

Fintechs tend to view impact measurement – especially outcomes at the customer level – as expensive, rather than a tool for business development. This mindset can hinder resources and efforts to meaningfully collect and analyze customer data. Impact investors who are actively engaged in fintechs’ governance can change this mindset by demonstrating the business value of impact measurement and providing examples of use cases.

Data on customers’ ability to cope with shocks, save, purchase working capital for their businesses, or manage their household consumption can be very valuable to a fintech if analyzed. For example, data can be disaggregated by product as well as by gender, location, income level, or customer satisfaction score (e.g., promoters vs. detractors), and can used to inform product design and customer acquisition efforts. Having data available allows both fintechs and investors to analyze correlations between impact performance and financial performance for various services.

3. Establish that measuring resilience is possible through core data collection by fintechs.

Collecting data on customer outcomes has historically been costly, involving specialized staff or outsourcing to experts. While these types of research efforts are still necessary (e.g., to define theories of change and impact indicators as discussed above), monitoring customer outcomes does not need to be the work of experts. Fintechs have built their success on their ability to make data-driven decisions. Their impact measurement and management should operate similarly. Once they have defined the appropriate indicators and their business use cases, fintechs can benefit from their digital platforms to collect impact data directly from their customers. This can be in the form of simple mobile surveys circulated among a random sample of customers on a regular basis.

Fintechs have built their success on their ability to make data-driven decisions. Their impact measurement and management should operate similarly.

While this will entail an upfront cost to develop the surveys and integrate them into the user interface, it will ultimately cut costs in the long-term as fintechs can gain valuable customer insights and business intelligence without having to engage external consultants. Development funders (multilateral development agencies and government agencies), donors, and research networks can contribute to building the capacity of fintechs to launch such initiatives.

More research needs to be done, in line with growing innovations in the platform and fintech economies, to understand how or if fintechs are increasing (or decreasing) customer resilience. It is important to ensure that the right set of products and services (daily insurance, savings, income opportunities, advice and/or connection to government payments, etc.) are available to assist customers manage difficult times. If the actions outlined above can be put into practice on the fintech side, in harmony with the broader PACT framework, we believe resilience of both low-income customers and the fintechs that support them during times of crisis will be supported.