This is part of a series of work done in partnership with CFI and WFP, with funding from the Bill & Melinda Gates Foundation, that explores how we can improve the design and delivery of digital cash transfers for low-income women.

Cash transfer programs have emerged as a crucial tool in the global effort to combat poverty, overcome shocks and other adversities, and achieve the Sustainable Development Goals (SDGs). Cash transfers provide financial support to vulnerable households, enabling them to meet their basic needs, access essential services, and invest in income-generating activities. However, beyond the immediate economic relief they offer, cash transfer programs also have the potential to address deeper societal issues, including gender inequality.

By putting money directly into the hands of women within households, these programs challenge traditional gender norms and empower women to make decisions about finances, thereby enhancing their control over economic resources.

Women’s economic empowerment is increasingly recognized as a central objective of cash transfer programs. By putting money directly into the hands of women within households, these programs challenge traditional gender norms and empower women to make decisions about finances, thereby enhancing their control over economic resources. This not only contributes to reducing gender inequalities but also enhances women’s access to formal digital financial services and potentially brings additional benefits such as increasing access to identification documents.

As we explore the potential benefits of directing funds to women, a critical question arises: could this approach exacerbate the risk of intimate partner violence (IPV)? This question probes the potential shifts in power dynamics within households and the increased vulnerability women might face as they gain control over financial matters.

Is this concern rooted in perception, or does substantial evidence support these claims? To dig into this question, a comprehensive study conducted by CFI, in partnership with the World Food Programme (WFP) and funded by the Bill & Melinda Gates Foundation, examined existing evidence and sought insights from experts in the field. The study’s findings suggest that directing funds into the hands of women on behalf of their households can in fact reduce the risk factors associated with IPV. This positive outcome is primarily attributed to the alleviation of financial stress within households and improvements in emotional well-being. However, it is essential to acknowledge that despite the potential benefits, cash transfers to women may still trigger instances of IPV, especially in contexts where harmful gender norms are deeply ingrained.

Despite the potential benefits, cash transfers to women may still trigger instances of IPV, especially in contexts where harmful gender norms are deeply ingrained.

Globally, 27 percent of ever-married/partnered women, ages 15 – 49 years, have experienced physical or sexual violence by an intimate partner in their lifetime. Women living in the least developed countries and in countries facing conflicts are disproportionately affected with an even higher prevalence of IPV. Gender inequalities that restrict women’s access to basic services and rigid social norms that support masculinities based on power and control are major risk factors leading to IPV. Cash transfers directed to women on behalf of the household can challenge these norms by putting money in the hands of women. However, simply transferring cash is not enough and must be accompanied by programming to gradually transform gender norms.

In line with the “do no harm” principle, designing cash transfer programs that effectively minimize the risks of IPV is paramount, particularly in settings where such violence is prevalent. At the same time, it is crucial to consider the impact on IPV beyond the program’s duration and explore how the reduction in IPV can be sustained in the longer term.

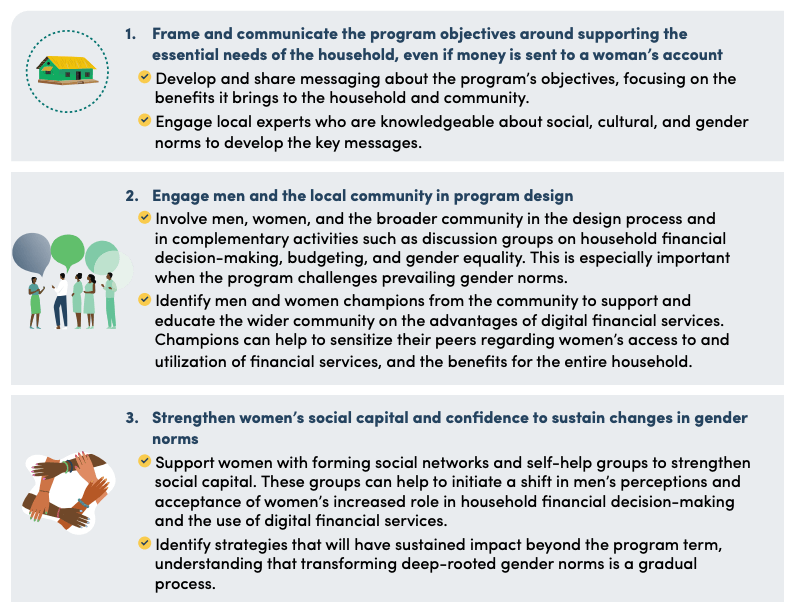

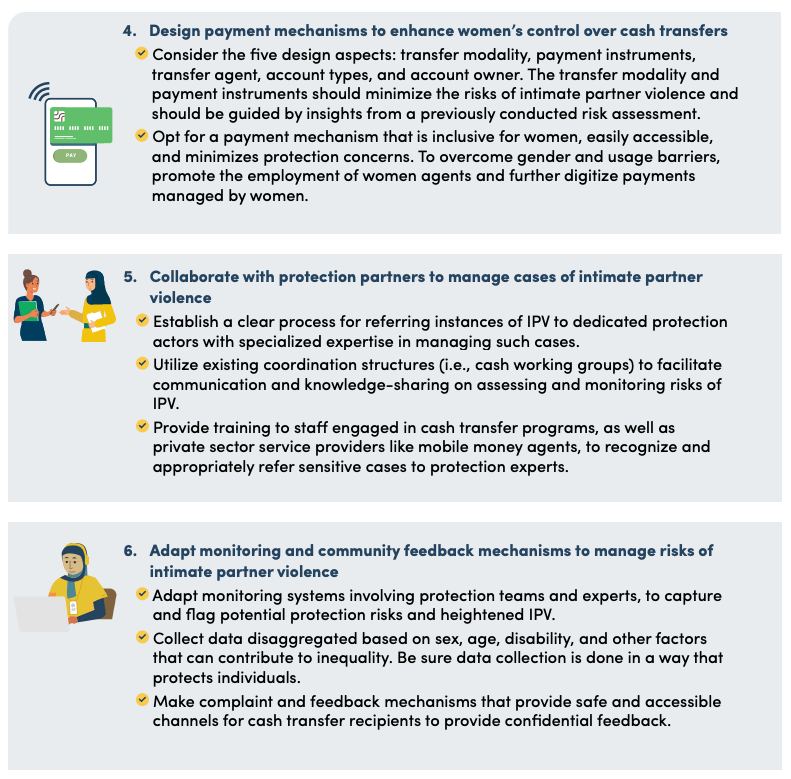

How to Design Cash Transfer Programs and Send Money to Women While Reducing Risk of Intimate Partner Violence

From this research, CFI and WFP developed a guide that details how to design cash transfer programs that enhance household well-being, increase women’s empowerment, and reduce the risks of IPV. It is important to note that effective design and implementation of cash transfer programs directed to women’s accounts should follow a comprehensive assessment of IPV risks, carefully considering contextual factors including prevailing gender norms, socioeconomic dynamics, and political conditions.

Several key recommendations emerge from our analysis:

The full report from the study details actionable insights backed by lessons and examples from diverse cash transfer programs.