At COP27, the finance ministers from 58 climate-vulnerable economies estimated that 98 percent of their nearly 1.5 billion citizens lack financial protection – a massive source of vulnerability for countries that already have lost about 20 percent of their collective GDP, or $525 billion, due to climate shocks since the year 2000. The past year alone was one of the worst in history: floods in Pakistan killed 1,700 people and left one-third of the country underwater. Persistent drought in East Africa has killed livestock and destroyed livelihoods. In Fiji, communities have been forced to relocate to escape rising sea levels. Initiatives discussed at COP27, such as the “Global Shield” for quickly deploying financial support during climate disasters, and a fund to cover “loss and damage,” are designed to help vulnerable countries deal with the consequences of these shocks.

The role of the inclusive finance sector in this context is still up for debate. On the one hand, the role varies depending on the nature of climate impact: Long-term gradual impact, such as sea-level rise and soil salinization, requires different coping mechanisms compared to sudden climate shocks like floods and hurricanes. On the other hand, the sector still lacks a quantitative layer to assess the role that inclusive finance can play in building resilience at the country level. The sector has made progress in measuring vulnerability and understanding the impact pathways and policy options in green inclusive finance. But we still have a limited quantitative understanding of how inclusive finance can help prepare for and respond to climate shocks.

Let’s examine how we can better address these gaps.

What Do We Know About Climate Shocks and Finance?

Answering the question of how households in developing economies prepare for and deal with climate shocks is not straightforward. Research has shown that most households affected by shocks face increased expenses. They need to secure their food supplies, make essential house repairs and replace essential tools and equipment, including mobile phones, electricity, livestock and farming equipment, that were damaged or lost. The range of immediate needs is extremely diverse and context dependent, hence virtually impossible to map comprehensively.

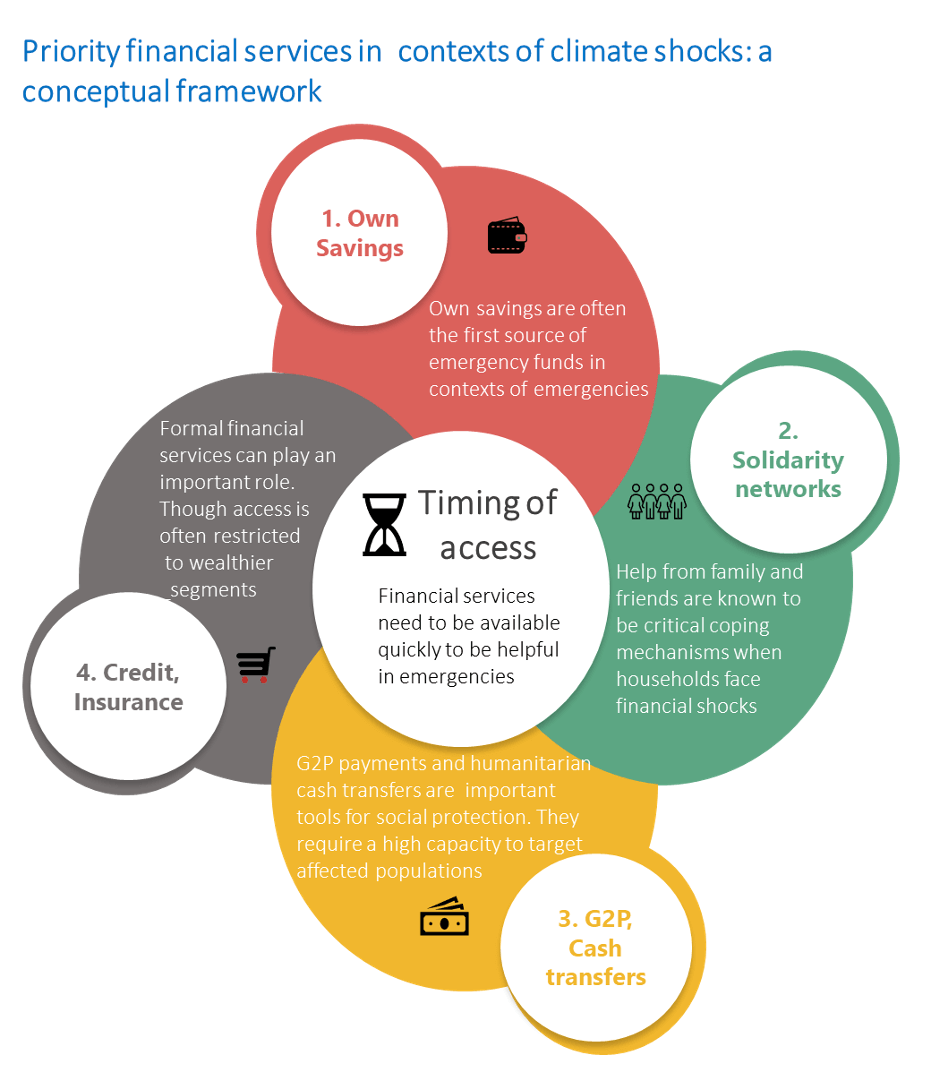

What we can model more accurately, however, is the role that financial services can play in the context of climate shocks. Existing literature (e.g.: El-Zoghbi et al 2017 and Linnerooth and Hochrainer 2015) has created useful taxonomies that show that households have limited financial options in face of calamities. They can:

1. Tap into their own funds:

Households and small businesses often turn to their own savings as the first source of emergency funds to pay for urgent needs. To be accessible in the short term, savings need to be liquid and safe.

2. Access solidarity networks:

Help from social networks, via remittances, mobile payments, and other means, can be vital during emergencies. To receive this money digitally, households need accounts at financial institutions or mobile money accounts, and they need to have access to cash-in/cash-out points such as bank agents and mobile money agents. Disruptions to the agents’ networks can limit the effectiveness of remittances in the context of shocks.

3. G2P payments and humanitarian aid:

Government payments (G2P) and various forms of humanitarian cash transfers can play a critical role in building resilience to climate shocks. In particular, “adaptive” social protection programs can be designed to address contexts of emergencies such as climate shocks.

4. Leverage formal financial services:

Households may be able to access traditional financial services, such as credit and insurance, to address their increased expenses. However, payouts may be slow and access challenging for consumers with thin credit files.

Another critical dimension is the speed with which households can access financial resources. Timing can vary from days or weeks, to far longer. For example, illiquid savings such as land and cattle for a farmer may be of little use in an emergency, irrespective of how valuable these assets are. Similarly, if payouts are too slow, formal loans and insurance products may fail to improve a household’s resilience.

Which Countries Show Financial Resilience?

To answer this question, we looked at data showing which countries are most exposed to climate shocks and how easily their populations can access different forms of finance.

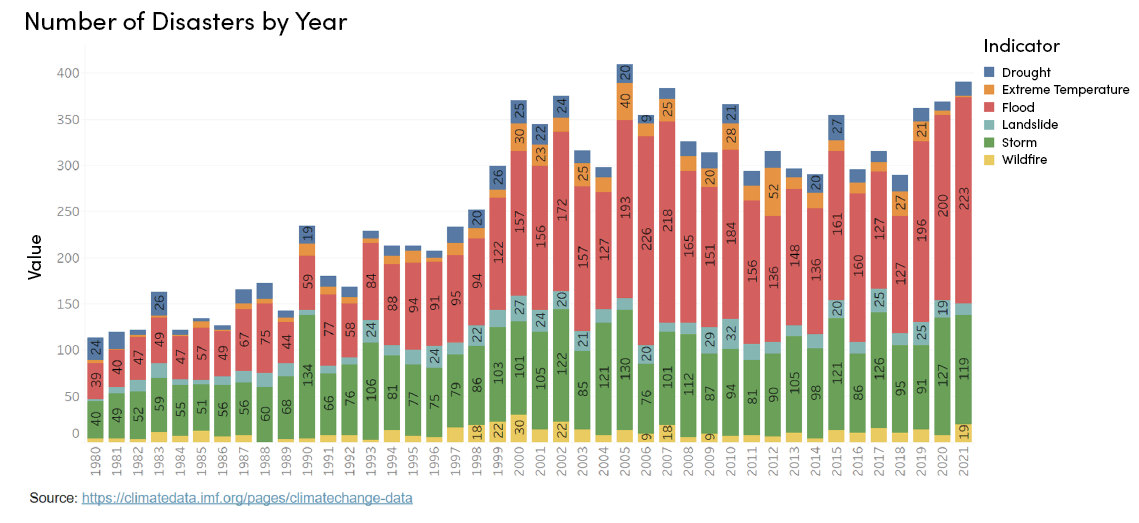

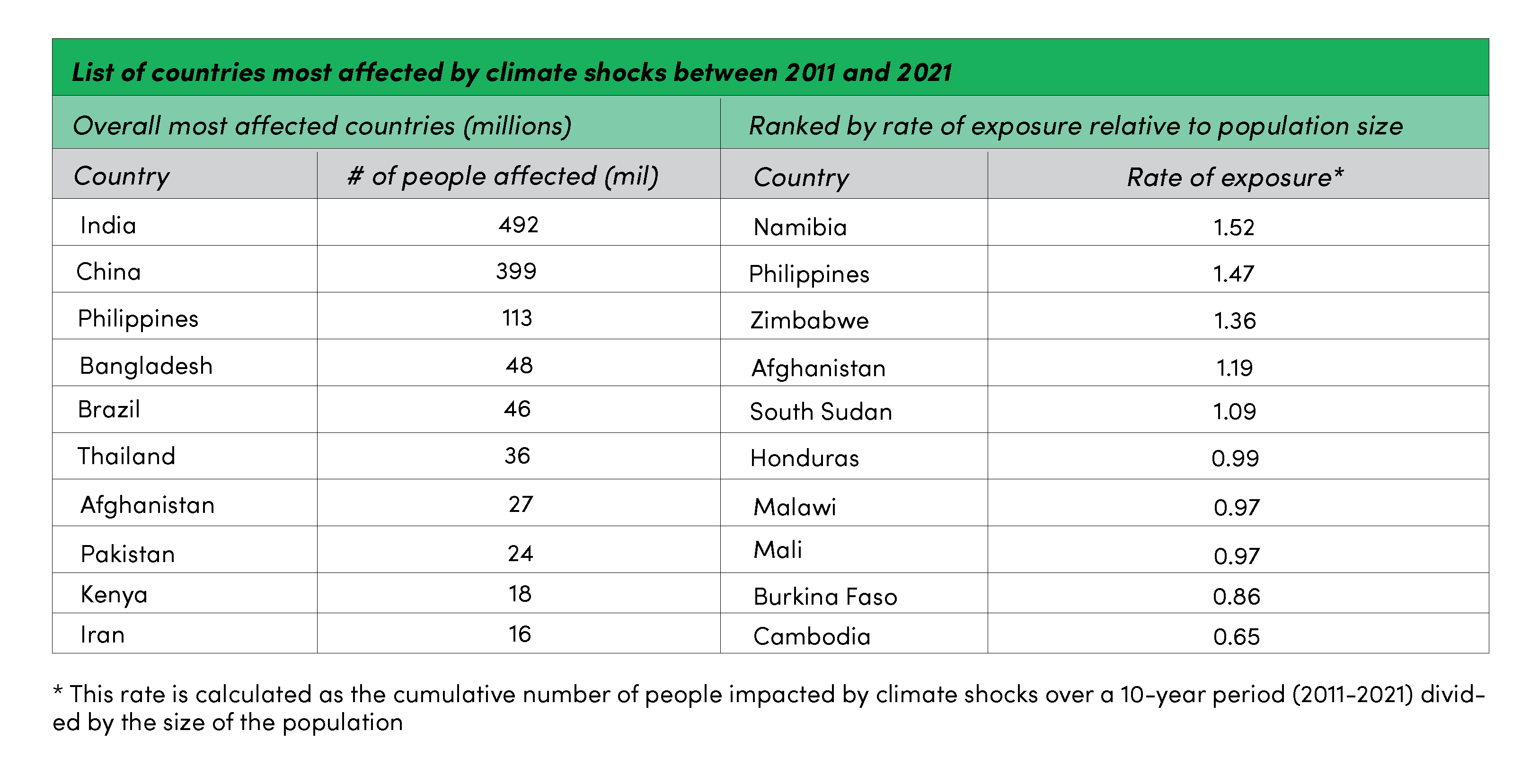

1. Exposure to climate shocks

Looking at climate shocks at the country level, we found that populous countries like India, China, and the Philippines were the most exposed. To measure this, we used data on natural disasters from CRED and calculated the number of people who were affected by or who had died from a natural disaster between 2011 and 2021. Disasters examined included droughts, extreme temperatures, floods, landslides, storms and wildfires. However, when we normalize the indicator by population size (see table below), we see that some of the world’s poorest countries, like Afghanistan and South Sudan, had some of the highest rates of exposure to climate shocks.

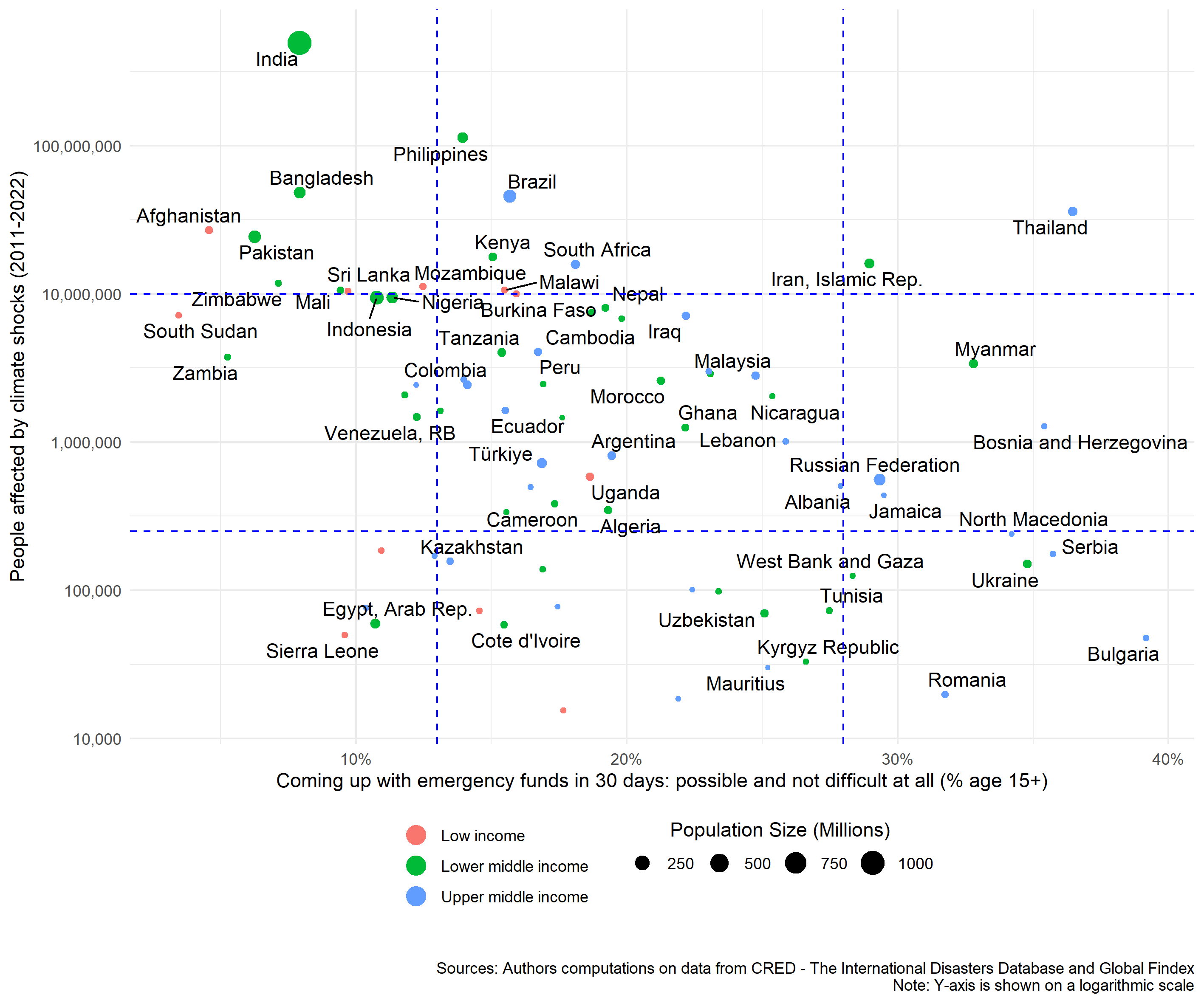

2. Access to emergency funds

Next, we measured whether people in countries most exposed to climate shocks could access emergency funds within 30 days. The chart below shows that South Asian countries such as India, Afghanistan, Bangladesh, and Pakistan are the most vulnerable. Not only do they have the highest number of people affected by climate shocks in absolute terms, households also have the least ability to come up with emergency funds. India is by far the most affected. CRED estimates that almost 500 million people in that country were cumulatively affected by climate shocks in the last decade, primarily from events such as the drought in 2015-16 and the 2018 Kerala floods among others, and yet fewer than 10 percent can access emergency funds within 30 days. Other countries such as the Philippines, Brazil, Kenya and South Africa perform only slightly better, with 15-20 percent of individuals capable of accessing emergency funds; this means that four in five individuals are financially exposed to climate risks. In contrast, the bottom right quadrant shows that Eastern European countries such as Serbia, Ukraine and Bulgaria are relatively less vulnerable, having lower exposure to climate shocks and higher capacity to come up with emergency funds.

3. Access to finance

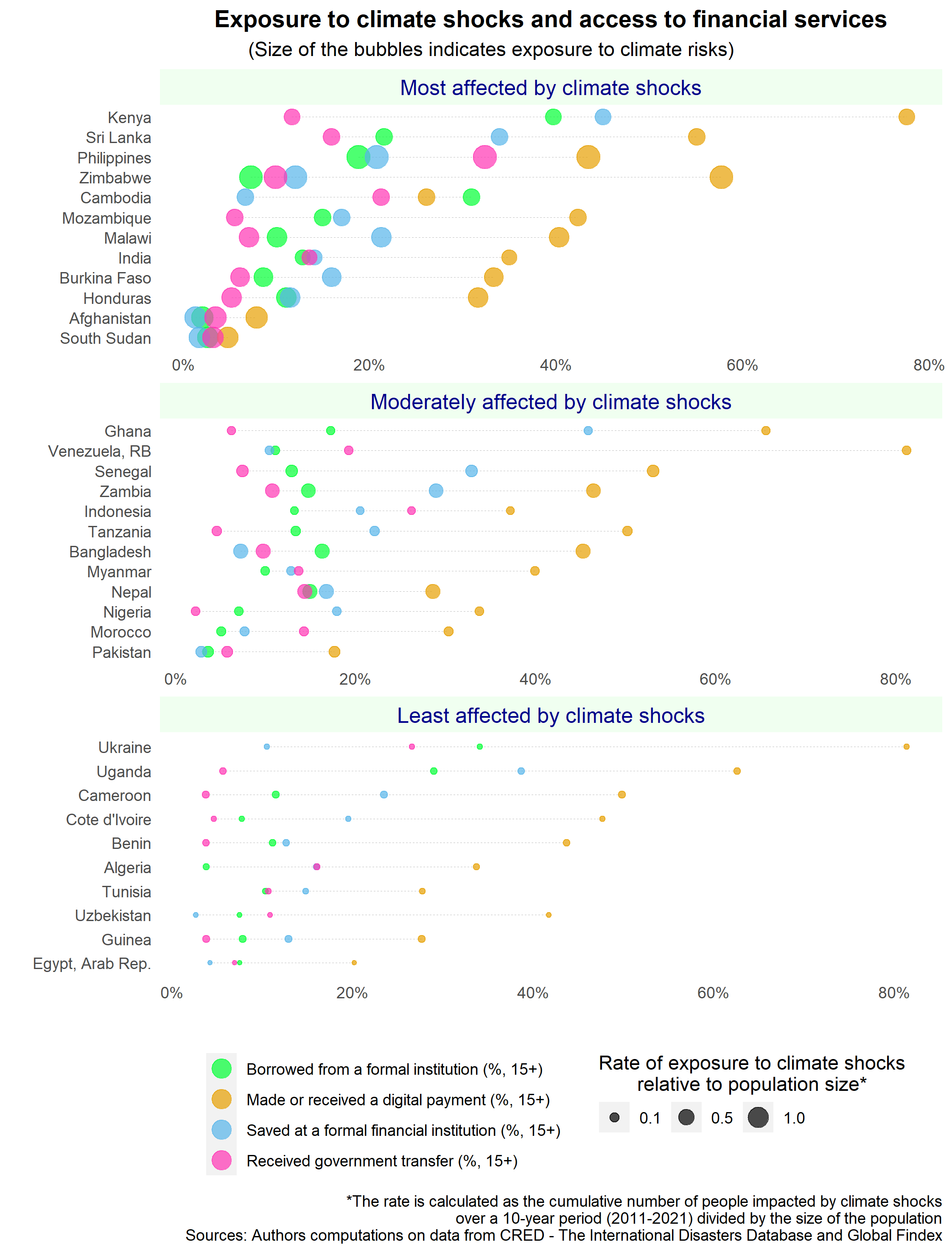

Our analysis mapped the exposure to climate risks with the levels of access to financial services. We used Findex data to measure access to digital payments, savings, loans and G2P payments, which our conceptual framework identified as important coping mechanisms in case of climate shocks. Due to limitations in the data, we do not include analysis on insurance and humanitarian cash transfers.

There is a lot we can unpack from the figure above. Here are some takeaways:

Mapping climate risks against access to financial services can be a valuable diagnostic tool to identify vulnerable countries.

The chart shows, for example, that people living in Afghanistan and South Sudan are the world’s most vulnerable to climate shocks because they are both the most affected by climate emergencies (on a per capita basis) and have the least access to financial services. Countries such as India, Burkina Faso, Mali, and Bangladesh are also at risk as their exposure to climate shocks is high and access to financial services is limited in large parts of their populations.

High penetration of digital payments indicates a potentially important role for solidarity networks.

Digital payments have relatively high levels of penetration in most countries. Kenya, Uganda, and Ghana, for example, have a penetration rate above 60 percent. Even Venezuela, which has extremely low access to formal savings and credit, has very high penetration of digital payments. On the other hand, countries like Pakistan, Afghanistan and South Sudan have very low penetration, hence internal remittances are likely to be slower and more expensive, making it more difficult for solidarity networks to be fast and efficient. Several studies have shown the importance of digital payments in contexts of shocks — for example, the seminal work by Jack and Suri in Kenya on the role of MPesa, and in Mozambique, mobile money was an essential coping mechanism during severe floods.

Savings and credit have limited penetration, with a few exceptions.

The data suggests that a majority of households do not have any savings in formal financial institutions. Countries such as Bangladesh, Venezuela, and Uzbekistan are particularly vulnerable, as their level of savings in formal institutions is extremely low, even lower than access to credit. Countries such as Kenya, Ukraine, and Uganda have relatively high access to both formal savings and credit, though the effectiveness of these services during shocks is not yet fully understood. Formal savings require a functioning and effective cash-in/cash-out network, which can be disrupted in cases of climate shocks.

G2P payments are low in most countries.

With a few exceptions such as Indonesia and the Philippines, the level of government transfers is low. While Kenya has the highest levels of financial inclusion overall, it has few G2P payments, despite its high exposure to climate shocks. Countries such as Nigeria, Ghana, Tanzania, and Cameroon also have extremely low levels of G2P penetration, though the populations have been relatively less affected by climate shocks.

What next?

We have only scratched the surface in exploring the intersection of climate shocks and inclusive finance. Much more research is needed if the inclusive finance industry is to fully understand and fulfil its role in building resilience in face of climate shocks. This analysis was based on publicly available historical data, which helps paint a general picture. But it excludes the impact of prolonged and gradual environmental stresses, which are expected to become more pronounced as climate change accelerates. Moreover, each country context is different, and the types of climate shocks they are subject to have very diverse implications. Extreme heat in India, for example, affects livelihoods very differently from floods or droughts in other countries. And the role that financial services can play also differs from country to country.

Demand, however, for this work is accelerating. Humanitarian organizations are increasingly interested in understanding the role of financial services in responding to emergencies, especially given the frequency and scale of climate-driven shocks. Their efforts so far have largely focused on designing efficient cash transfer programs and working with local savings and loan associations to distribute the financial aid. As humanitarian organizations focus more on building resilient market systems in the long term, the role of green inclusive finance can help them address emergencies at a market system level.